Western Alliance (WAL.US) seems to be another regional bank that has found itself in trouble in the aftermath of recent turmoil in the US banking sector. Financial Times reported that Western Alliance is exploring potential sale of its business. This is another bank that is considering sale of its business amid troubles in the banking sector and deposit outflows. As recently as yesterday in the evening PacWest Bancorp (PACW.US) also announced that it is in talks with partners and investors over a potential sale. If those sales go forward, number of regional US banks that have failed and had to be taken over would climb to 5 (after Silicon Valley Bank, Signature First and First Republic). Troubles in US banking sector weigh on Wall Street today with all major US stock market indices trading lower today - Dow Jones drops 1.2%, S&P 500 trades 1% lower and small-cap Russell 2000 plunges 2.2%. Nasdaq is an outperformer as it drops 'only' 0.7%.

Western Alliance (WAL.US) trades over 40% lower after Financial Times reported it is considering a potential sale. Source: xStation5

Western Alliance (WAL.US) trades over 40% lower after Financial Times reported it is considering a potential sale. Source: xStation5

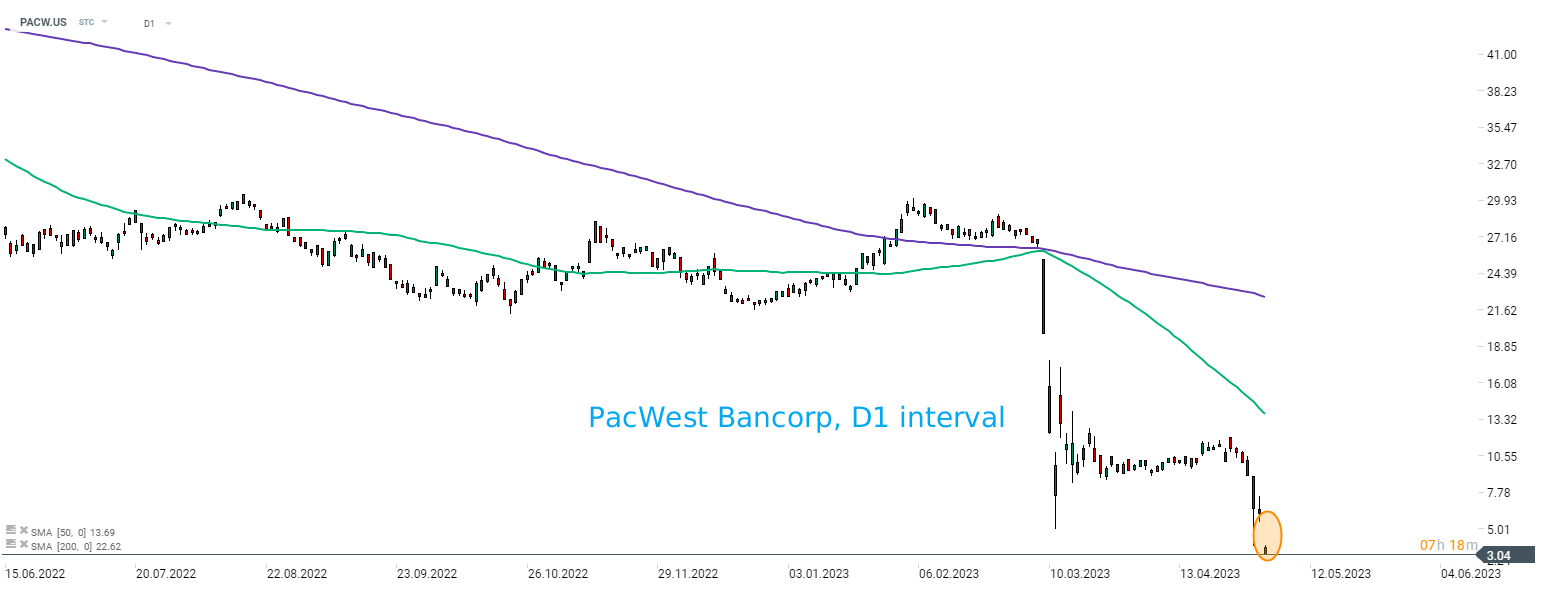

PacWest Bancorp (PACW.US) trades around 50% lower after the company confirmed yesterday that it is exploring potential sale. Source: xStation5

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals