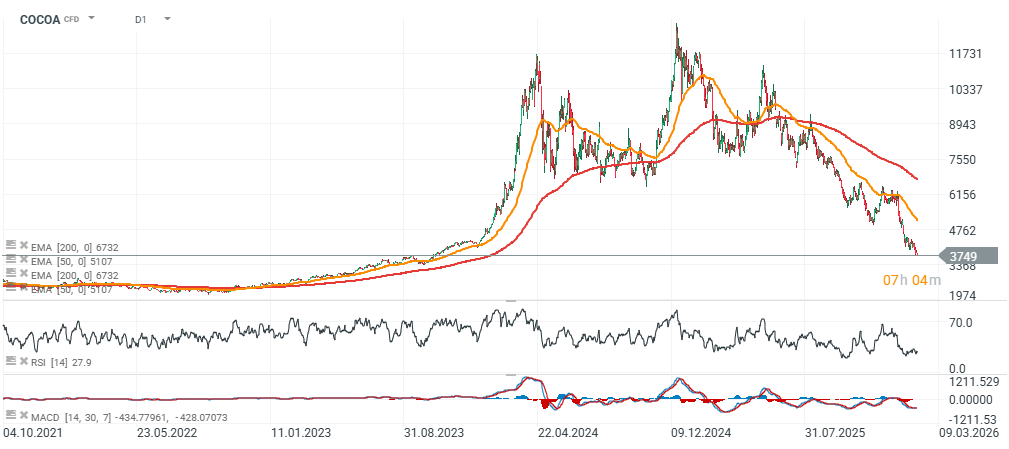

ICE cocoa futures (COCOA) are hitting their lowest levels since early October 2023 today, pressured by weakening demand and rising supply across key producing regions. Data point to increasing inventories from the two largest exporters: Ghana and Cote d’Ivoire. Cote d’Ivoire’s figures show that, as of February 8, cumulative port arrivals/shipments since the start of the 2025/26 crop season on October 1 have fallen 4.5% y/y to 1.263 million tonnes. Altogether, this materially worsens cocoa’s fundamentals and - combined with favorable weather forecasts in West Africa has triggered a broad liquidation of long positions. Prices are sliding to around $3,750 per tonne today.

COCOA (D1 interval)

Source: xStation5

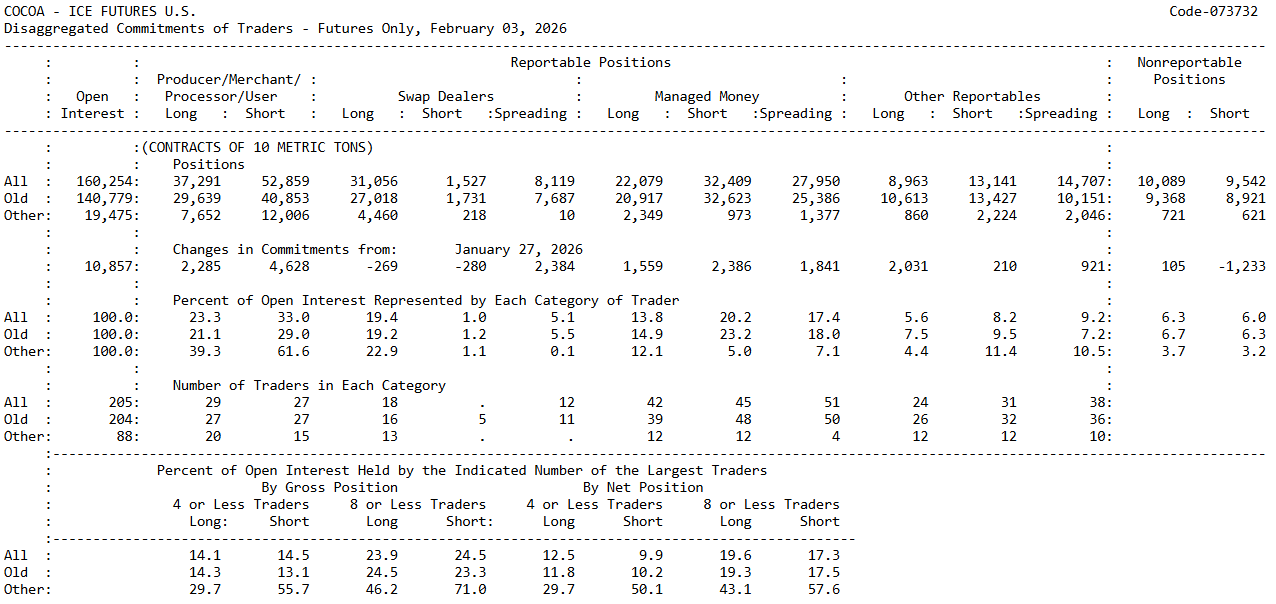

CoT report: speculators add shorts while Commercials increase hedging

The latest COT report for cocoa (ICE Futures U.S., as of February 3, 2026) shows a clear pickup in activity and a widening gap between commercial participants and speculative capital. Open interest increased by 10,857 contracts to 160,254, suggesting fresh capital entering the market and growing commitment to the prevailing trend. Key takeaways:

Managed Money is expanding net short exposure

-

Long positions: 22,079

-

Short positions: 32,409

-

Net positioning: a clear short bias (approx. -10k contracts)

-

Over the week, shorts increased (+2,386) more than longs (+1,559)

Commercials (Producer/Merchant/Processor/User) are adding short hedges

-

Long: 37,291

-

Short: 52,859

-

Net positioning: clearly negative (typical for producer hedging)

-

Weekly changes show shorts rising (+4,628) more than longs (+2,285)

Open interest is rising

This indicates the positioning shift is not merely a rotation of existing exposure, but reflects new capital building market positions.

Positioning shares of open interest

-

Managed Money: 13.8% of OI on the long side vs 20.2% on the short side

→ Speculators are clearly positioned defensively / bearish. -

Commercials: 23.3% of OI long vs 33.0% short

→ A classic production-hedging profile at relatively elevated price levels.

Concentration remains moderate

The 8 largest traders control roughly 24–25% of gross positions, which does not point to extreme concentration risk, but confirms meaningful participation by large players. Cocoa is entering a phase of increasing polarization:

-

Speculators are adding to downside bets.

-

Commercial participants are intensifying hedging at current levels.

Rising open interest alongside growing Managed Money shorts suggests pressure is building for a more directional move. If prices were to remain high, further short accumulation could raise the risk of a short squeeze on any unexpected supply shock or bullish fundamental catalyst. Overall, the COT data reinforce a clearly bearish message at this stage, with positioning aligned with the deterioration in fundamentals (West Africa production outlook, weather, inventories, and industrial demand) - however the report came in in the beginning of the February.

Source: CFTC

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks