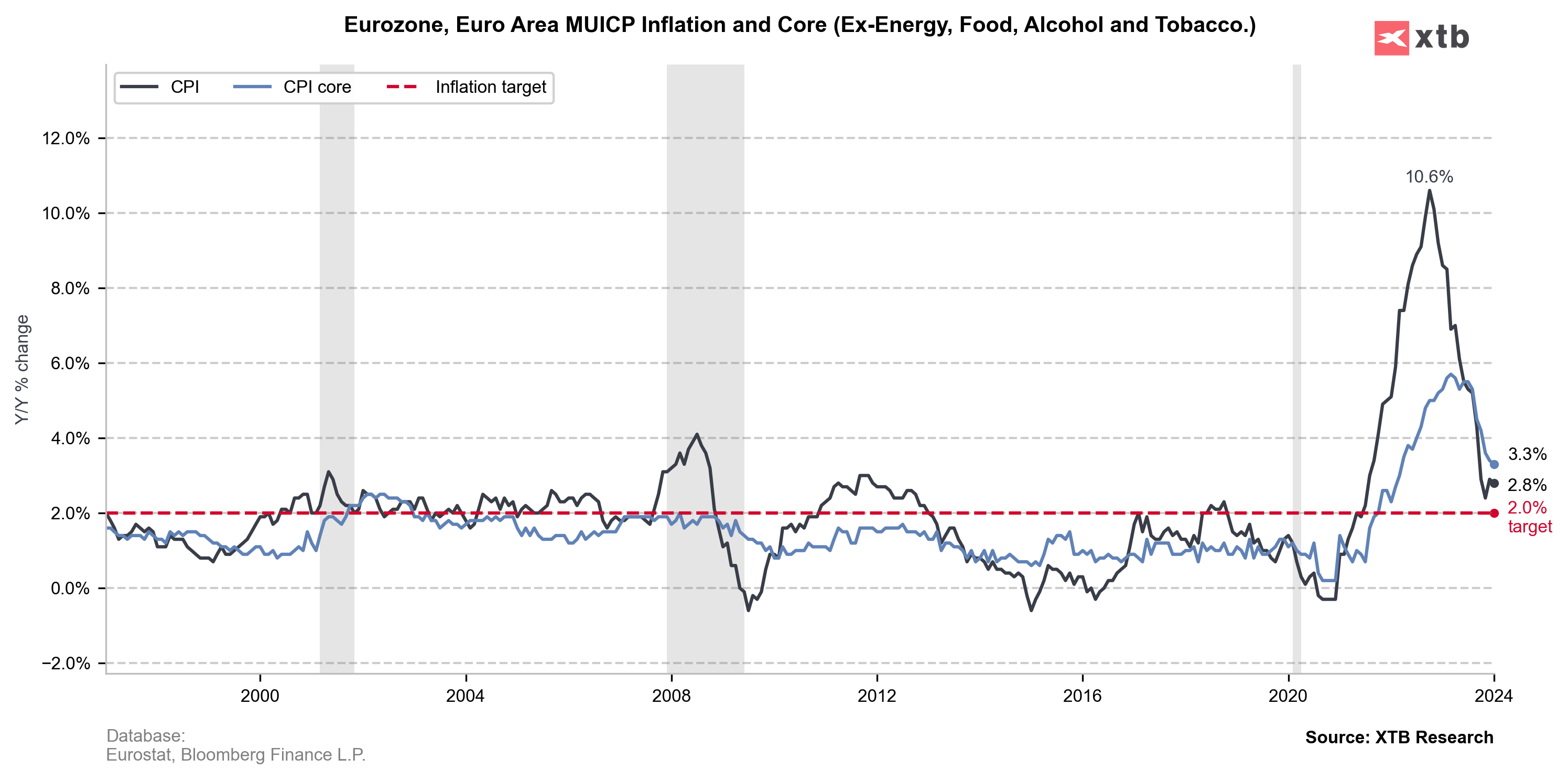

Flash CPI inflation data from euro area was released today at 10:00 am GMT. Report was expected to show a deceleration in headline and core price growth in January, compared to December. Such a development was strongly hinted at by member states data released earlier this week.

Actual report showed a slightly higher pace of price growth than expected. Nevertheless, headline and core inflation still decelerated compared to previous month's levels.

Euro area, CPI inflation for January

- Headline: 2.8% YoY vs 2.7% YoY expected (2.9% YoY previously)

- Core: 3.3% YoY vs 3.2% YoY expected (3.4% YoY previously)

In spite of higher-than-expected inflation being a 'hawkish' development, EUR pulled back following the release. EURUSD was attempting to break back above the 1.08 mark prior to the release and is now pulling back from the area slightly.

Source: xStation5

Source: xStation5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀