01:30 PM BST, United States - Philadelphia Fed Manufacturing Index for April:

- actual 15.5; forecast 1.5; previous 3.2;

- Philly Fed Employment: actual -10.7; previous -9.6;

01:30 PM BST, United States - Employment Data:

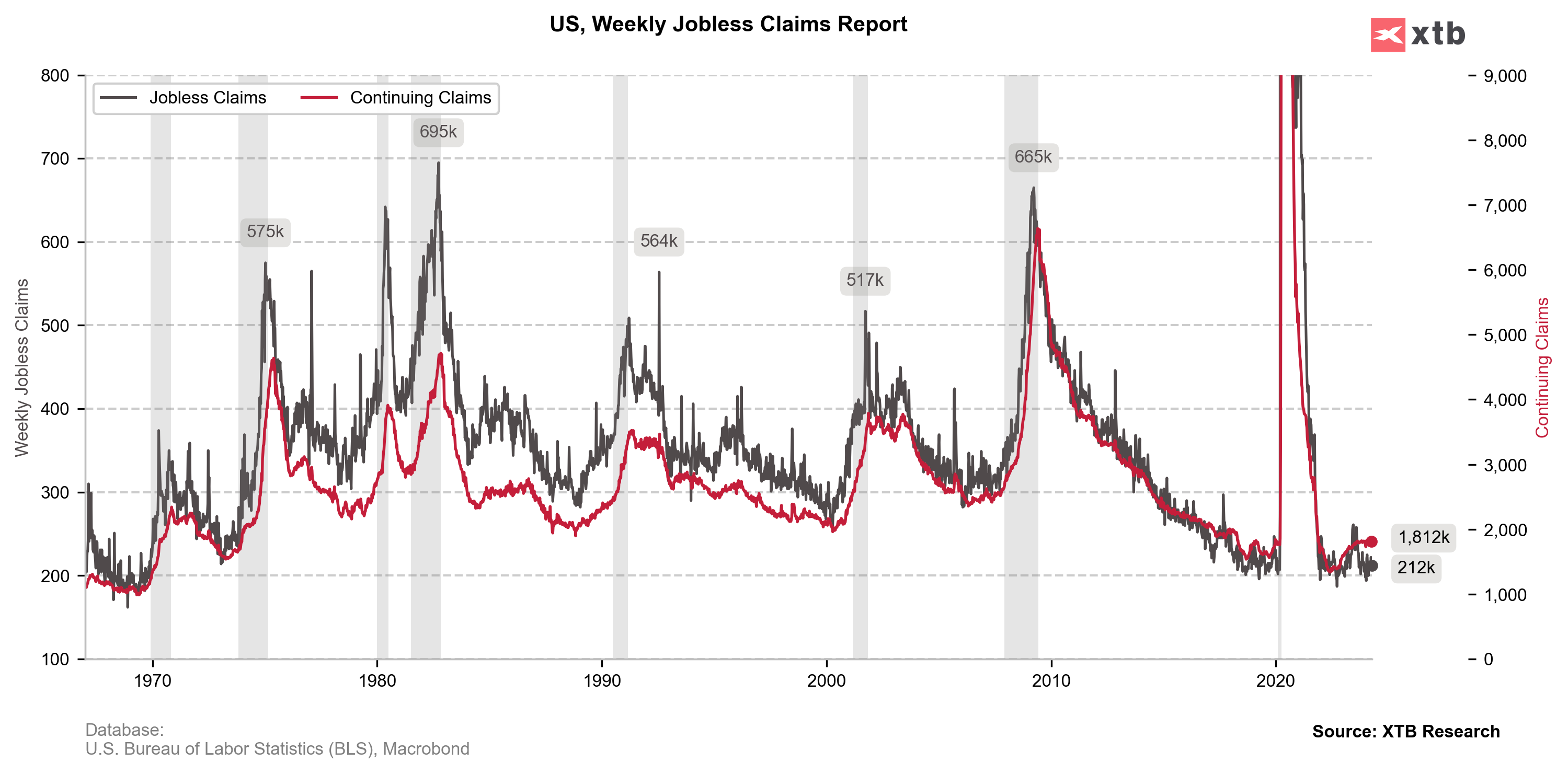

- Jobless Claims 4-Week Avg.: actual 214.50K; previous 214.50K;

- Initial Jobless Claims: actual 212K; forecast 215K; previous 212K;

- Continuing Jobless Claims: actual 1,812K; forecast 1,818K; previous 1,810K;

The dollar strengthens after the publication. The labor market remains strong, which is confirmed by the low values of Jobless Claims for the last week. Moreover, the first regional index, the Philly Fed, indicates a significant improvement in industry in April.

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸