While markets' attention was mostly on Bank of Japan during the Asia-Pacific session, it was not the only central bank that announced a decision today. Reserve Bank of Australia left interest rates unchanged at 4.35% for the third time in a row. RBA statement remove wording that said that further hike cannot be ruled out, and instead replaced it with a phrase saying that the board is not ruling anything in or out. Bank noted that rate path to CPI target remains uncertain, while governor Bullock warned that inflation war is not yet won, but progress has been made.

RBA Statement

- Rate path that best ensures CPI hits target is uncertain

- Need to be confident CPI moving sustainably to target

- Board remains resolute in its determination to return inflation to target

- Board is not ruling anything in or out

- Services inflation remains elevated, and is moderating at a more gradual pace

- Growth in unit labor costs moderating, remains high

RBA Governor Bullock speech

- Making progress in fight against inflation

- On the right track according to recent data

- Outlook risks finely balanced

- Energy price easing is positive for inflation outlook

- Inflation war not yet won

- Keeping keen eye on employment numbers

- Labour market remains slightly tight

- Not just the unemployment rate is being considered

- Board considers a range of possibilities on policy

AUD weakened following the decision and governor Bullock speech, and is now one of the worst performing G10 currencies today, gaining only against Japanese yen. Money markets currently see the first RBA rate cut in September this year. Given that governor Bullock said she will keep a keen eye on employment data, AUD may also see some more volatility later this week when Australian jobs data for February is released on Thursday, 0:30 am GMT.

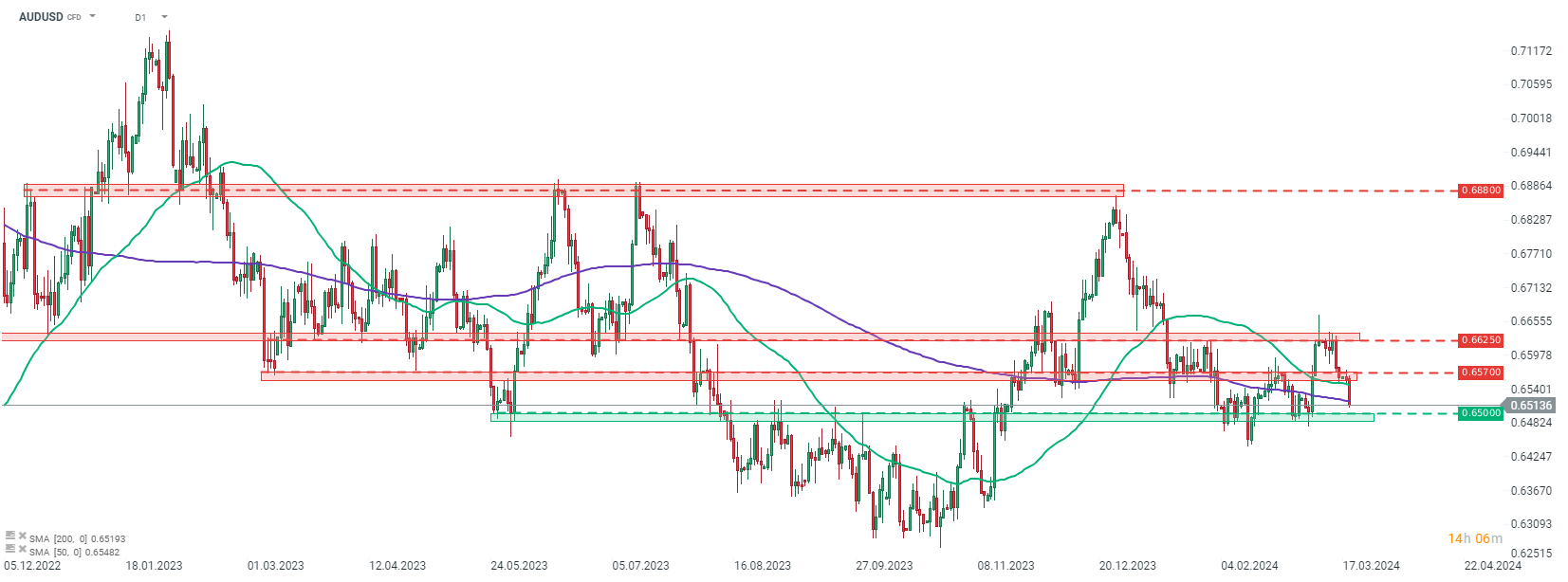

Taking a look at AUDUSD chart at D1 interval, we can see that the pair slumped today, breaking below the 0.6570 support zone as well as 50-session moving average (green line). Pair is also trying to break below the 200-session moving average (purple line) for the first time in two weeks. A near-term support zone to watch can be found in the 0.6500 area and is marked with the previous price reactions.

Source: xStation5

Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts