Reserve Bank of Australia announced an expected 25 basis point rate hike today. This was the first rate move after four meetings of holding rates unchanged. Money markets saw an around-60% chance of such a decision while the majority of economists revised their expectations to rate hike following a higher-than-expected CPI report for Q3 2023.

Key takeaways from statement

- CPI inflation is now expected to be at the top of the target range of 2 to 3% by the end of 2025

- The board remains resolute in its determination to return inflation to the target

- The board judged that an increase in interest rates was warranted today to be more assured that inflation would return to target in a reasonable timeframe

- Services price inflation has been surprisingly persistent overseas and the same could occur in Australia

- Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable time frame will depend upon the data and the evolving assessment of risks

- To date, medium-term inflation expectations have been consistent with the inflation target and it is important that this remains the case

- There are still significant uncertainties around the outlook

- High inflation is weighing on people’s real incomes and household consumption growth is weak, as is dwelling investment

- Wages growth has picked up over the past year but is still consistent with the inflation target, provided that productivity growth picks up

- The weight of information suggests that the risk of inflation remaining higher for longer has increased

While a rate hike is a hawkish decision, the remainder of the statement suggests that further tightening may not be necessary. RBA highlighted that inflation trends are consistent with return of inflation to target but remained open to more moves, saying that they will depend on incoming data. Money markets are no longer pricing in any RBA rates hikes. However, no rate cuts are priced in throughout 2024 either.

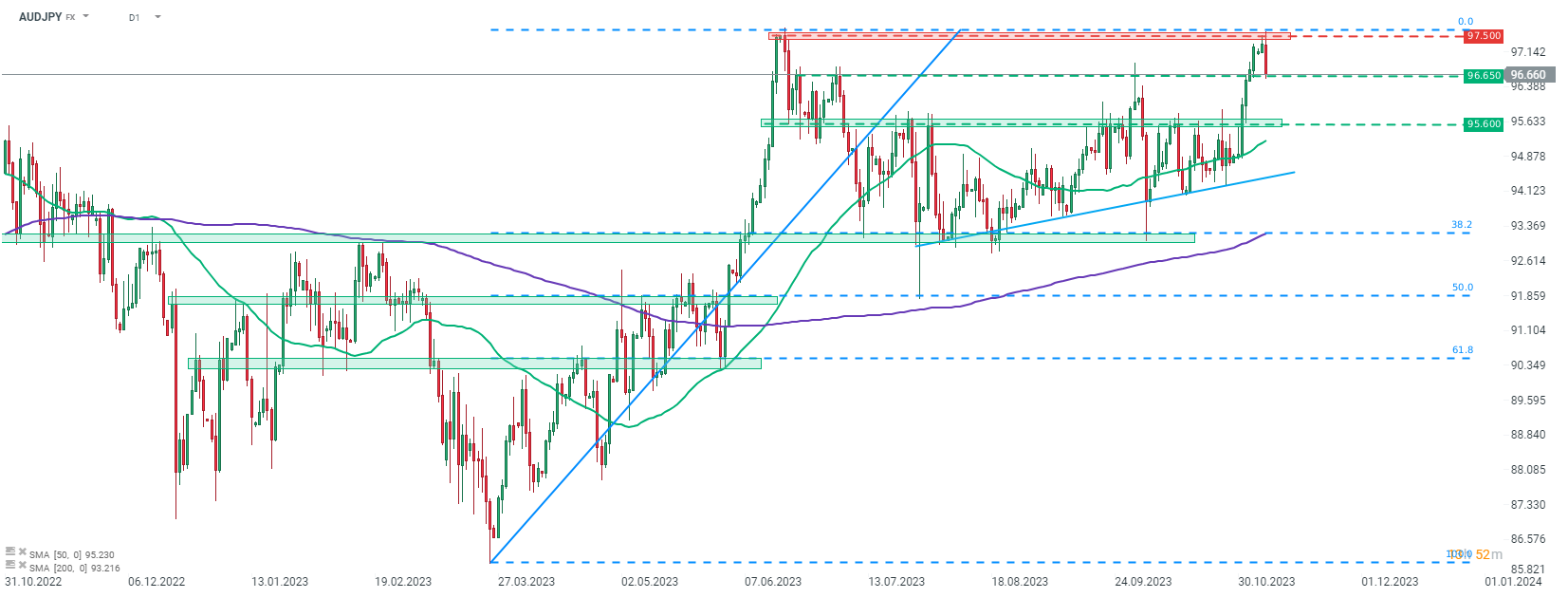

Australian dollar took a hit amid lack of clear hawkish guidance from RBA. Taking a look at AUDJPY chart at D1 interval, we can see that the pair is taking a dive today after failed to break above the 97.50 resistance zone. Sellers are now testing 96.65 swing area and a break below would pave the way for a test of the 95.60 support, which served as the upper limit of the ascending triangle pattern.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️