US, US GDP report for Q2.

-

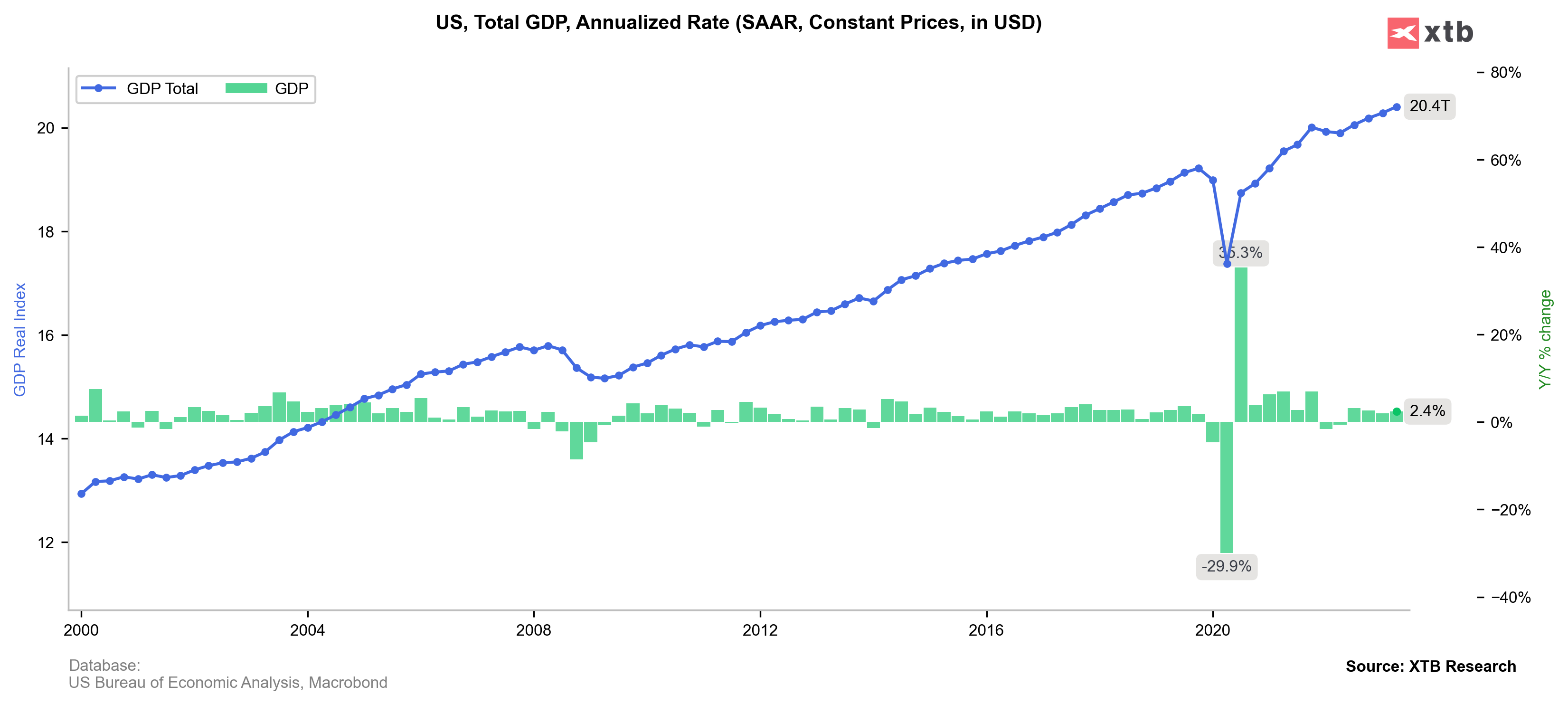

GDP growth (annualized). Actual: 2.4%. Expected: 1.8%. Previous: 2.0%

-

PCE core. Actual: 3.8% QoQ. Expected: 4.0% QoQ. Previous: 4.9% QoQ

In the second quarter of 2023, the United States saw an increase in real GDP by an annual rate of 2.4%, according to the Bureau of Economic Analysis. This followed an increase of 2.0% in the first quarter. The rise in GDP is attributable to increases in consumer spending, nonresidential fixed investment, state and local government spending, private inventory investment, and federal government spending. These gains were somewhat offset by declines in exports and residential fixed investment. Compared to the first quarter, the GDP acceleration in the second quarter was primarily due to a rebound in private inventory investment and an acceleration in nonresidential fixed investment. Despite a downturn in exports, and decelerations in consumer spending, federal government spending, and state and local government spending, current-dollar GDP rose by 4.7% or $305.2 billion, bringing the total to $26.84 trillion. The personal saving rate was 4.4% in the second quarter, compared to 4.3% in the first quarter.

In the second quarter of 2023, the United States saw an increase in real GDP by an annual rate of 2.4%, according to the Bureau of Economic Analysis. This followed an increase of 2.0% in the first quarter. The rise in GDP is attributable to increases in consumer spending, nonresidential fixed investment, state and local government spending, private inventory investment, and federal government spending. These gains were somewhat offset by declines in exports and residential fixed investment. Compared to the first quarter, the GDP acceleration in the second quarter was primarily due to a rebound in private inventory investment and an acceleration in nonresidential fixed investment. Despite a downturn in exports, and decelerations in consumer spending, federal government spending, and state and local government spending, current-dollar GDP rose by 4.7% or $305.2 billion, bringing the total to $26.84 trillion. The personal saving rate was 4.4% in the second quarter, compared to 4.3% in the first quarter.

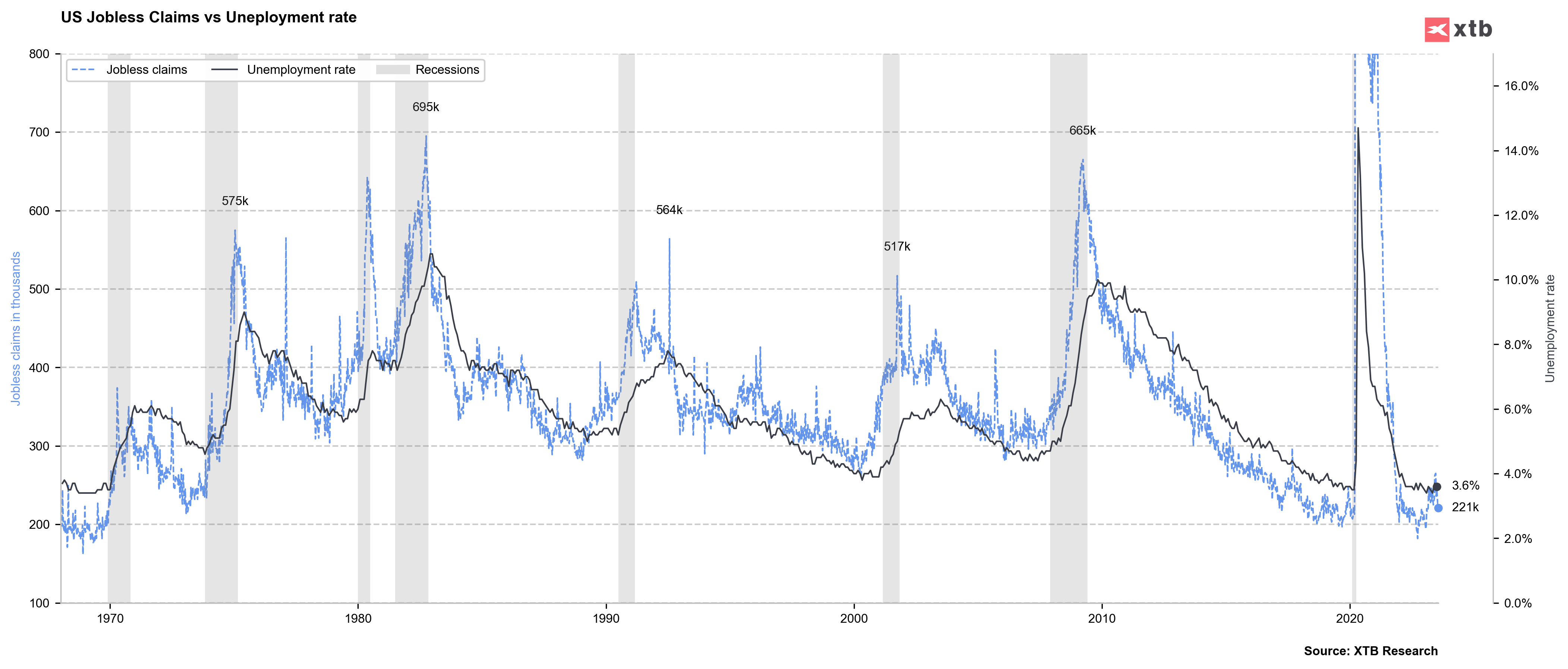

US, initial jobless claims. Actual: 221k. Expected: 235k. Previous: 228k

Strong jobless claims and the US GDP annualized rate suggest that the US economy remains resilient to the tightening cycle so far. This is definitely a crucial argument for the Fed to continue tightening. If such a strong labor market persists until September, we could see another rate hike of 25bp.

su

su

source xStation 5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

BREAKING: US jobless claims slightly higher than expected