Fed cuts rates by 25 bps to 3.75% in line with Wall Street expectations. Vote in favor of policy decision was 9-3, with Miran preferring a half-percentage-point cut and Goolsbee and Schmid preferring no cut..

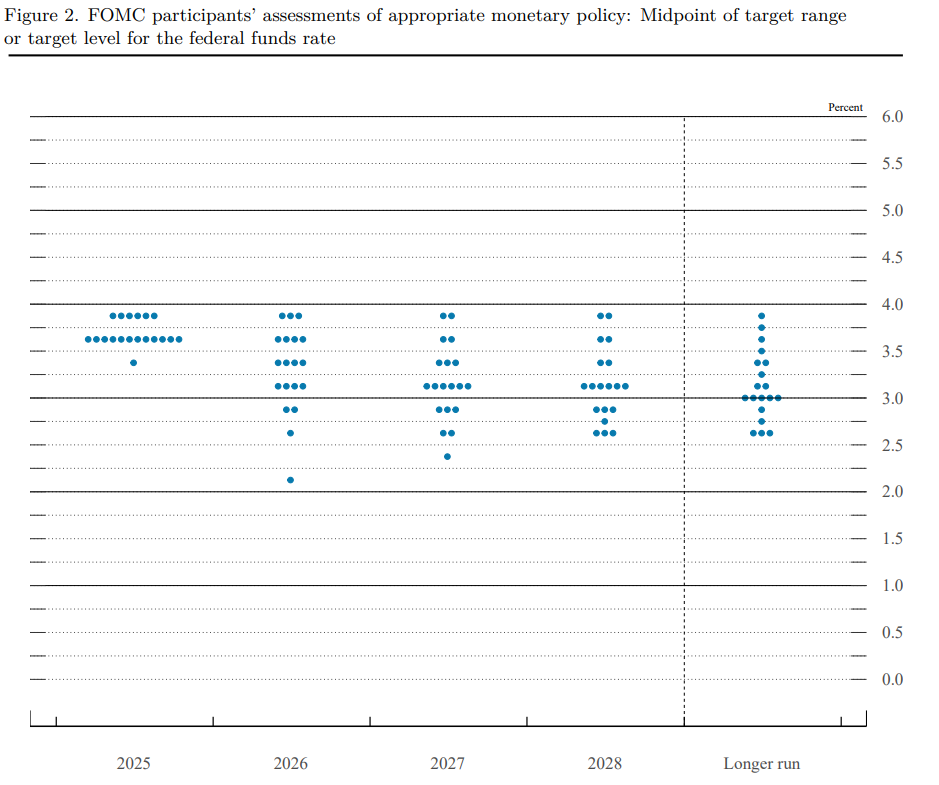

In first reaction to data futures on Nasdaq 100 (US100) gain. Fed median projection maintains 25 bps of rate cuts in 2026; seven officials penciled in no rate cuts for 2026. Four Fed members signalled in two quarter-point cuts for 2026. Fed policymakers see end-2026 PCE inflation at 2.4% (vs. 2.6% prior); core at 2.5% (vs. 2.6%). Projections show wide divergence of views for the path of rates in 2026 and beyond.

- Fed median unemployment projection 4.5% in '25, 4.4% in '26.

- Fed median projection shows rates at 3.1% by the end of 2028.

- Unemployment edged up through September.

- Fed median projection shows rates at 3.4% in '26, 3.1% in '27.

- Median GDP projection at 1.7% in 2025, 2.3% in 2026.

- Fed will buy $40 billion of treasury bills over the next 30 days and consider the extent and timing of additional adjustments.

- Four officials see at least three-quarter-point cuts for 2026.

- Pace of future reserve management purchases likely to be significantly reduced.

- Initial Treasury bill buying to be elevated 'for a few months'; Fed ends operational limit on standing overnight repo operations.

Fed Projections

- Fed Median Rate Forecast (Next 3 Yrs): 3.125% (Forecast 3.125%, Previous 3.125%)

- Fed Median Rate Forecast (Next 2 Yrs): 3.125% (Forecast 3.125%, Previous 3.125%)

- Fed Median Rate Forecast (Current): 3.625% (Forecast 3.625%, Previous 3.625%)

- Fed Median Rate Forecast (Next Yr): 3.375% (Forecast 3.375%, Previous 3.375%)

- Fed Median Rate Forecast (Long Run): 3% (Forecast 3.125%, Previous 3%)

Federal Reserve signals uncertainty about the outlook remains elevated with 'attentive to risks on both sides of mandate', downside risks to employment have risen. However, the US economy is expanding at moderate pace; job gains have slowed, and unemployment has edged up. Inflation has risen from earlier in the year and remains elevated.

Source: xStation5

Source: Federal Reserve

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Economic calendar: ADP Labor market report and ISM services 🔎

Morning wrap (04.03.2026)

Economic calendar: Eurozone CPI and central bankers speeches in focus