01:30 PM GMT, United States - Inflation Data for June:

- Real Personal Consumption: actual 0.2% MoM; previous 0.4% MoM;

- Personal Income: actual 0.2% MoM; forecast 0.4% MoM; previous 0.4% MoM;

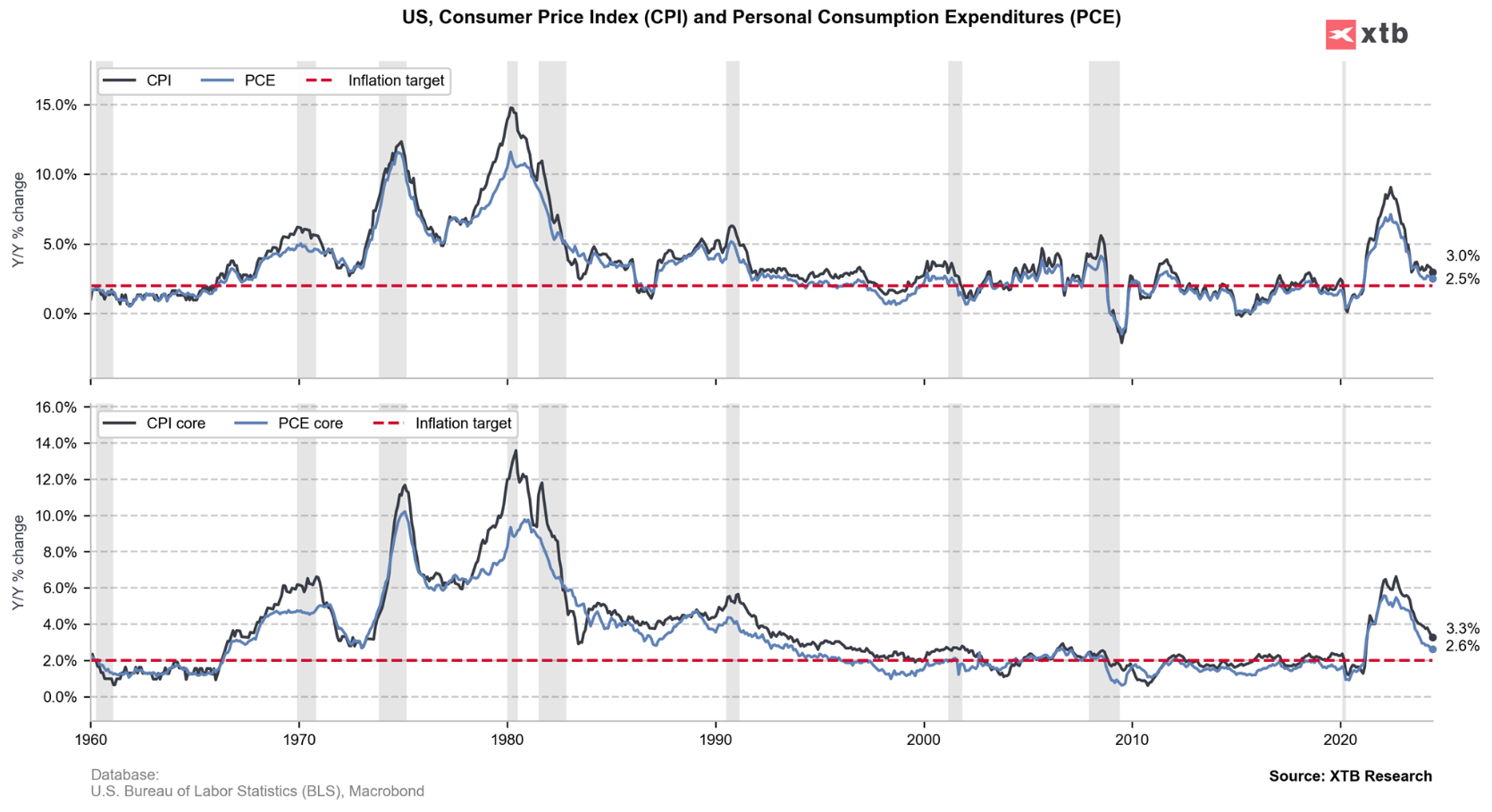

- PCE Price index: actual 2.5% YoY; forecast 2.5% YoY; previous 2.6% YoY;

- PCE price index: actual 0.1% MoM; forecast 0.1% MoM; previous 0.0% MoM;

- Core PCE Price Index: actual 0.2% MoM; forecast 0.2% MoM; previous 0.1% MoM;

- Core PCE Price Index: actual 2.6% YoY; forecast 2.5% YoY; previous 2.6% YoY;

In June, U.S. personal income rose, driven by increased compensation and transfer receipts, while disposable income also saw growth. Consumer spending climbed, particularly in services such as international travel and housing, though it was partially offset by declines in motor vehicle and gasoline expenditures. The overall price index saw a modest increase, with food prices slightly up and energy prices down. Over the past year, the PCE price index rose 2.5%, reflecting stable but modest inflation, which is relatively favorable for the Fed.

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸