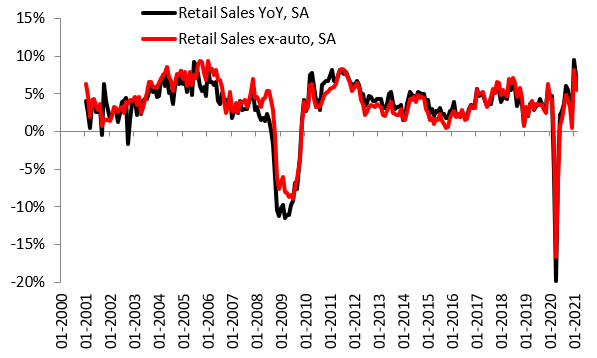

US retail sales data for February was released at 12:30 pm GMT. Report turned out to be weaker than expected but it did not trigger any major moves on the markets. Highlights of the report:

• Headline: -3.0% MoM vs -0.5% MoM expected (5.3% MoM previous - revised to 7.6%)

• Ex-autos: -2.7% MoM vs -0.1% MoM expected (5.9% MoM previous - revised to 8.5%)

It is the biggest decline since a record drop in April of 2020. Source: Macrobond, XTB

EURUSD bounced off the 1.1952 resistance after today's data releases and is heading towards support level at 1.1905. Source:xStation5

EURUSD bounced off the 1.1952 resistance after today's data releases and is heading towards support level at 1.1905. Source:xStation5

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸