US ISM Services PMI : 54.4 vs. 52.2 exp.(prior 52.6)

- Prices Paid : 64.3 vs. 65.4 prior

- New Orders : 57.9 vs. 52.9 prior

- Employment : 52.0 vs. 48.9 prior

US JOLTS Job Openings Actual 7.146M (Forecast 7.6475M, Previous 7.670M, Revised 7.449M)

- Job Openings Rate: 4.3% (prev 4.6%; prevR 4.5%)

- Quits Level: 3.161M (est 2.995M; prev 2.941M; prevR 2.973M)

- Quits Rate: 2.0% (prev 1.8%; prevR 1.9%)

- Layoffs Level: 1.687M (est 1.816M; prev 1.854M; prevR 1.850M)

- Layoffs Rate: 1.1% (prev 1.2%)

US Durable Goods Orders (M/M) Oct F: -2.2% (est -2.2%; prev -2.2%)

- Durables Ex Transportation (M/M): 0.1% (est 0.2%; prev 0.2%)

- Cap Goods Orders Nondef Ex Air (M/M): 0.5% (prev 0.5%)

- Cap Goods Ship Nondef EX Air (M/M): 0.8% (prev 0.7%)

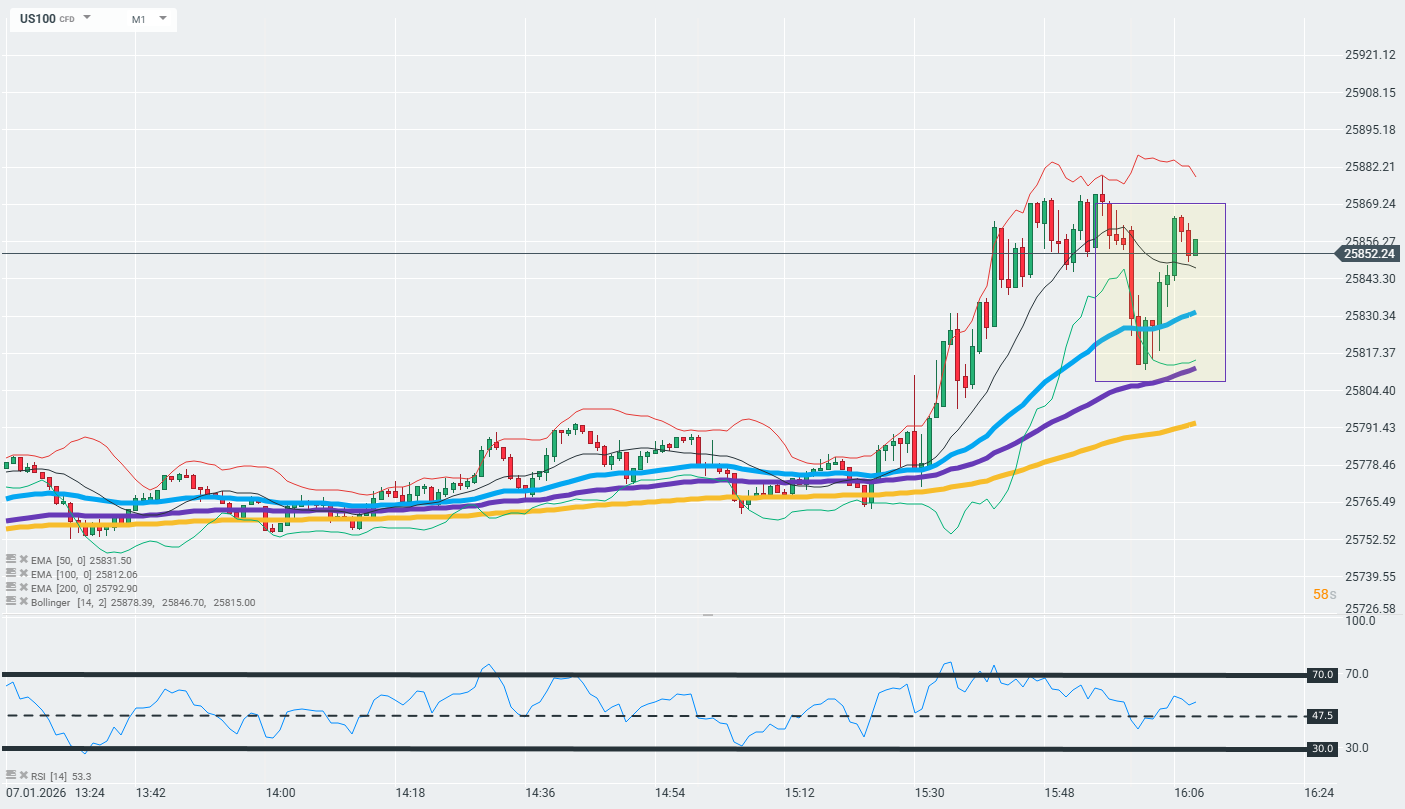

Solid ISM Services print (US services activity expanded in December at the fastest pace in more than a year, fueled by solid demand growth and a pickup in hiring.). Weak JOLTS data. Interesting mix however the intial drag on US equities was reversed. Overall, today's reports do not point to a single common conclusion for the market. Weakness in the job market and orders for durable goods is offset by high PMIs for services. However, the rapid rebound in stocks after publication (as it was at the opening of the session) may indicate that the market is increasing the chances of further interest rate cuts in the USA which might be seen as positive for equities.

Market Watch: Calm European Session, Weak Industry, Easing Inflation

Bitcoin gains 3%, attempting a trend reversal 📈

Chart of the Day: US500 Moves on PCE Data and AI Momentum

Economic Calendar: U.S. PCE Reading in the Spotlight!