War in Ukraine led to big price increases on the commodity markets. While conflict is a big source of uncertainty that should have a negative impact on more risky currencies, like Antipodean currencies, the Australian dollar resists pressure. Australian currency continues to gain against the US dollar as the commodity trade is an important part of the Australian economy and rising coal and iron ore prices are providing support for AUD.

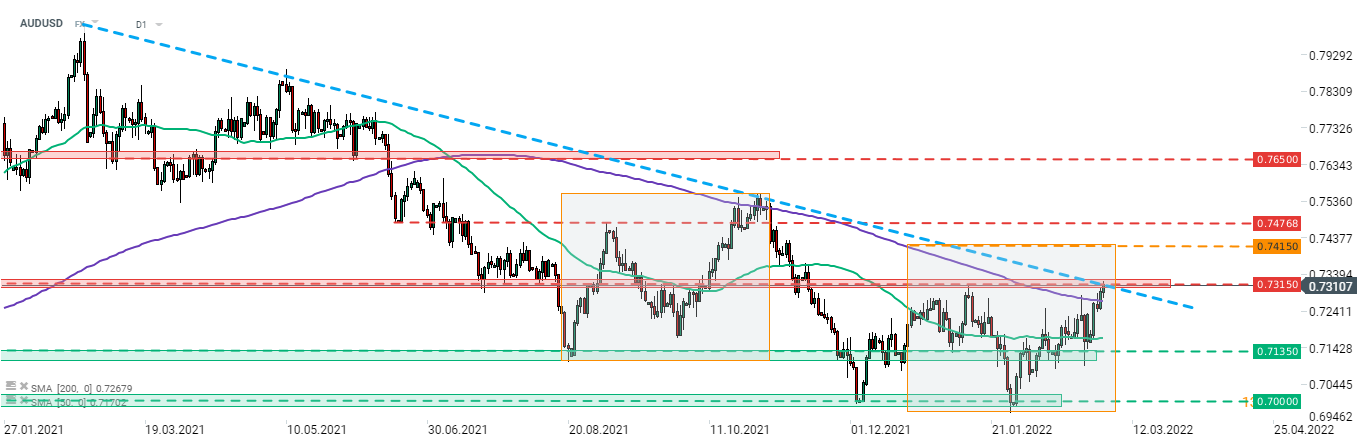

Taking a look at AUDUSD chart, we can see that the pair has recovered almost 5% off the late-January low. The pair reached a mid-term resistance zone in the 0.7315 area this week. Note that this zone is marked not only with previous price reactions but also with a downward trendline. Breaking above 0.7315 area would improve a technical picture for bulls. However, in order to talk about a trend reversal a break above the upper limit of the Overbalance structure at 0.7415 would be needed.

Source: xStation5

Source: xStation5

Chart of the Day: EURUSD – Why is the Euro Losing to the Dollar?

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

🚨EURUSD fights for 1.16 ahead of US CPI

AUDUSD: Is the RBA the first central bank returning to rate hikes? 🪙