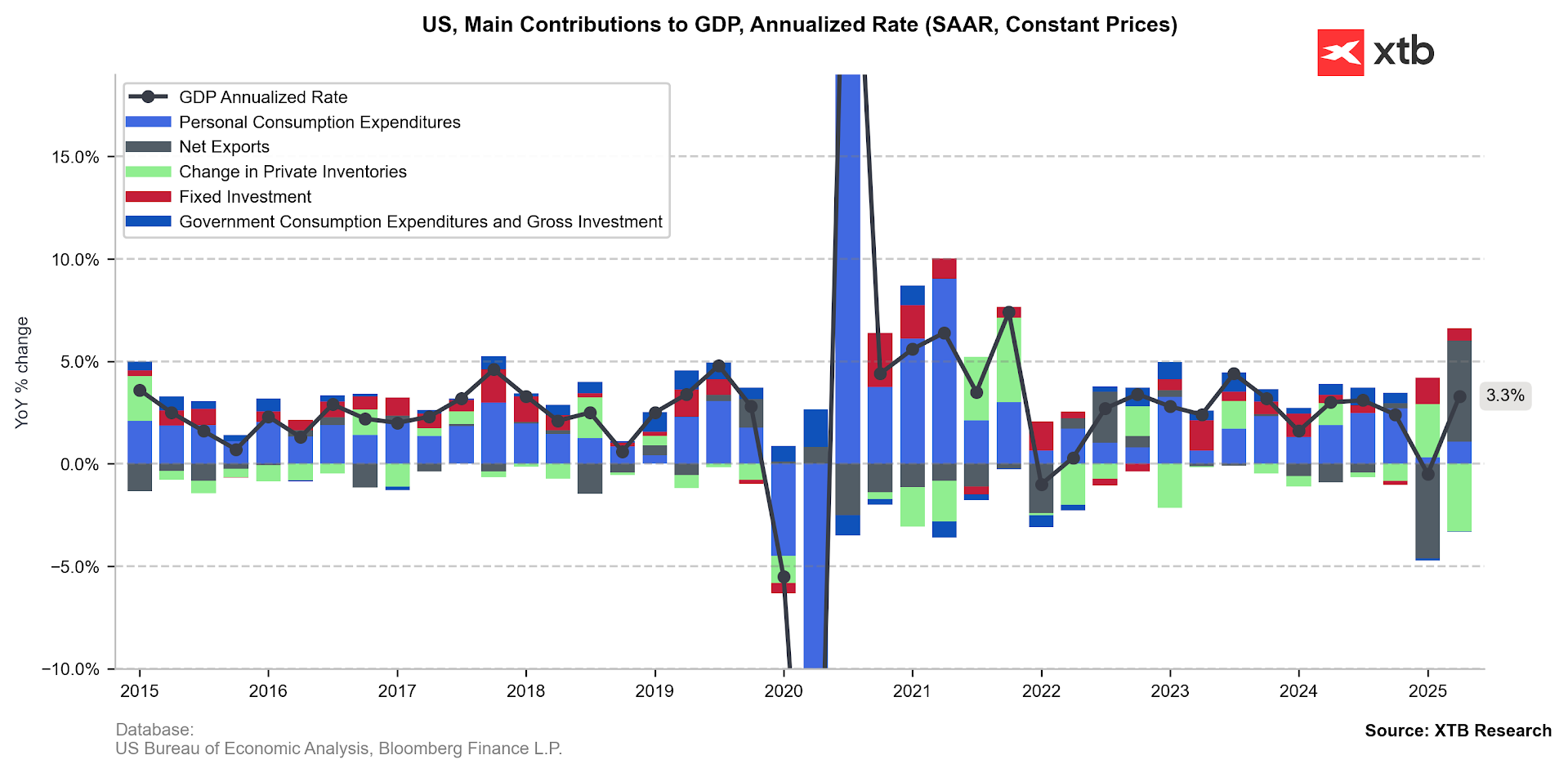

- Final Q2 GDP is revised up to 3.8% (expected: 3.3%; previous reading: 3.3%, Q1: -0.5%). Data was revised up mainly due to net exports that came out even better than in previous readings.

- GDP Price Index in Q2: 2.1% (expected 2.0%; previous: 2,0%, Q1: 3,8%).

- Core PCE Prices in Q2: 2.6% (expected: 2.5%; previous 2.5%, Q1: 3.5%)

- Initial Jobless Claims: 218k (expected: 233k; previous: 232k)

- Trade balance for August: -$85,5B (expected: -$95.7B; previous: -$103,6B)

- Durables Goods Orders for August: 2.9% MoM (expected: -0.3% MoM; previous: -2.7% Mom)

- Core Durables Goods Orders: 0.4% MoM (expected: -0.1% MoM; previous: 1.1% MoM)

Strong US Data Fuels Dollar Rally, Challenges Fed Rate Cut Outlook

A powerful set of US economic data was released, led by a significant upward revision to second-quarter GDP growth. The trade balance came in much better than expected, and initial jobless claims are returning to previous low levels, suggesting the spike from two weeks ago was a one-off event.

Furthermore, durable goods orders showed a strong rebound. While this was largely influenced by transportation orders, core orders also recovered, pointing to broader economic resilience.

Overall, the data paints a very positive picture of the US economy. The dollar strengthened considerably in response, now testing the 1.1700 level. This has also triggered a sharp pullback in US index futures, indicating the market is interpreting the data as hawkish. Given the economy's underlying strength, some members of the Federal Reserve may now question the justification for two interest rate cuts this year, especially since inflation continues to be a problem.

Growth is driven mainly by net exports but there is also a positive contribution from consumption and fixed investment, which indicates that even without tariffs turbulence, the change should be positive. Source: Bloomberg Finance LP, XTB

EURUSD has decreased significantly today due to strong data package from the USD which undermines probability of further Fed cuts this year. Source: xStation5

Market is not sure about future cuts from the Fed after very positive data from the US economy. US500 is below opening price after recent roll-over. Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure