The Australian dollar is one of the best performing major currencies today. Parliamentary elections were held in Australia that resulted in a change of government. Labor Party managed to score a win and dethrone Liberal Party. As a result Anthony Albanese was sworn in as a new Prime Minister, succeeding Liberal PM Morrison. This is expected to bring some changes in policy, especially in issues that were neglected by Morrison, like for example climate change. Australian policy is expected to become more "green" under Albanese. However, no major changes are expected in case of foreign policy - Anthony Albanese already said that relations with China will remain difficult.

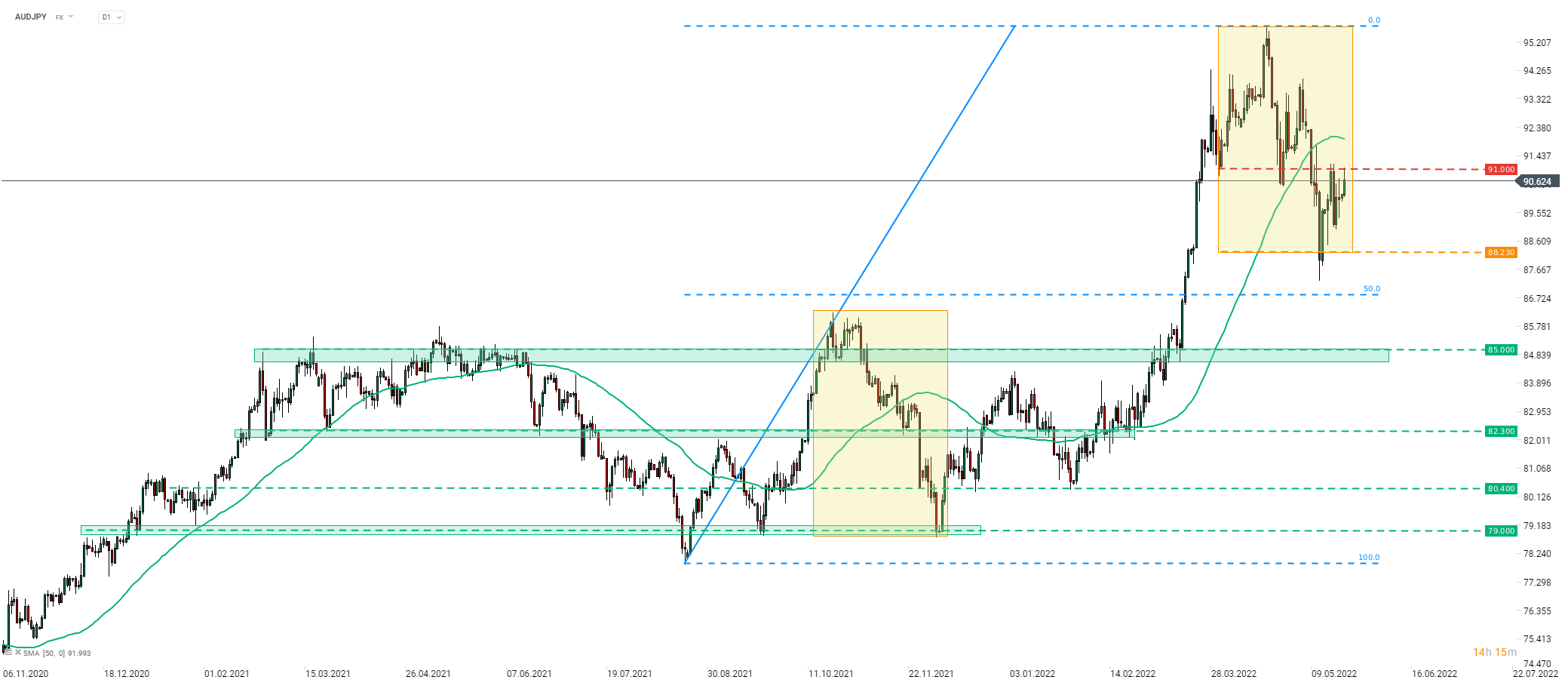

Australian dollar is not only driven by election results today but also by an overall risk-on attitude that can be spotted on the global markets. Joe Biden once again hinted that he is considering removing some of Trump-era tariffs placed on China. While this is providing support for AUD, it is also a drag on JPY. Taking a look at AUDJPY chart at D1 interval, we can see that the pair has reapproached recent local high in the 91.00 area today but failed to break above so far. The bigger picture, however, still looks bullish - the pair continues to recover following a test and successful defense of the lower limit of the Overbalance structure.

Source: xStation5

Source: xStation5

Three Markets to Watch Next Week (09.01.2026)

BREAKING: Employment in Canada better than expected! 🍁📈

EURUSD continue to decline despite solid Eurozone retail sales data📉

NY Fed Survey: higher inflation expectations, but also higher equity price expectations 📄🔎