The main US stock indices started today’s trading today below yesterday's close. Despite an attempt to rebound in the first minutes of the session, the sellers did not give up and in the following hours we can observe a deepening downward move. No key macro data (apart from US PPI inflation) that could be a direct cause of today's sell-off. Investors are clearly concerned about tomorrow's Federal Reserve decision. The US central bank is expected to announce an acceleration in the pace of QE tapering, which may directly translate into faster interest rate hikes in the US.

Technical situation on US100

Looking technically at the US100 chart on the H4 interval, we can see that bulls were not able to break above the resistance zone at 16,440 pts, after which lead to a strong sell-off. Both the support at 16,110 pts and at the round level of 16,000 pts did not manage to halt declines, and the sell-off accelerated in the last hour. If the current sentiment prevails, downward move may accelerate further towards support at 15,575 pts.

US100 interval H4. Source: xStation5

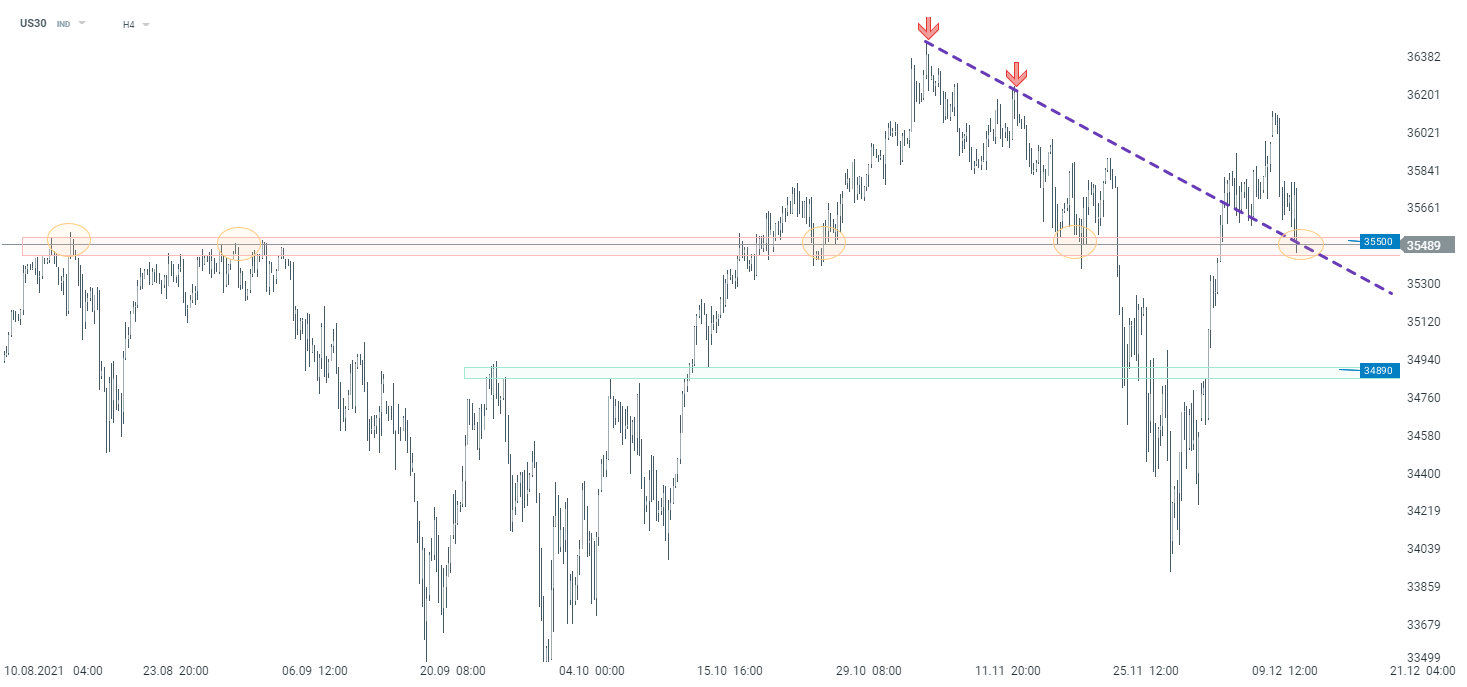

Technical situation on US30

Index reached the key horizontal support zone at 35,500 pts. If it is negated, the sell-off could accelerate even towards another important support zone 34,890 pts. On the other hand, if buyers manage to halt declines, then another u[ward impulse may be launched.

US30 interval H4. Source: xStation5

US30 interval H4. Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments