C3.ai (AI.US) stock jumped 30% on Friday after the tech company posted upbeat results for the third quarter, with CEO Thomas Siebel seeing a "dramatic change" in sentiment and sees the company becoming profitable in fiscal 2024..

-

The provider of artificial intelligence company recorded a narrower-than-expected loss of 6 cents per share ex-items, while analysts expected loss of 22 cent. Revenue of $66.7 million also beat market projections of $64.2 million.

-

Gross came in at 76%, down slightly from the 80% during the year-ago period

-

C3.ai had $790 million of cash/equivalents on the balance sheet at the end of third quarter, which is down from $859 million last quarter and may mean that the company is burning cash at a quick pace.

Company expects to reach non-GAAP operating profitability by FQ4'24, which would be a significant improvement compared to recent quarterly trends, including the non-GAAP operating loss margin of 23% during FQ3. Source: C3.ai

-

"As we enter Q4 FY 23, we are seeing tailwinds from improved business optimism and increased interest in applying C3 AI solutions to address an increasing range of applications across a broad range of industries," Chief Executive Thomas Siebel said in a release. "The overall business sentiment appears to be improving. This is a dramatic change from what we experienced in mid-2022."

-

"The company is starting to gain momentum in building significant enterprise opportunities in its pipeline with its suite of innovative enterprise AI solutions," said Wedbush analyst Daniel Ives.

-

Company expects fourth quarter revenue in the region of $70 million to $72 million in revenue, above analysts’ estimates of $69.9 million. Executives also anticipate a $24 million to $28 million adjusted loss from operations.

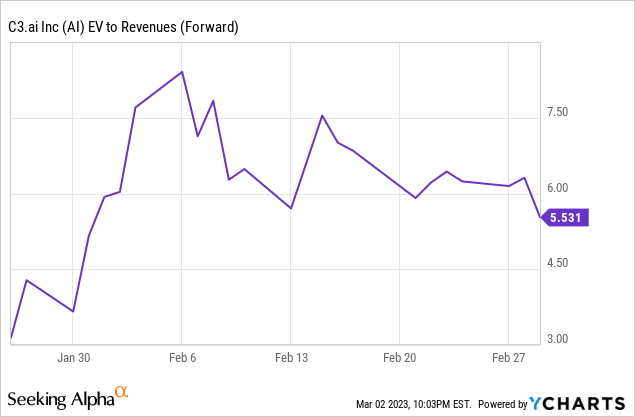

C3.ai's stock currently trades at 5.5x forward revenue, which is hard to quantify given the unclear revenue growth as the company is moving towards a consumption-based pricing model. However, even if the company were to grow consistently over 25% over the long term, the lack of profitability should be treated as a warning sign. Source: Seeking Alpha/ YCharts

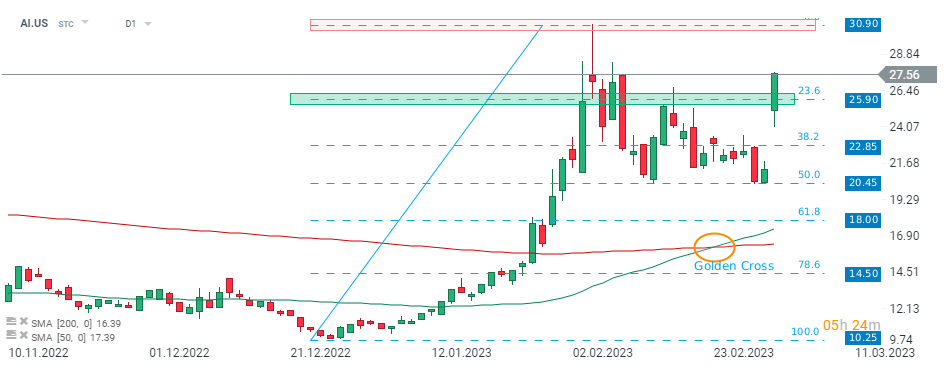

C3.ai (AI.US) stock launched today's session with a massive bullish price gap and easily broke above local resistance at $25.90, which coincides with 23.6% Fibonacci retracement of the last upward wave. If current sentiment prevails, the upward move may accelerate towards the recent high at $30.90. Also medium-term 50-day SMA (green line) crossed above the long-term 200-day SMA (red line). This formed a ‘golden cross’ formation, which supports market bulls. Source: xStation5

The Oracle paradox. Huge investments and the paradox of growing debt

Palantir Preview: Perfection already priced in?

US Open: America rises, precious metals fall!

US500 rebounds after the sell-off📈Wall Street earnings season analysis🗽