There’s been some sizable selling seen in the crude markets today with both Oil (-2.8%) and Oil.WTI (-3.0%) tumbling lower. The declines began in earnest when China announced that they were yet to sign a trade deal with the US and despite significant geopolitical risks as tensions in the Middle East flare up once more the market seems more focused on the demand rather than the supply side at present.

On the geopolitical front, Hassan Rouhani has claimed to have video evidence of two missiles hitting the Iranian tanker last week and that this was “undoubtedly carried out by a government”. However, this has failed to see much of positive reaction and the markets continue to languish near their lowest levels of the day.

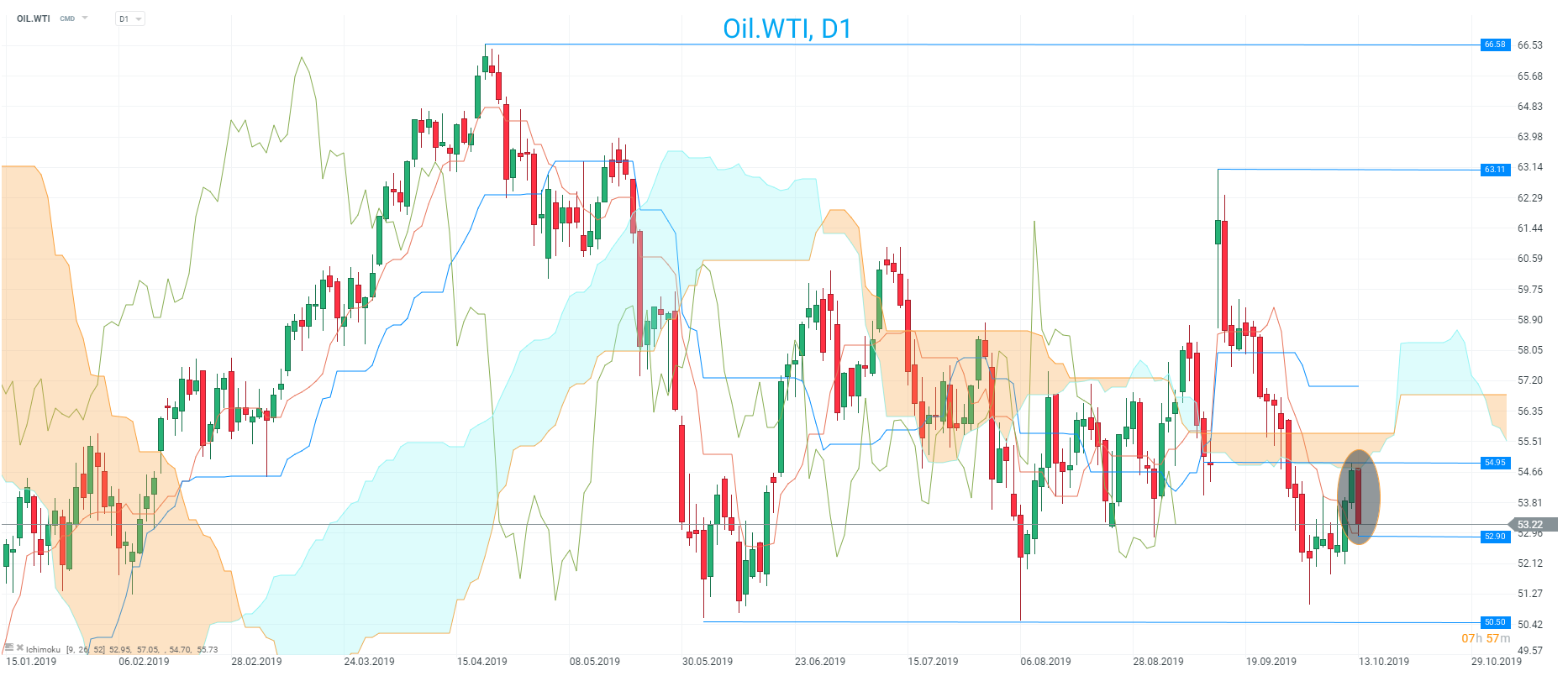

Oil.WTI has fallen today with a possible bearish engulfing candle forming on D1. Lows around 52.90 could be seen as a level to watch but if price breaches there then the longer term support around 50.50 could be in for a retest. Source: xStation

Oil.WTI has fallen today with a possible bearish engulfing candle forming on D1. Lows around 52.90 could be seen as a level to watch but if price breaches there then the longer term support around 50.50 could be in for a retest. Source: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report