01:30 PM BST, United States - Inflation Data for August:

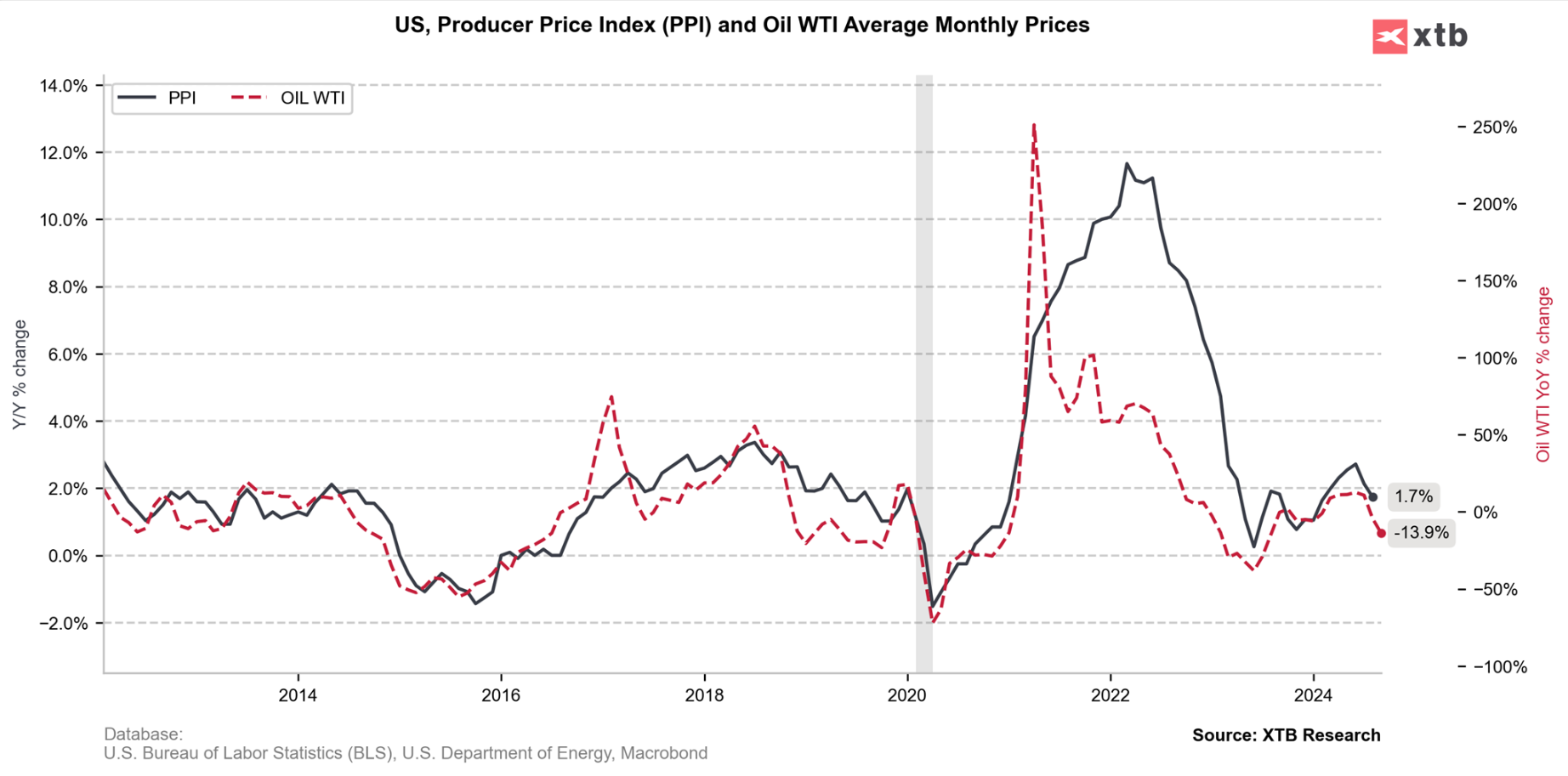

- Core PPI: actual 2.4% YoY; forecast 2.5% YoY; previous 2.4% YoY;

- Core PPI: actual 0.3% MoM; forecast 0.2% MoM; previous -0.2% MoM;

- PPI ex. Food/Energy/Transport: actual 3.3% YoY; previous 3.2% YoY;

- PPI ex. Food/Energy/Transport: actual 0.3% MoM; forecast 0.2% MoM; previous 0.3% MoM;

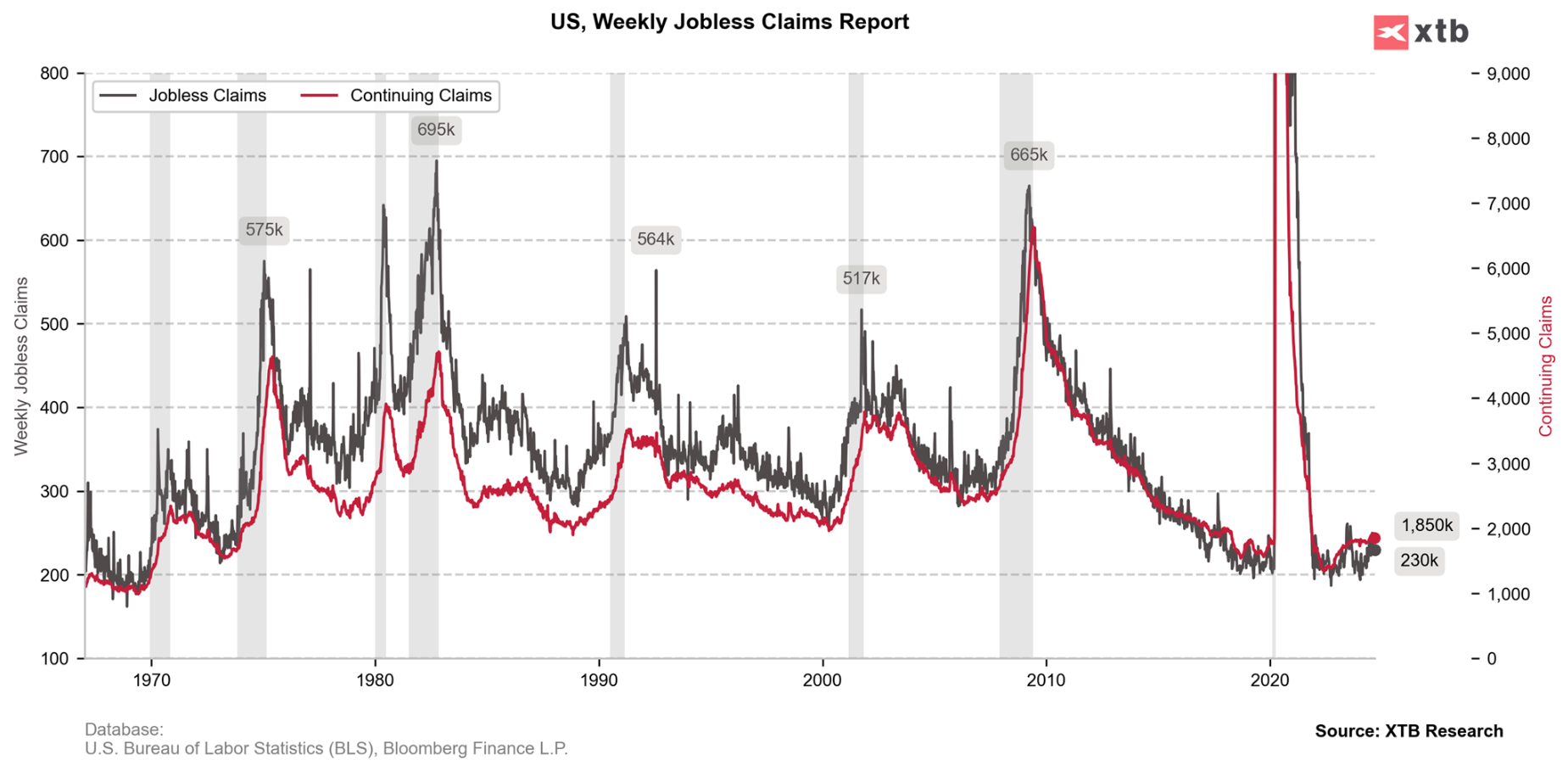

01:30 PM BST, United States - Employment Data:

- Jobless Claims 4-Week Avg.: actual 230.75K; previous 230.25K;

- Initial Jobless Claims: actual 230K; forecast 227K; previous 228K;

- Continuing Jobless Claims: actual 1,850K; forecast 1,850K; previous 1,845K;

The data fall more or less in line with expectations. The labor market continues not to surprise negatively, and jobless claims remain at low levels. Market reaction is limited. PPI inflation falls lower, as suggested earlier by declines in the fuel market and oil in particular.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)