NFP report release is a key macro event of the day. US jobs data for May will be published at 1:30 pm BST and is expected to show 320k increase in non-farm payrolls. However, whether the actual reading will match expectations was put into doubt following yesterday's private estimate. ADP report showed a mere 128k employment increase while the market expected 295k addition. Moreover, White House further cooled down expectations when it said that it does not expect to see a blockbuster jobs reading every month. There is a scope for disappointment and if such occurs, one can be sure that US President Biden will try to talk it out during his speech (1:30 pm BST). A point to note is that wage growth is expected to slow down, although this can be ascribed to a lower base than in April.

1:30 pm BST - US, NFP report for May

-

Non-farm payrolls. Expected: 320k. Previous: 428k

-

Wage growth. Expected: 5.2% YoY. Previous: 5.5% YoY

-

Unemployment rate. Expected: 3.5%. Previous: 3.6%

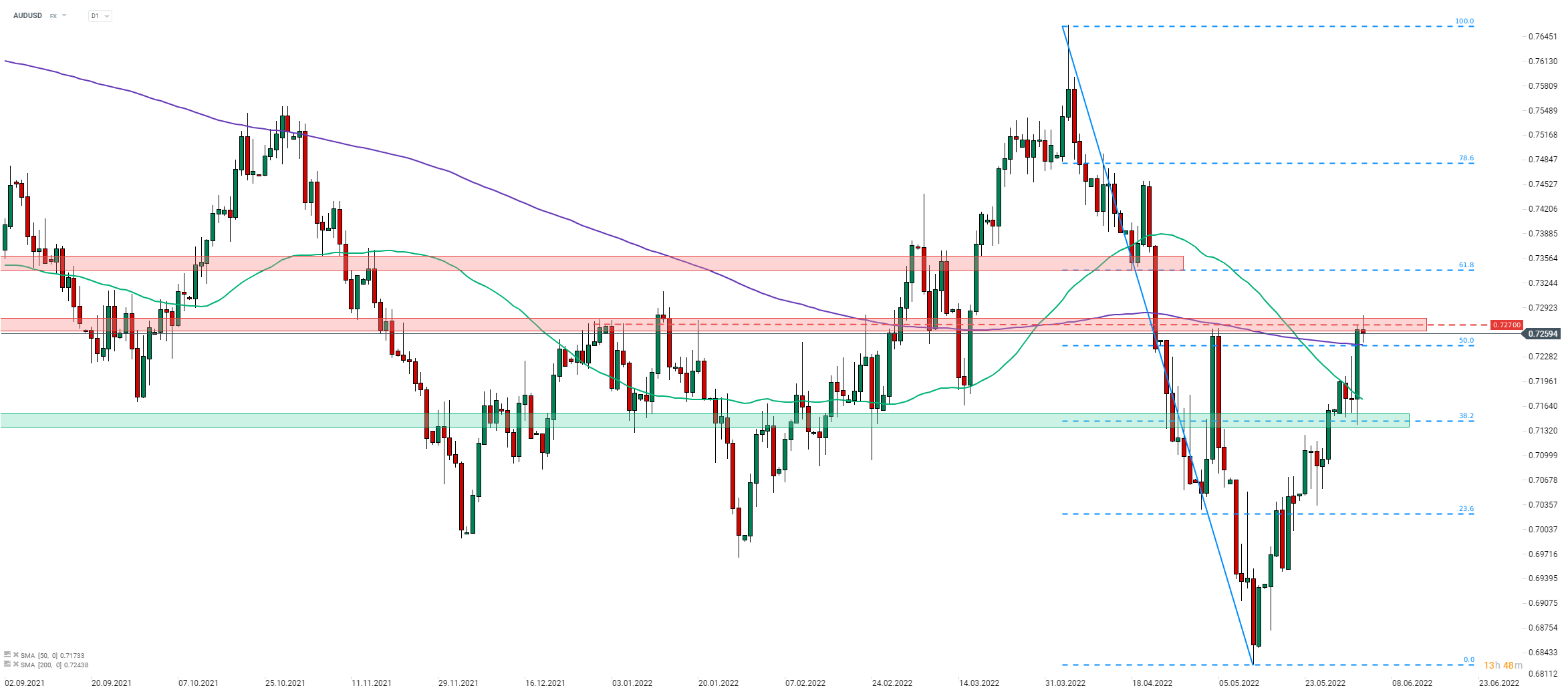

Fed members have been quite hawkish as of late and it would probably take a disastrous NFP reading to make them reconsider the need for 50 basis point rate hikes at upcoming meetings. Nevertheless, report release is expected to trigger at least some short-term volatility on USD market. AUDUSD is one of the pairs to watch as it has reached an important technical resistance. The pair broke above the 200-session moving average and the 50% retracement of the recent drop but failed to break above the 0.7270 resistance, marked with previous price reactions. The pair may remain active early next week as the RBA is expected to deliver a rate hike on Tuesday.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%