- US NFP report for April.

- Change in non-farm employment. Currently: 175 thousand. Expected: 245 thousand. Previously: 303 thousand.

- Change in private sector employment. Currently: 167 thousand. Expected: 180 thousand. Previously: 232 thousand.

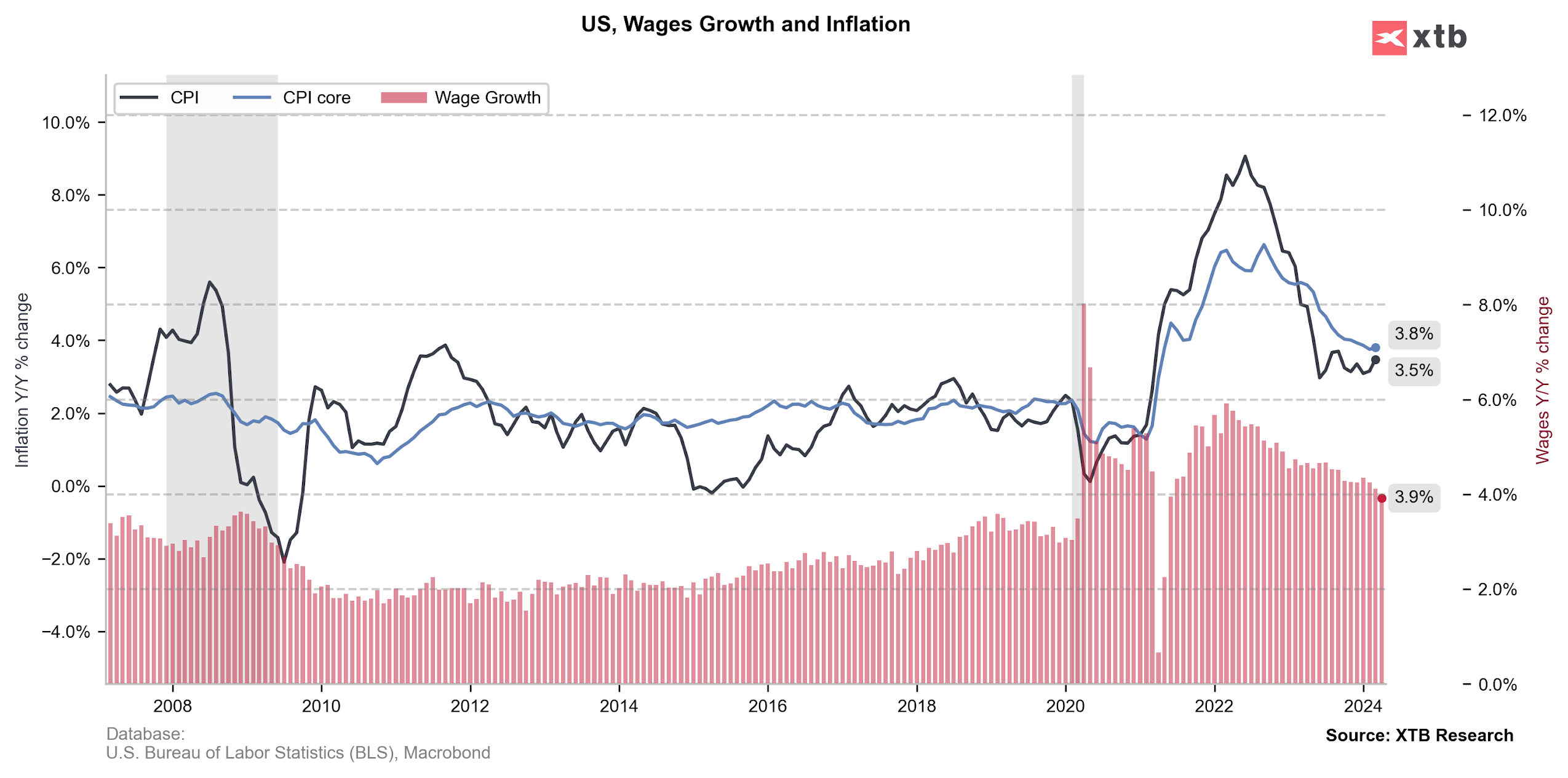

- Average hourly wages on an annualized basis. Currently: 3,9%. Expected: 4%. Previously: 4.1%.

- Average hourly wages by month. Currently: 0.2%. Expected: 0.3%. Previously: 0.3%.

- Unemployment rate. Currently: 3.9%. Expected: 3.8% y/y. Previously: 3.8% y/y.

The data is performing poorly, given that many investment banks were expecting that the data may have come out more clearly above expectations. U.S. Fed funds futures raise the odds of a rate cut in September to 78% after the employment data, compared to 63% just before it. In addition to the sheer powerful rallies in the quotations of U.S. indices, we are seeing a large appreciation of the yen against the U.S. dollar. The USDJPY pair is currently losing nearly 1.2%.

Source: XTB Research

Source: XTB Research

Source: xStation

Source: xStation

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸