Data from the UK indicates that price pressure in the country is falling relatively in line with expectations, which is weakening the British pound against the backdrop of declining chances of maintaining a conservative monetary policy, and rather leaning towards possible interest rate cuts.

UK CPI (M/M) Oct: 0.4% (0.4%; prev 0.0%)

- CPI (Y/Y): 3.6% (est 3.5%; prev 3.8%)

- CPI Core (Y/Y): 3.4% (est 3.4%; prev 3.5%)

- CPI Services (Y/Y): 4.5% (est 4.6%; prev 4.7%)

- CPIH (Y/Y): 3.8% (est 3.8%; prev 4.1%)

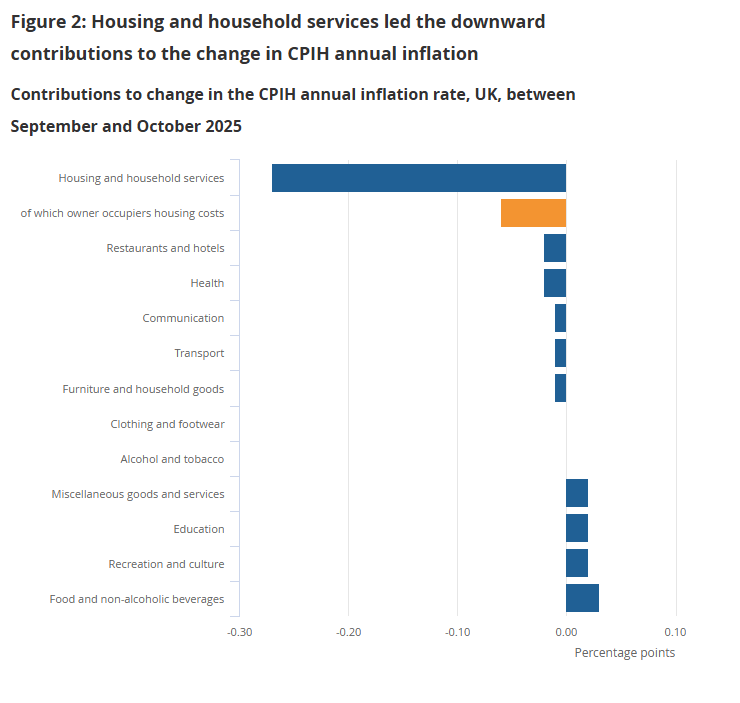

The slowing in the CPIH rate into October 2025 reflected downward contributions from six divisions, offset by upward contributions from four divisions. The largest downward contributions were from the housing and household services, and restaurants and hotels divisions. The largest offsetting upward contribution came from the food and non-alcoholic beverages division - ONS

Source: ONS

Source: xStation

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)