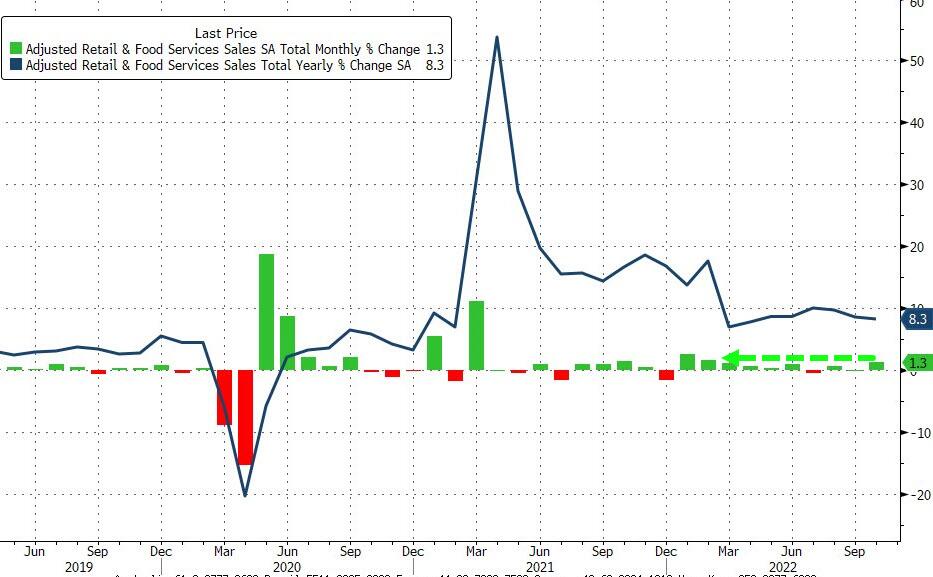

US retail sales data for October was released at 1:30 pm GMT. Report turned out to be better than but it did not trigger any major moves on the markets. Highlights of the report:

• Headline: 1.3% MoM vs 0.9% MoM expected (0.0% MoM previous)

• Ex-autos: 1.3% MoM vs 0.5% MoM expected (0.1% MoM previous)

• Ex-gas and autos: 0.9% MoM vs 0.2% MoM expected (0.3% MoM previous)

Auto sales were up 1.3% as supply chain constraints have been easing while rising gasoline costs pushed sales at gasoline stations 4.1% higher. Other increases were also seen for food services and drinking places (1.6%); food and beverages stores (1.4%); nonstore retailers (1.2%); furniture (1.1%); building materials (1.1%); and health and personal care (0.5%). Retail sales aren’t adjusted for inflation. October data pointed to resilient consumer spending, despite high inflation and rising borrowing costs hit consumer demand, according to U.S. Census Bureau

US retail sales recorded the sharpest jump since February 2022. Source: Bloomberg

US retail sales recorded the sharpest jump since February 2022. Source: Bloomberg

In nominal terms, US Retail Sales still remain strong, rising 7.5% over the last year & hitting a new high in October, however after adjusting for inflation, things look different. Real Retail Sales reached high in March 2021 & are down 0.3% over the last year. Source: Compound@ Charlie Bilello / Ycharts

In nominal terms, US Retail Sales still remain strong, rising 7.5% over the last year & hitting a new high in October, however after adjusting for inflation, things look different. Real Retail Sales reached high in March 2021 & are down 0.3% over the last year. Source: Compound@ Charlie Bilello / Ycharts

Retail sales expanded at a faster rate than expected in October, partially due to the impact of California stimulus checks, nevertheless today's reading suggests some resilience in household spending despite the slowing economy. Still, money markets point to a broad consensus that the Fed will slow the pace of its rate hikes in December as both consumer and producer inflation were below expectations for October.

EURUSD saw a relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.0400 level. Source: xStation5

EURUSD saw a relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.0400 level. Source: xStation5

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)