The core PCE price index, which excludes volatile items such as food and energy and is the Federal Reserve's favorite inflation indicator, rose to 3.5 % over year-on-year in June, after a 3.4% advance in May and below market expectations of 3.7%. On a monthly basis, core PCE prices decreased to 0.4% in June from 0.5% in May, below market consensus of 0.6%.

Personal income in the United States edged 0.1 percent higher in June , trying to recover from a revised 2.2 percent drop in May and beating market expectations of a 0.3 percent fall.

Personal consumption in the US surged 1% mom in June, rebounding from a 0.1% drop in May and beating market forecasts of a 0.7% increase.

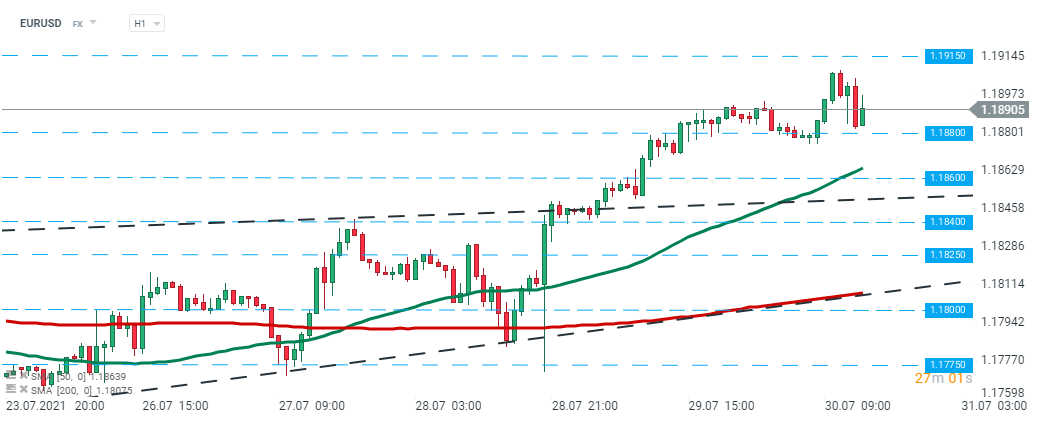

EURUSD saw a relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.1890 level. Source: xStation5

EURUSD saw a relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.1890 level. Source: xStation5

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸