01:30 PM BST, United States - Employment Data for August:

-

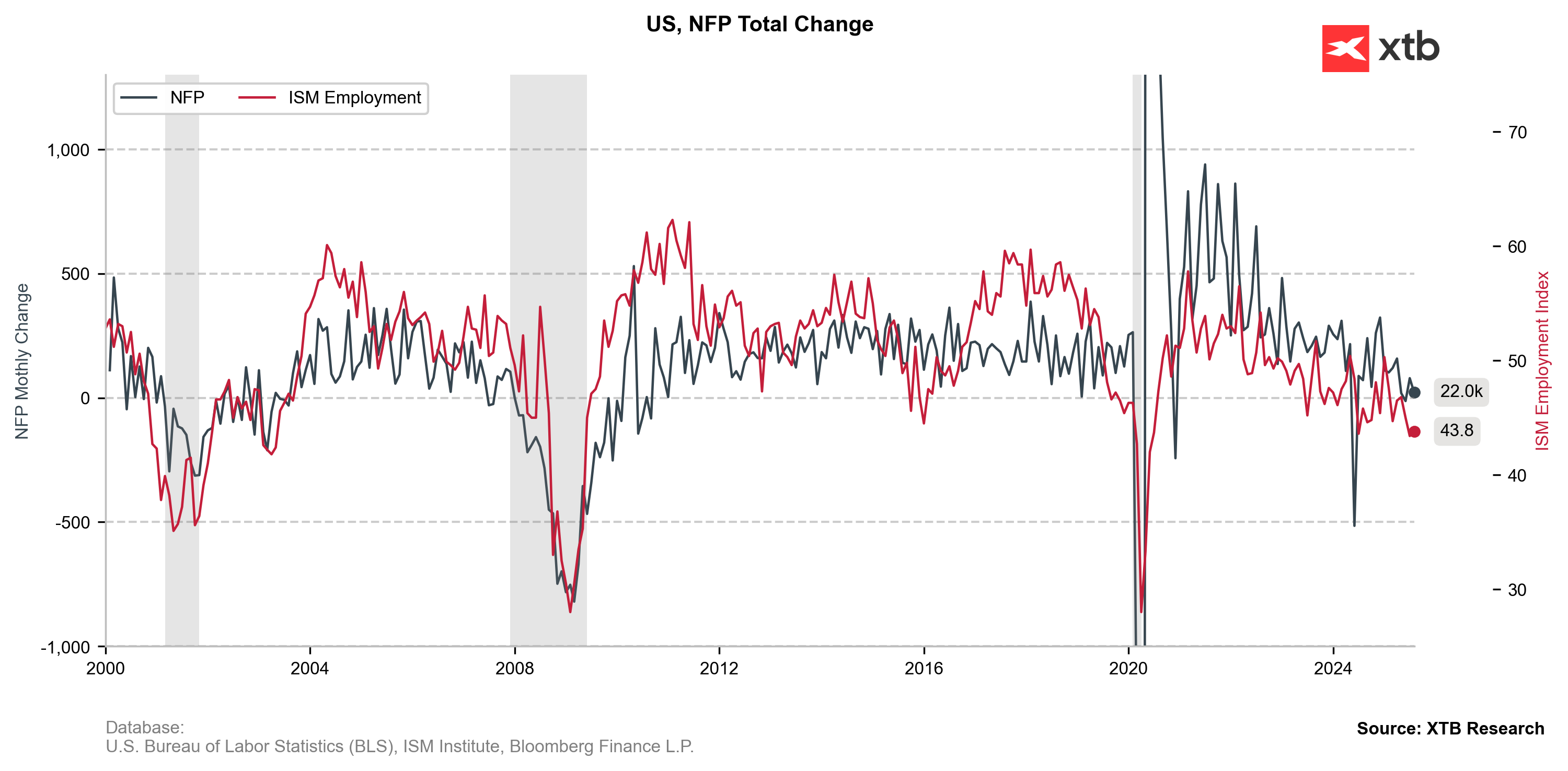

Nonfarm Payrolls: actual 22K; forecast 75K; previous 79K;

-

Unemployment Rate: actual 4.3%; forecast 4.3%; previous 4.2%;

-

Average Hourly Earnings: actual 3.7% YoY; forecast 3.7% YoY; previous 3.9% YoY;

-

Private Nonfarm Payrolls: actual 38K; forecast 75K; previous 77K;

-

Government Payrolls: actual -16.0K; previous 2.0K;

-

Manufacturing Payrolls: actual -12K; forecast -5K; previous -2K;

-

Participation Rate: actual 62.3%; previous 62.2%;

Payrolls miss, revisions add fuel

Employment data came in well below expectations for August. In addition, there were revisions to the last two months (June and July), with a slight upward revision for July – June to −13k (from +14k) and July to +79k (from +73k), leaving employment for June–July 21k lower than previously reported.

EURUSD is sharply higher, breaking out of the month-long consolidation capped by 1,172 level. The market is currently pricing a full rate cut in September, with potentially another in October and December. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Economic calendar: NFP data and US oil inventory report 💡