In the last hours, we can observe solid declines on gold, but also on other precious metals. This is related to the upward movement on US bond yields, which rose from 1.5% to 1.59% during today's session (at the same time the prices of these bonds fell). The rise in 10-year Treasury bond yields is also accompanied by a strengthening of the dollar, which is today gaining over 0.6% to AUD, CAD and NZD and over 0.8% to EUR, GBP and CHF.

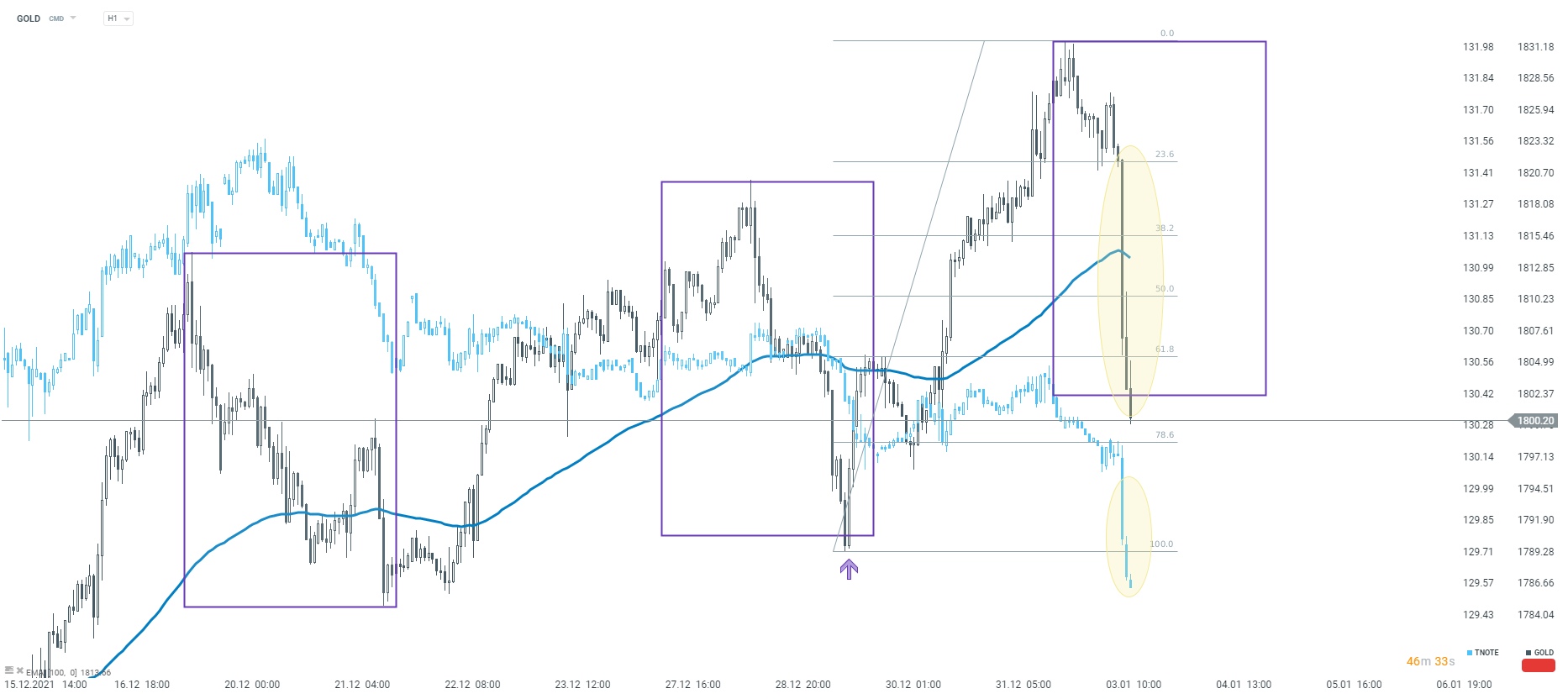

Looking at the H1 chart of gold, trading has dived below the EMA100 average, which may indicate that sellers have taken the initiative in the short term. As the nearest support, consider the area around the level of $1802, where the lower limit of the wide 1:1 system (purple rectangle) is located. The current decline is already stronger than the two previous ones, marked by purple rectangles.

Gold is suffering losses due to rising US bond yields (and falling bond prices). Source: xStation 5

Morning Wrap - Oil price is still elevated (07.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook