Report from the US Department of Energy failed to trigger big moves on the oil market. Crude inventories fell less than expected while gasoline stockpiles increased significantly. There was also a surprise in distillate inventories data as it showed a big build.

• Oil inventories: - 2.144 million barrels vs -3.283 million barrels expected (API: -0.643 million barrels)

• Gasoline inventories: +10.128 million barrels vs +1.775 million barrels expected (API: +7.06 million barrels)

• Distillate inventories: + 4.418million barrels vs +1.525 million barrels expected (API: +4.38 million barrels)

• Oil inventories at Cushing, Oklahoma: +2.577 million barrels vs 1.055 million barrels previously

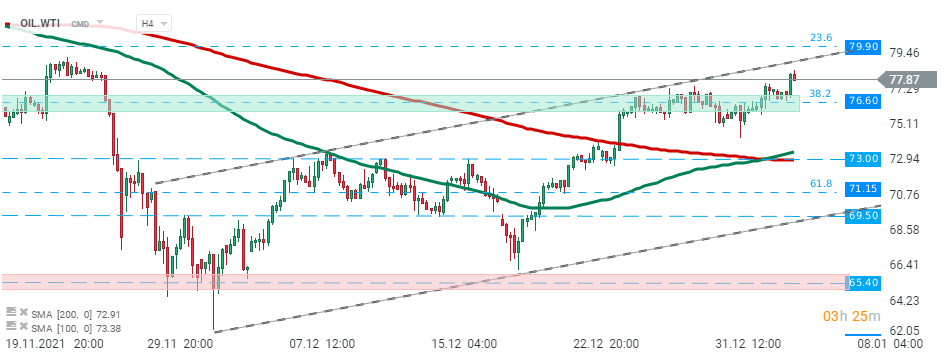

The publication of today's report did not have a significant impact on the oil prices. WTI Oil (OIL.WTI) continues to trade around the $77.80 level. Source: xStation5

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Economic calendar: ADP Labor market report and ISM services 🔎

Morning wrap (04.03.2026)