GBPUSD plunged below $1.19, while AUDUSD lost 1.9% as traders damped riskier assets and rushed towards greenback following Fed Chair Powell's hawkish comments. During his testimony in front of Congress Powell said that the Fed might need to increase interest rates more than forecast to combat inflation. Elsewhere, the Bank of England is seen increasing rates by a further 25 bps this month, before ending the current tightening cycle. Board member Catherine Mann had warned on Tuesday that the pound could be vulnerable to Federal Reserve and European Central Bank hawkish outlooks. Powell’s remarks drove money markets to bet on a 50 bps interest rate hike this month, compared to prior expectations of a softer 25bps. The yield on the US 10-year Treasury note briefly jumped above 4.0%, which put additional pressure on precious metals. Gold retreated to support at $1820, while silver plunged nearly 4.0% to $20.25 mark.

GBPUSD fell sharply and is currently testing key support at 1.1860, which is marked with lower limit of the 1:1 structure, 200 SMA (red line) and 38.25 Fibonacci retracement of the downward wave started in June 2021. Should break lower occur, downward move may deepen towards October 2022 highs at 1.1650. Source: xStation5

SILVER is losing over 5.0% on a weekly basis and is approaching psychological support at $20.00 which coincides with 200 SMA (red line). Source: xStation5

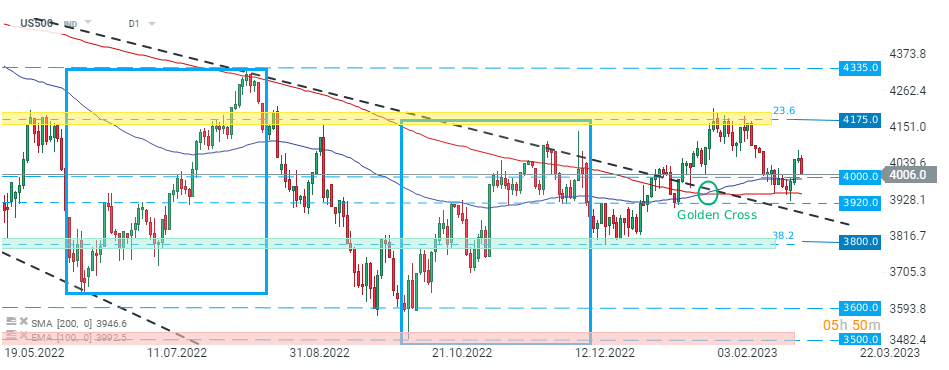

US500 also retreated sharply and is approaching key support at 4000 pts. Source: xStation5

The US dollar is the strongest G10 currency on Tuesday. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉