US Department of Energy issued a weekly report on US oil inventories today at 3:30 pm BST. Report was expected to show declines in oil, gas and distillate inventories, but not as big as hinted by private API report yesterday in the evening.

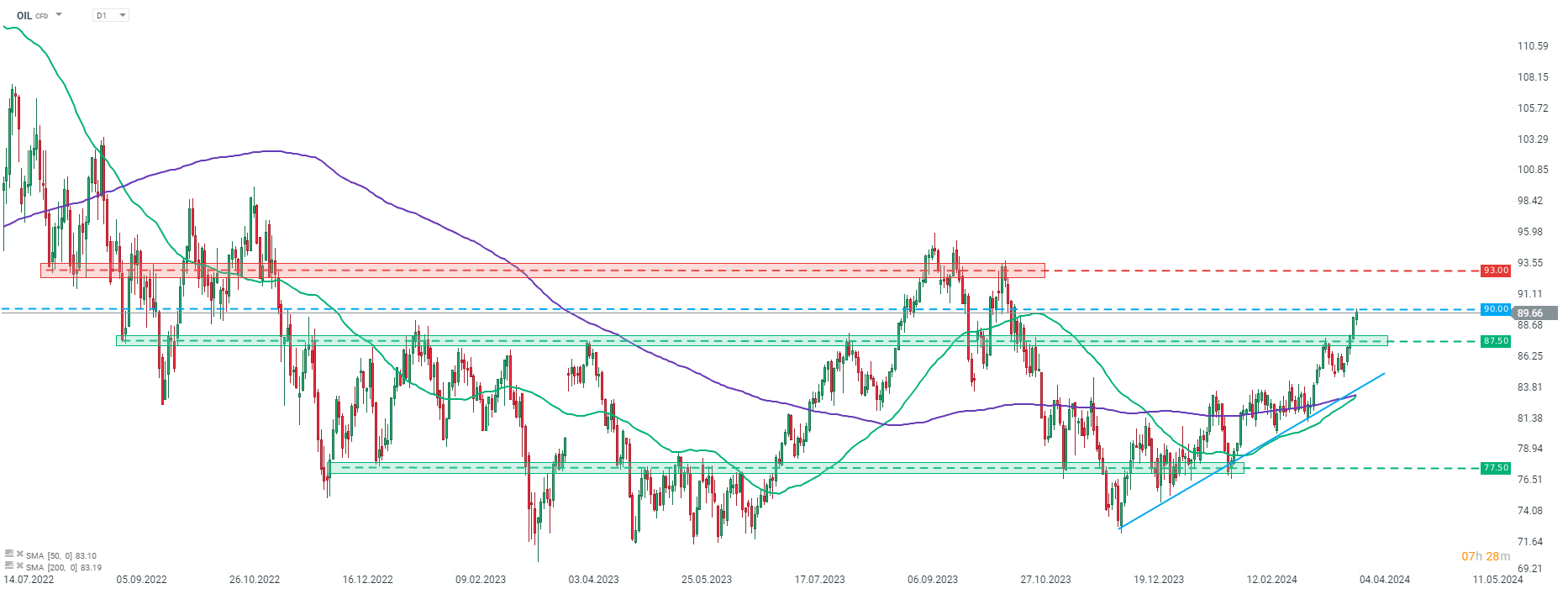

Official report turned out to be mixed. While gasoline and distillate inventories dropped more than expected, the headline crude inventories show an unexpected, and quite big, increase. Build in oil inventories seem to outweigh drops in gasoline and distillate stockpiles, causing Brent (OIL) pulled back from the $90 area following the release.

DOE report on US oil inventories

- Oil inventories: +3.21 mb vs -1.5 mb expected (API: -2.29 mb)

- Gasoline inventories: -4.26 mb vs -0.8 mb expected (API: -1.42 mb)

- Distillate inventories: -1.27 mb vs -0.5 mb expected (API: -2.55 mb)

Source: xStation5

Source: xStation5

BREAKING: US Manufacturing data above expectations! 📈🏭

BREAKING: Euro area manufacturing PMIs for February broadly confirmed a return to modest expansion

Economic calendar: PMI data in focus 💡

BREAKING: GDP collapse in Canada; US producer inflation accelerates🚨