The Australian dollar is the best performing G10 currency today. AUD got a lift following the release of RBA minutes from its latest meeting in early-May. Document showed that the Bank was considering three different rate hike options - 15 basis points, 25 basis points and 40 basis points. A 25 basis point increase was deemed appropriate and ultimately delivered. However, the fact that the RBA even considered a 40 basis point rate hike is a very hawkish signal. Central bankers noted that further increases in the cash rate will be needed at the coming meetings in order not to de-anchor inflation expectations.

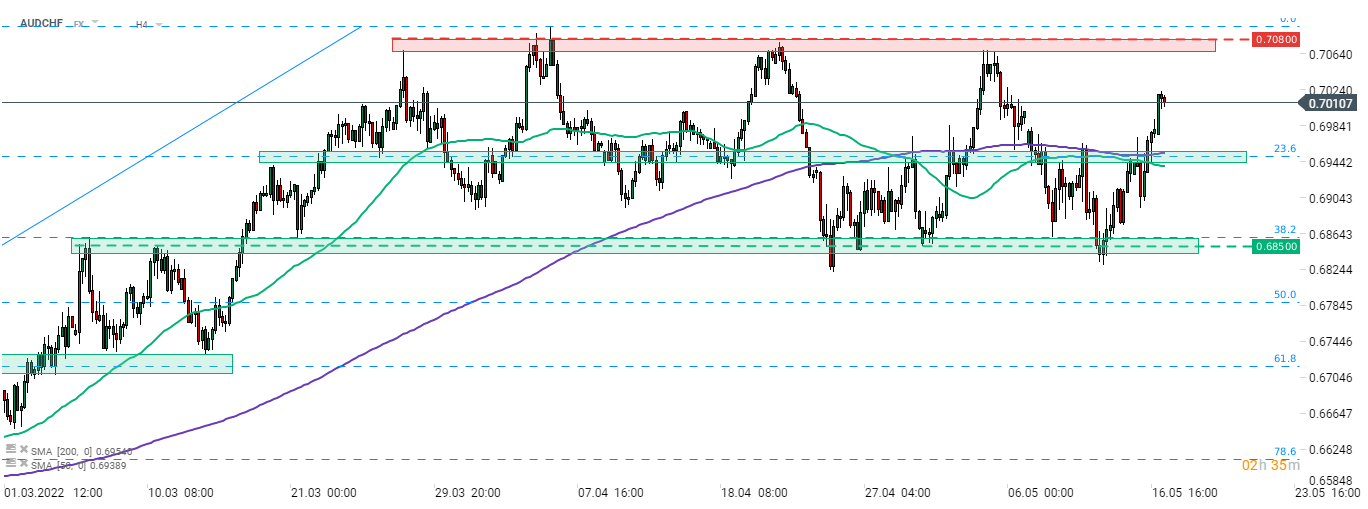

AUDCHF has been trading sideways in a 0.6850-0.7080 range since late-March 2022. The pair pulled back last week and tested lower limit of the range near 38.2% retracement of the upward move launched in late-January 2022. Bulls managed to defend the area and launch a recovery move. The pair has already recovered past the midpoint of the range marked with 23.6% retracement as well as 50- and 200-period moving averages (H4 interval). The next resistance to watch now is the upper limit of the range in the 0.7080 area, around 1% above current market price.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)