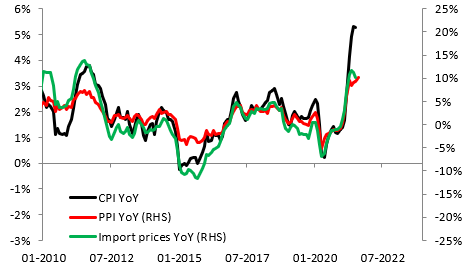

Two macroeconomic reports from North America were released at 1:30 pm BST today. US PPI inflation for August showed a larger acceleration in producer's price growth than expected. Headline jumped from 7.8% to 8.3% YoY while core accelerated from 6.2% to 6.7% YoY. Such a readings hints that companies may be more prone to pass rising prices onto consumers, what threatens to fuel consumer price inflation further. The other release - Canadian jobs data for August -was mixed. While the unemployment rate dropped from 7.5% to 7.1% (exp. 7.3%), employment gained missed expectations. On a positive note, it should be noted that employment gain was driven by full-time jobs.

US PPI data for August

-

Headline: 8.3% YoY vs 8.2% YoY expected (7.8% YoY previously)

-

Core: 6.7% YoY vs 6.6% YoY expected (6.2% YoY previously)

Canadian jobs data for August

-

Employment change: 90.2kvs 100k expected (94k previously)

-

Unemployment rate: 7.1% vs 7.3% expected (7.5% previously)

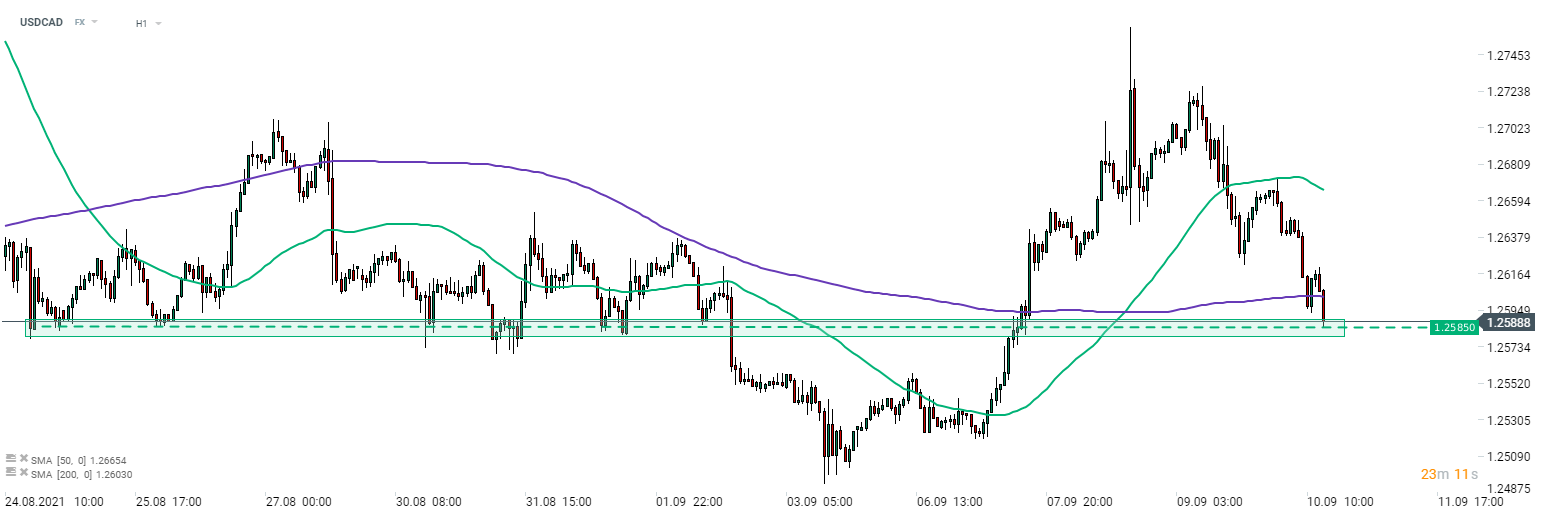

USDCAD moved lower following the release and US dollar weakened against other major currencies as well. However, the scale of moves was minor with USDCAD and EURUSD dropping less than 0.1%.

USDCAD dropped below the 200-hour moving average following the release of US and Canadian data. However, scale of the drop was minor and it was halted by the support at 1.2585 so far. Source: xStation5

USDCAD dropped below the 200-hour moving average following the release of US and Canadian data. However, scale of the drop was minor and it was halted by the support at 1.2585 so far. Source: xStation5

US PPI accelerated from 7.8 to 8.3% YoY in August, more than expected by economists. Source: Macrobond, XTB

US PPI accelerated from 7.8 to 8.3% YoY in August, more than expected by economists. Source: Macrobond, XTB

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Economic calendar: ADP Labor market report and ISM services 🔎