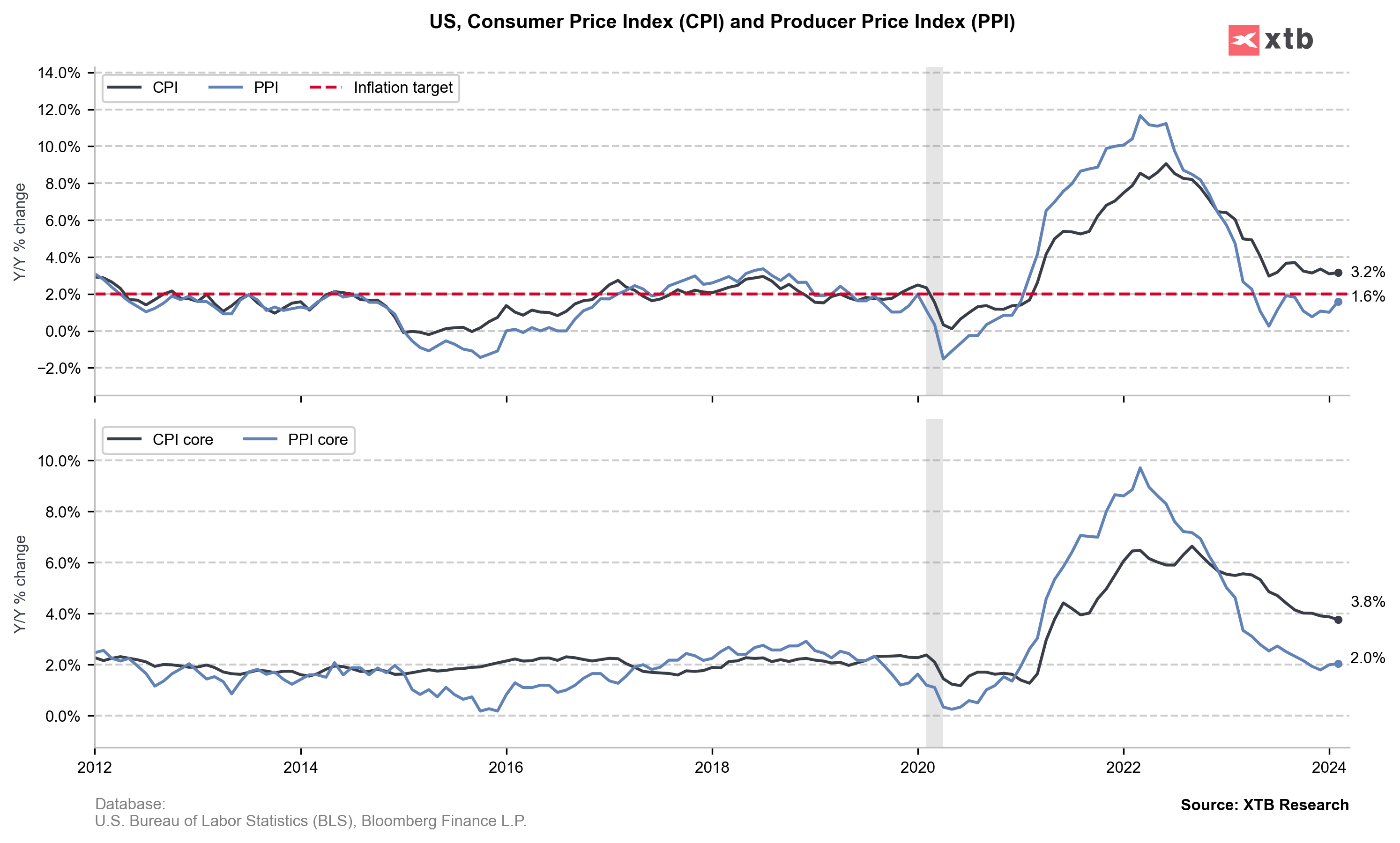

US PPI inflation report for February was released today at 12:30 pm GMT. The report was of second-importance, as the more important CPI data was already released on Tuesday. Report was expected to show an acceleration in headline producers' price growth and a small slowdown in core price growth.

However, actual report turned out to be a hawkish surprise - headline inflation accelerated more than expected while core inflation stayed unchanged at 2.00%. USD gained following the release. It looks like higher-than-expected PPI data outweighted a weaker-than-expected retail sales print that was released at the same time.

US PPI inflation for February

- Headline (annual): 1.6% YoY vs 1.1% YoY expected (0.9% YoY previously)

- Headline (monthly): 0.6% MoM vs 0.3% MoM expected (0.3% MoM previously)

- Core (annual): 2.0% YoY vs 1.9% YoY expected (2.0% YoY previously)

- Core (monthly): 0.3% MoM vs 0.2% MoM expected (0.5% MoM previously)

EURUSD dropped following the release but majority of the losses have been erased already. Source: xStation5

EURUSD dropped following the release but majority of the losses have been erased already. Source: xStation5

Source: Bloomberg Finance LP, XTB

Economic calendar: Eurozone CPI and central bankers speeches in focus

Morning wrap (03.03.2026)

BREAKING: US Manufacturing data above expectations! 📈🏭

BREAKING: Euro area manufacturing PMIs for February broadly confirmed a return to modest expansion