Fed Minutes (January 2025)

- Fed can maintain policy at restrictive level if economy strong

- Several participants suggest halting or slowing balance sheet reduction pending debt ceiling resolution

- Two participants believe risks to achieving inflation mandate outweigh risks to employment mandate

- Most participants judged risks to dual mandate objectives were roughly in balance

- Fed wants further progress on inflation before adjusting rates

- Few believe Fed funds may not be far above neutral level

- Various Fed officials see potential for big swings in reserves.

- Fed may need to pause, slow run-off until debt limit resolved. Inflation risks skewed upward.

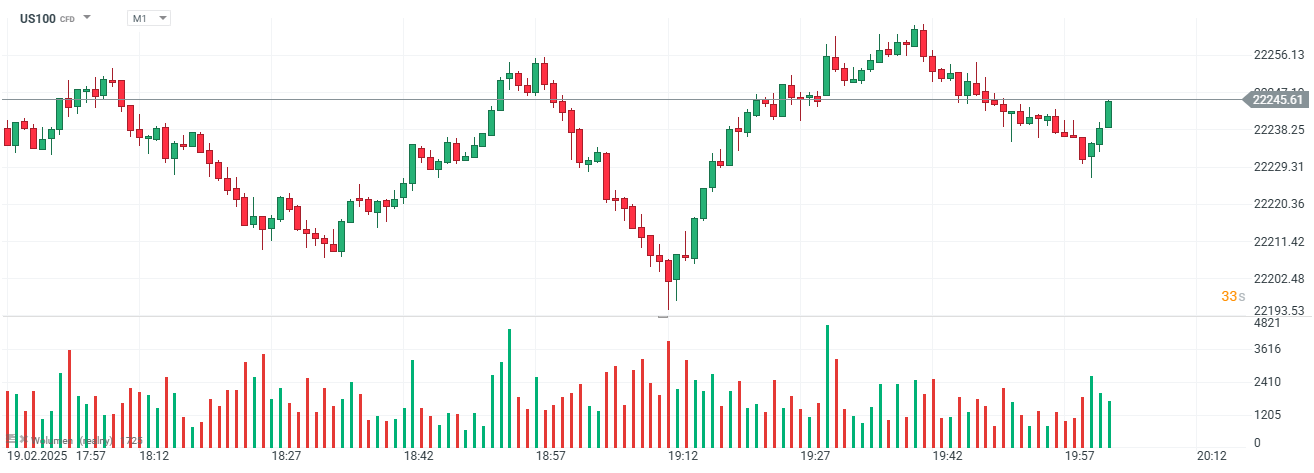

In the first reaction to Fed Minutes, US100 risen slightly, however the report is not any surprise for overall market sentiments and anticipations. Fed members pointed to upside inflations risks much more than slowing consumption, signalling that Fed will wait with rate cuts as long as possible to be sure that inflation is under control. This statement may be seen as slightly hawkish. However, since January we saw some mixed macro reports from the US (retail sales) and easing trade war tensions.

Source: xStation5

Market wrap: European stocks attempt to stabilize despite the surge in oil prices 🔍

Economic Calendar: U.S. Unemployment Claims in spotlight (12.03.2025)

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

Daily summary: Oil still pressures Wall Street despite favorable CPI data 🗽