01:30 PM BST, United States - GDP data:

- GDP (Q2): actual 3.0% QoQ; forecast 3.0% QoQ; previous 3.0% QoQ;

- GDP Price Index (Q2): actual 2.5% QoQ; forecast 2.5% QoQ; previous 2.5% QoQ;

- GDP Sales (Q2): actual 1.9%; forecast 2.2%; previous 2.2%;

- Core PCE Prices (Q2): actual 2.80%; forecast 2.80%; previous 2.80%;

- PCE Prices (Q2): actual 2.5%; forecast 2.5%; previous 2.5%;

- Real Consumer Spending (Q2): actual 2.8%; forecast 2.9%; previous 2.9%;

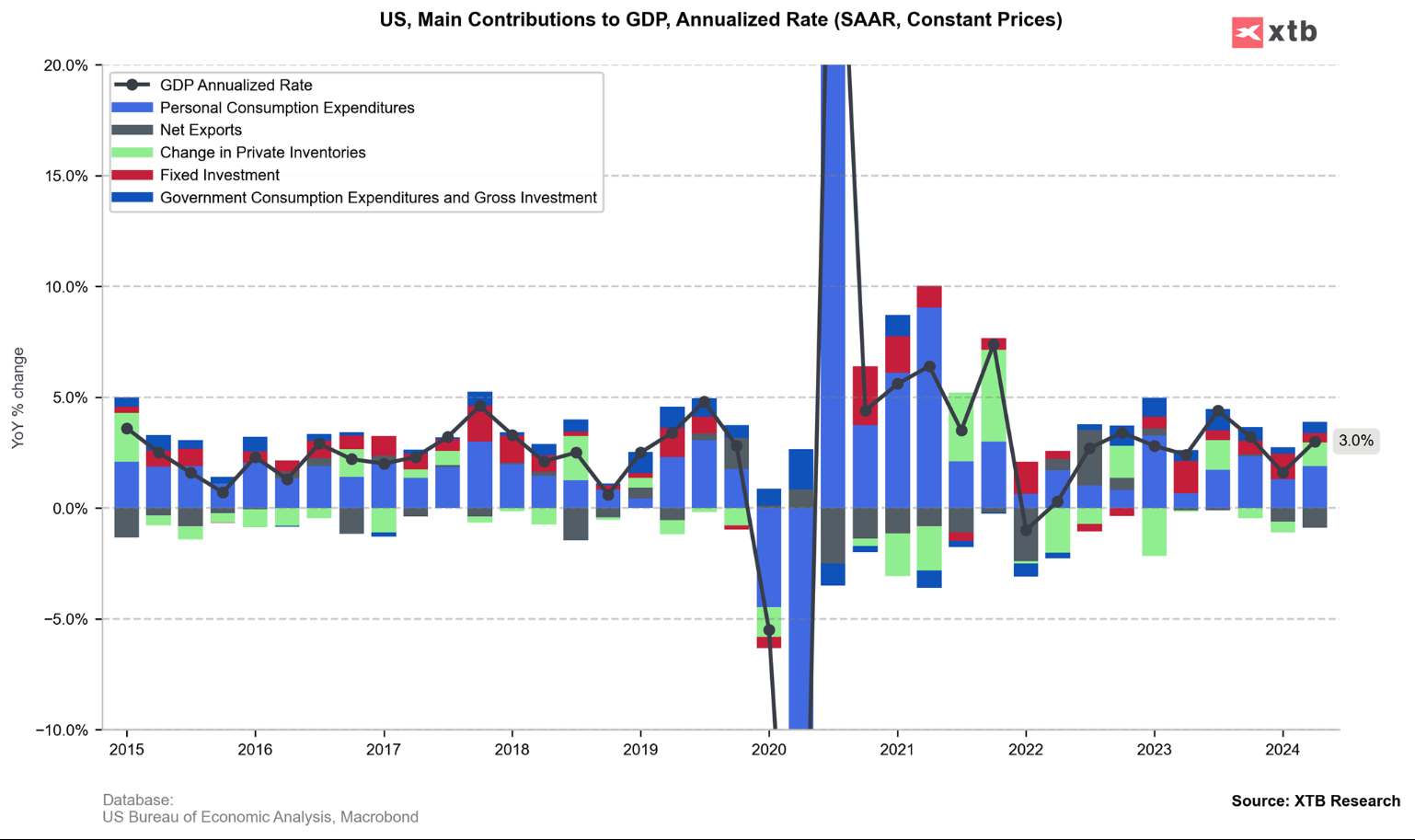

In Q2 2024, the U.S. real GDP grew at an annualized rate of 3.0%, up from 1.6% in Q1, driven by increases in consumer spending, private inventory investment, and nonresidential fixed investment. Current-dollar GDP rose 5.6% to $29.02 trillion. Personal income saw significant gains, with disposable income up 5.0%. Real gross domestic income (GDI) increased by 3.4%, while corporate profits rose $132.5 billion, reflecting strong performance in nonfinancial corporations despite a slight decline in financial sector profits.

The final data for the last quarter turn out to be even better than expected with no indication of a potential slowdown. Following the publication, the dollar strengthens slightly against the euro. However, the dollar index continues to remain in negative territory on a daily basis.

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS