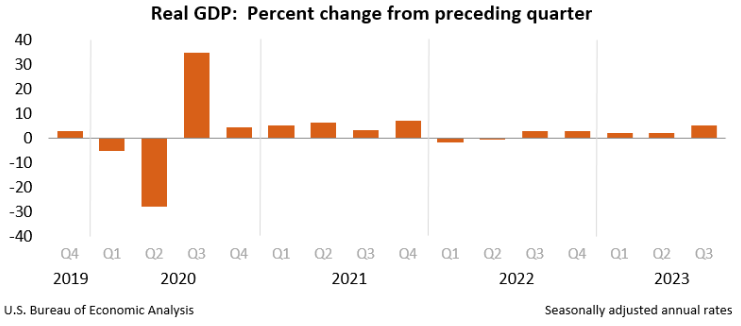

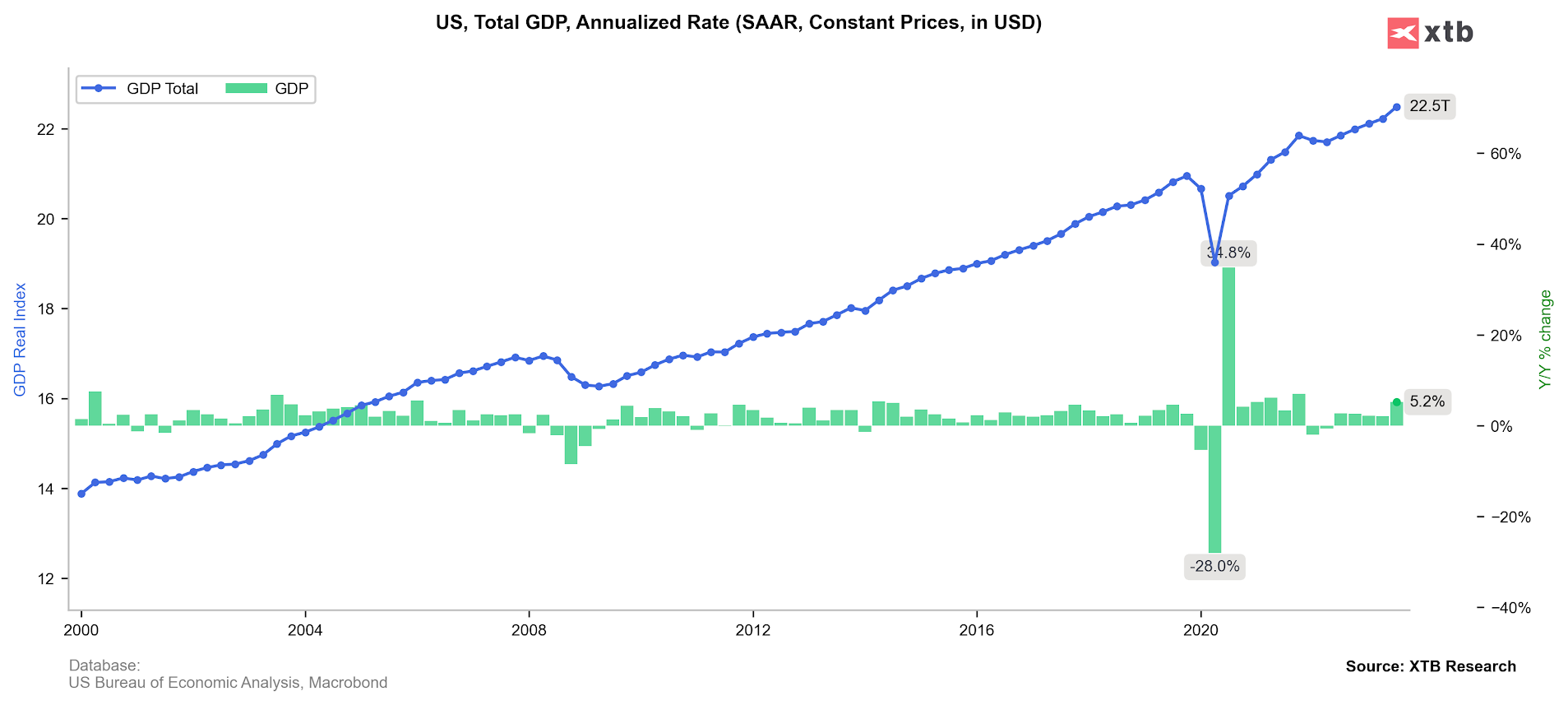

1:30 PM GMT - US Q3 GDP revision

- GDP (annualized): 5.2% vs 4.9% previously

- GDP Deflator. 3.6% vs 3.5% previously

- US GDP Price Index: 3.6% vs 3.5% previously

- US Core PCE: 2.3% vs 2.4% previously

- US Consumers spending: 3.6% vs 4.0% previously

- US Wholesale inventories: -0.2% vs 0.2% previously

- US Advance Goods Trade Balance: -$89.84 billion (flat q/q)

- US Real Inventories (Ex-Auto): -0.9% vs 0.4% previously

US prelim Q3 PCE services price index ex-energy/housing: 3.4% vs 3.6% previously

US prelim Q3 PCE price index ex-food/energy/housing: 1.6% vs +1.8% previously

In first reaction strong GDP reading supported US dollar, weakening Wall Street sentiments slighlty.

Source: xStation5

Source: xStation5

Source: XTB Research, US Bureau of Economic Analysis, Conference Board, Macrobond

Source: XTB Research, US Bureau of Economic Analysis, Conference Board, Macrobond

Source: XTB Research, US Bureau of Economic Analysis, Conference Board, Macrobond

Source: XTB Research, US Bureau of Economic Analysis, Conference Board, Macrobond

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report