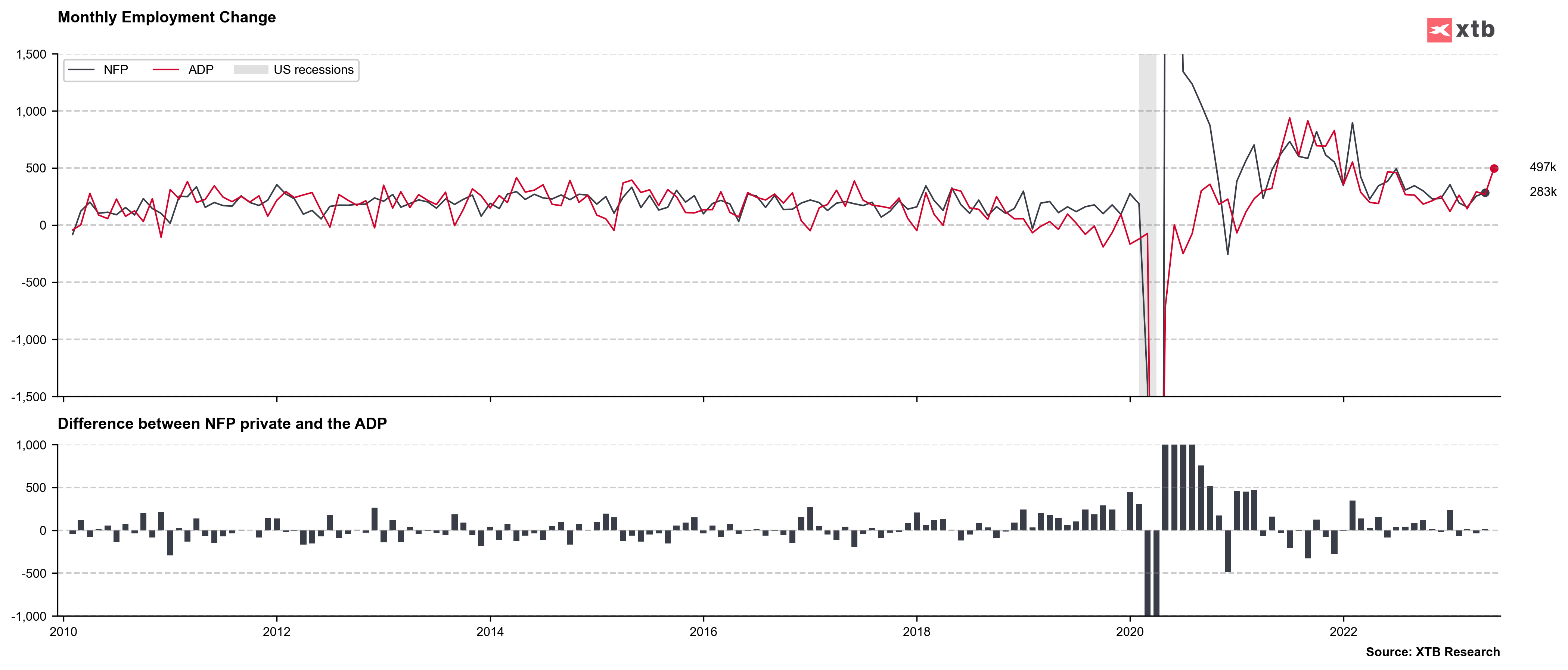

ADP employment report for June was released today at 1:15 pm BST. As usual, report was watched closely as it is one of the final hints ahead of the official NFP report for June that will be released tomorrow at 1:30 pm BST. Market expected ADP data to show a jobs gain of 230k. While ADP has had a rather poor track record of predicting NFP readings in the past, it should be said that readings of the two for the past 3 months were very aligned.

Actual ADP data for June turned out to be a massive positive surprise and showed a jobs gain of 497k! Release led to a hawkish reaction on USD market, with EURUSD dropping around 0.2% in the first minutes following the release. Equities were mixed - European index futures ticked higher while US index futures dropped. Gold dropped around 0.4% amid USD strengthening and jump in yields (2-year US yields climbed above 5%!)

EURUSD erased earlier gains following a massive ADP beat! The pair is now trading little changed on the day. Source: xStation5

ADP data surprised to the upside in June. Source: Macrobond, XTB

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Economic calendar: ADP Labor market report and ISM services 🔎

Morning wrap (04.03.2026)

Economic calendar: Eurozone CPI and central bankers speeches in focus