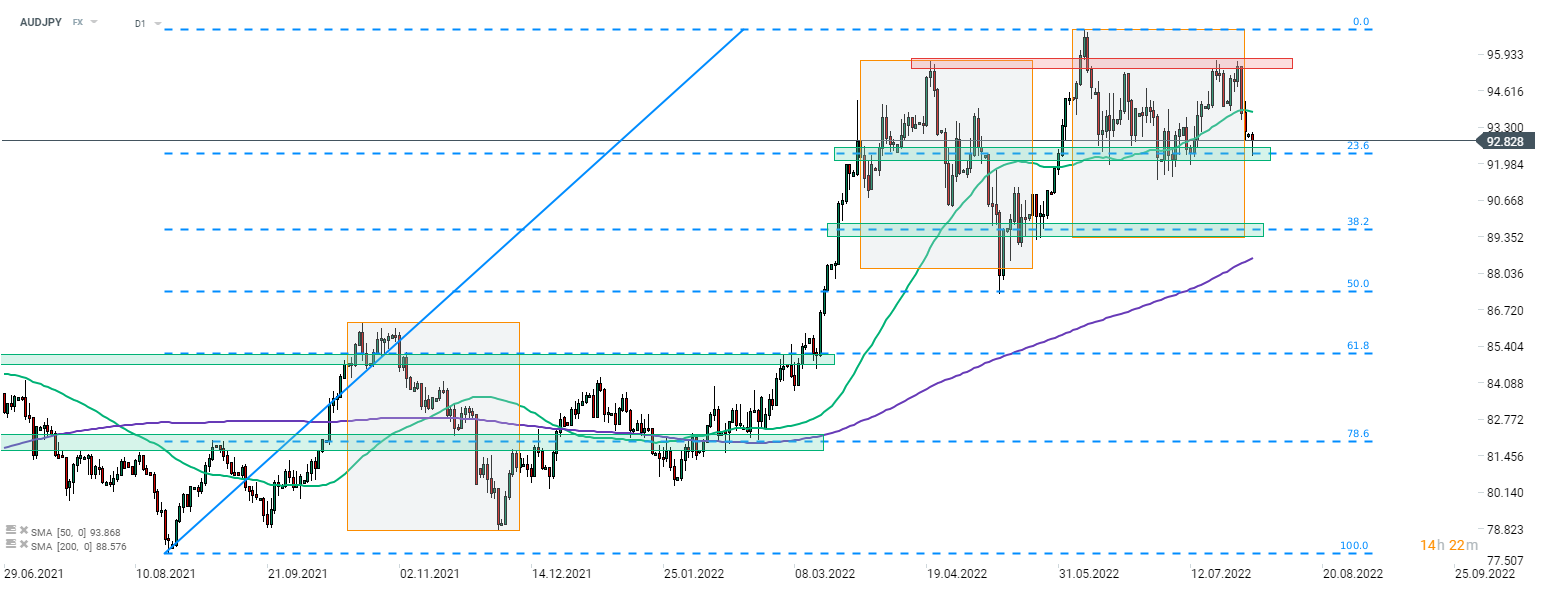

Japanese yen is regaining its shine as of late. While attention is mostly centered on USDJPY, which has pulled back from a high of around 144.00 to almost 132.00 now, other JPY-tied pairs are also noteworthy. AUDJPY, often seen as a risk barometer, is currently trading 3% below a local high reached last Wednesday. The pair tested a short-term support zone marked with 23.6% retracement of the upward move launched almost a year ago in August 2021 (92.30 area). Bears failed to push the pair below this hurdle on their first attempt today but the pair remains closeby. Should we see a break below, downward move may deepend towards the 89.60 area, where 38.2% retracement and the lower limit of the Overbalance structure can be found.

AUDJPY traders should keep in mind that the pair may get more volatile during the next Asian session as the Reserve Bank of Australia is set to announce monetary policy decisions tomorrow at 5:30 am BST. Market is pricing in an over-90% of a 50 basis point rate hike, what would be the third such a move in a row. Guidance may be crucial for AUD, especially whether RBA plans to carry on with rate increases amid deteriorating macroeconomic conditions.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%