USDJPY experienced a quick and steep drop shortly after 3:00 pm GMT. While moves on other USD-tied FX pairs were also spotted, the move against Japanese currency was the biggest. So far, no news surfaced that could have justified the drop. USDJPY has been trading above 150.00 mark for some time already - a level often seen as a trigger for Bank of Japan interventions. However, this does not seem like such intervention as the pair dropped around 0.5% while BoJ interventions performed earlier this year usually saw the pair move around 2%. On the other hand, it is hard to find any other logical reason why the move on USDJPY was so abrupt.

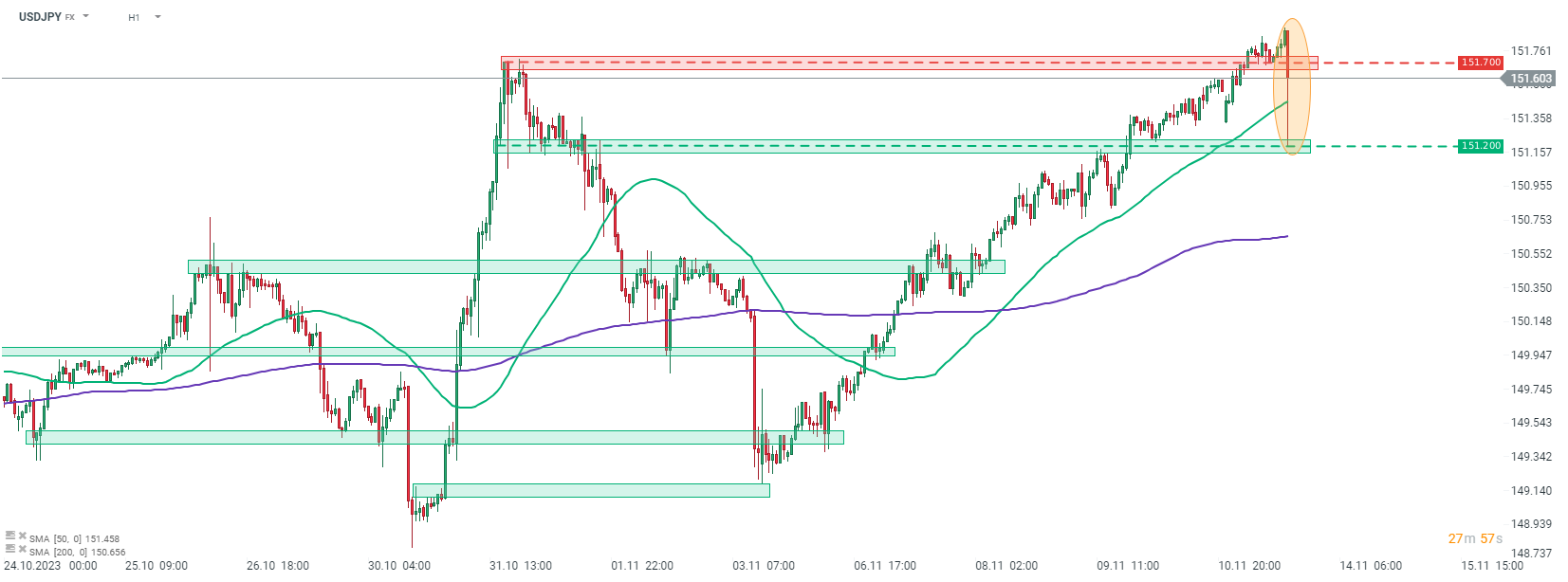

Taking a look at USDJPY at the H1 interval, we can see that the pair broke above the late-October local highs in the 151.70 area and was on its way to test the 152.00 mark. However, a quick reversal pushed the pair down to 151.20. Majority of those losses have been already recouped with the pair trading back near 151.60.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)