07:00 AM BST, United Kingdom - Retail Sales Data for August:

-

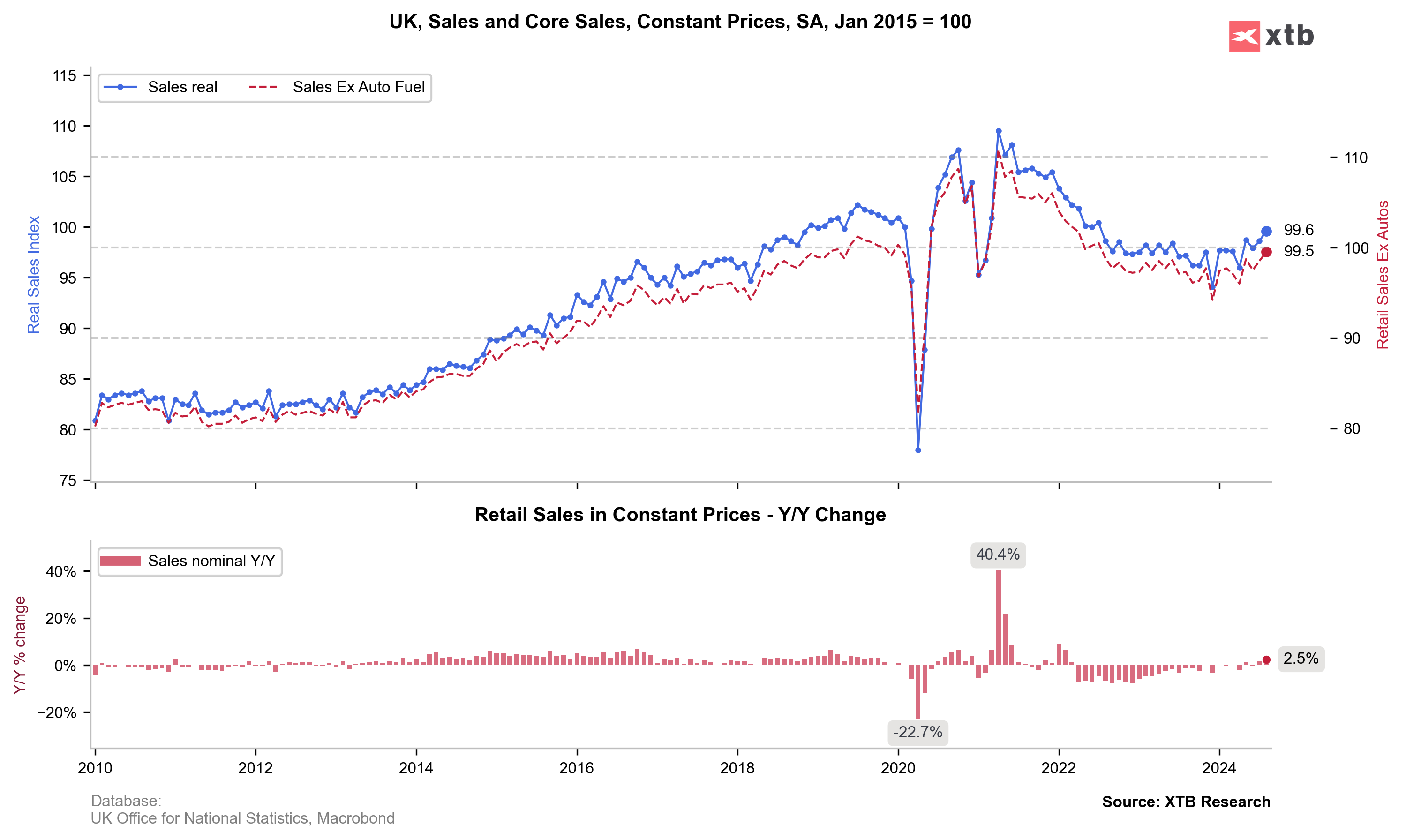

Retail Sales: actual 1% MoM; forecast 0.4% MoM; previous 0.5% MoM;

-

Retail Sales: actual 2.5% YoY; forecast 1.3% YoY; previous 1.4% YoY;

-

Core Retail Sales: actual 1.1% MoM; forecast 0.5% MoM; previous 0.7% MoM;

-

Core Retail Sales: actual 2.3% YoY; forecast 1.1% YoY; previous 1.4% YoY;

Stronger-than-expected retail sales data might be another argument for the BoE's decision to hold rates. This could help further strengthen the British pound against the dollar. Some reports from the UK also show signs of discretionary spending being under pressure.

On the news GBPUSD is up amost 0.2% and is currently approaching levels last seen at the begining of 2022. RSI is sligthly diverging bearish from 7 am high yesterday, which might potentially give a signal of trend reversal.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)