Eyes of oil traders are turned to Europe today as the European Union debates over the shape of the looming embargo on Russian oil. This is a major medium- and long-term factor for oil prices and is pushing crude prices higher today. Amid such high level talks it is easy to miss another factor for oil prices with more short-term implications on prices - weekly report from US Department of Energy on the level of oil and oil derivative inventories. Report completely missed estimates from API released yesterday in the evening.

-

Oil inventories: +1.30 mb vs -1.2 mb expected (API: -3.48 mb)

-

Gasoline inventories: -2.23 mb vs -0.2 mb (API: -4.50 mb)

-

Distillate inventories: -2.34 mb vs -1.1 mb (API: -4.46 mb)

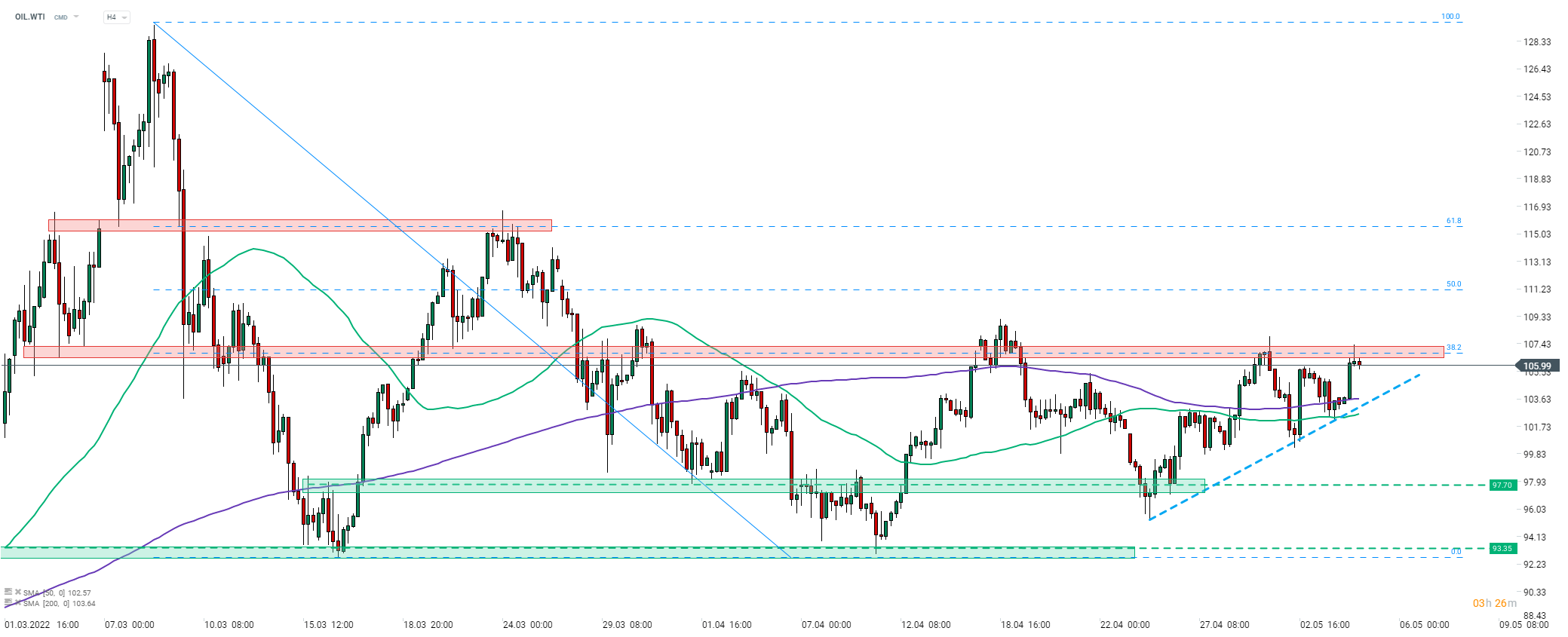

A build in headline crude inventories put some pressure on oil prices with WTI pulling back below $106 area. Taking a look at WTI chart at H4 interval (OIL.WTI), we can see that price made a failed attempt of breaking above resistance zone marked with 38.2% retracement earlier today ($106.75). A long, upper wick of previous H4 candlestick painted in the resistance zone suggests that some kind of a reversal may be looming. If pullback deepens, a near-term support to watch can be found in the $103.50 area, where the short-term upward trendline and 200-period moving average are located.

Source: xStation5

Source: xStation5

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?