Policy announcement from Reserve Bank of Australia was a key event of today's Asia-Pacific session. AUD has been muted at first as RBA left interest rates unchanged, in-line with market expectations, and retained its neutral bias hinting that rate hike or rate cut are equally probable in the future. While money markets saw an over-30% chance of RBA delivering a rate cut today, RBA statement said that upside risks to inflation outlook remain.

However, it was during the post-meeting press conference of RBA Governor Bullock that a hawkish comment was offered. Bullock said that rate hike was discussed at the meeting, but the Board has ultimately decided not to proceed with it. Meanwhile, she said that rate cut was not considered at today's meeting. While this is a hawkish development, it is not necessarily a surprise as similar comments were made by RBA after May meeting. Governor Bullock said that it is not obvious what to do with rates as there is still a lot to do to bring inflation back to 2-3% target range.

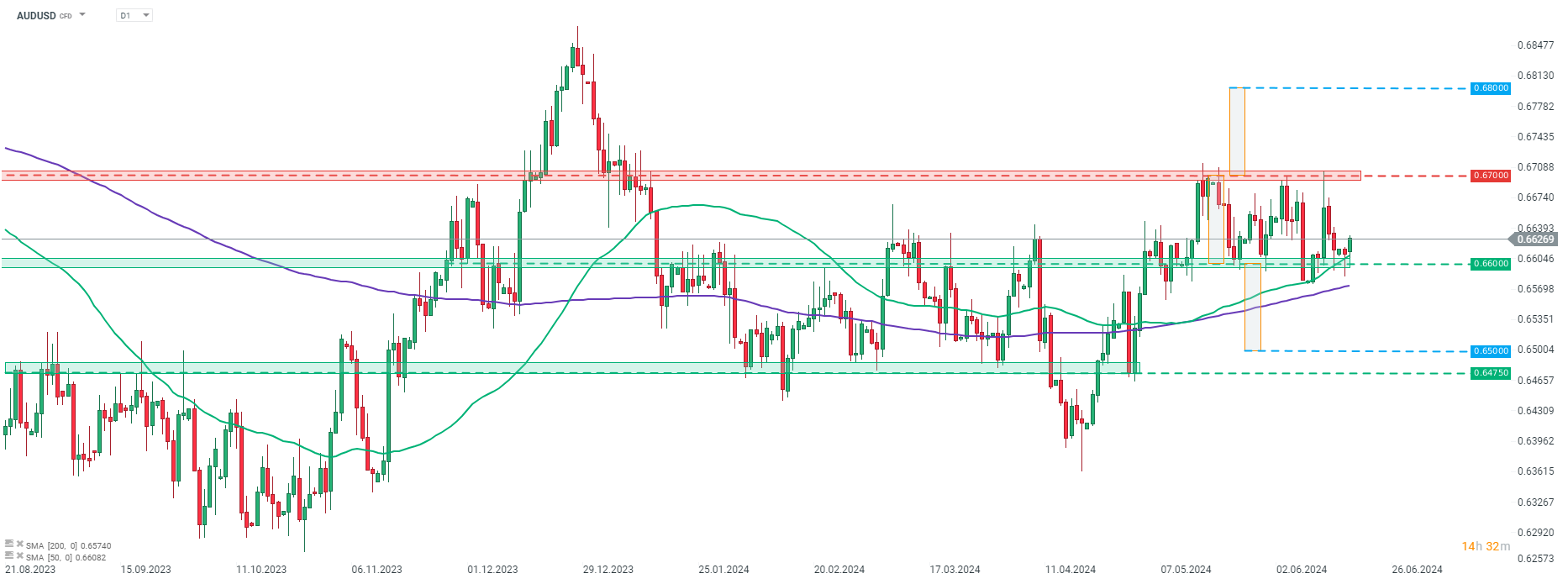

Taking a look at AUDUSD chart at D1 interval, we can see that the pair is bouncing off the lower limit of the short-term trading range at 0.6600, which is marked with previous price reactions as well as the 50-session moving average (green line). Should bulls remain in control of the market, the near-term resistance zone to watch can be found in the 0.6700 area, where the upper limit of the short-term range can be found. Note that the pair may become more active again this afternoon, when US retail sales report for May is released (1:30 pm BST).

Source: xStation5

Chart of the Day: EURUSD – Why is the Euro Losing to the Dollar?

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

🚨EURUSD fights for 1.16 ahead of US CPI

AUDUSD: Is the RBA the first central bank returning to rate hikes? 🪙