- The Australian dollar is the strongest G10 currency today, gaining 0.25% against the U.S. dollar and 0.3% against the euro.

- CPI inflation surged to a more-than-one-year high of 3.2%, reducing expectations of further interest rate cuts.

- The AUD is further supported by a global rise in risk appetite.

- The Australian dollar is the strongest G10 currency today, gaining 0.25% against the U.S. dollar and 0.3% against the euro.

- CPI inflation surged to a more-than-one-year high of 3.2%, reducing expectations of further interest rate cuts.

- The AUD is further supported by a global rise in risk appetite.

AUDUSD gains 0.25% on the back of Australia’s strongest CPI inflation data in over a year, which reduces the likelihood of further rate cuts. Hawkish expectations toward the Reserve Bank of Australia (RBA), coupled with a broader risk-on sentiment and renewed optimism over a potential U.S.-China trade peace, are making the Australian dollar the best-performing G10 currency this week.

AUDUSD broke above the 50% Fibonacci retracement level of the latest downward wave but encountered resistance near recent highs around 0.66. Strong “risk-on” momentum is also visible on AUDJPY (in blue). Source: xStation5

What’s driving AUDUSD today?

-

Consumer inflation (CPI) rose in Q3 2025 to 3.2% (previous: 2.1%, consensus: 3%) — the highest since Q2 2024. Even more concerning for price stability, monthly data show core inflation accelerating to 3.7% in September. The main price pressures came from housing (+2.5% q/q), recreation and culture (+1.9%), and transport (+1.2%), while electricity prices surged 9%.

-

The higher-than-expected reading ties the RBA’s hands, after the central bank paused easing in September amid worrying monthly data (rates have remained at 3.6% since August). The RBA has emphasized its preference for less volatile quarterly figures, so this clear confirmation of persistent inflation significantly reduces the likelihood of further rate cuts. Moreover, the trimmed mean CPI — which excludes extreme price movements — exceeded the RBA’s forecast for the first time since 2022.

-

Still, the RBA faces a policy dilemma, balancing resurgent inflation against a slowing labor market. Unemployment rose to 4.5% last month, the highest in nearly four years, though Governor Michele Bullock maintained a hawkish tone, noting labor data volatility and that “unemployment hasn’t risen much above forecasts.”

-

As a result, the AUD strengthened broadly, extending this week’s bullish pivot against the U.S. dollar. The currency is also supported by global risk appetite, fueled by strong Wall Street earnings, progress in Trump’s trade talks with China and rising Australian bond yields.

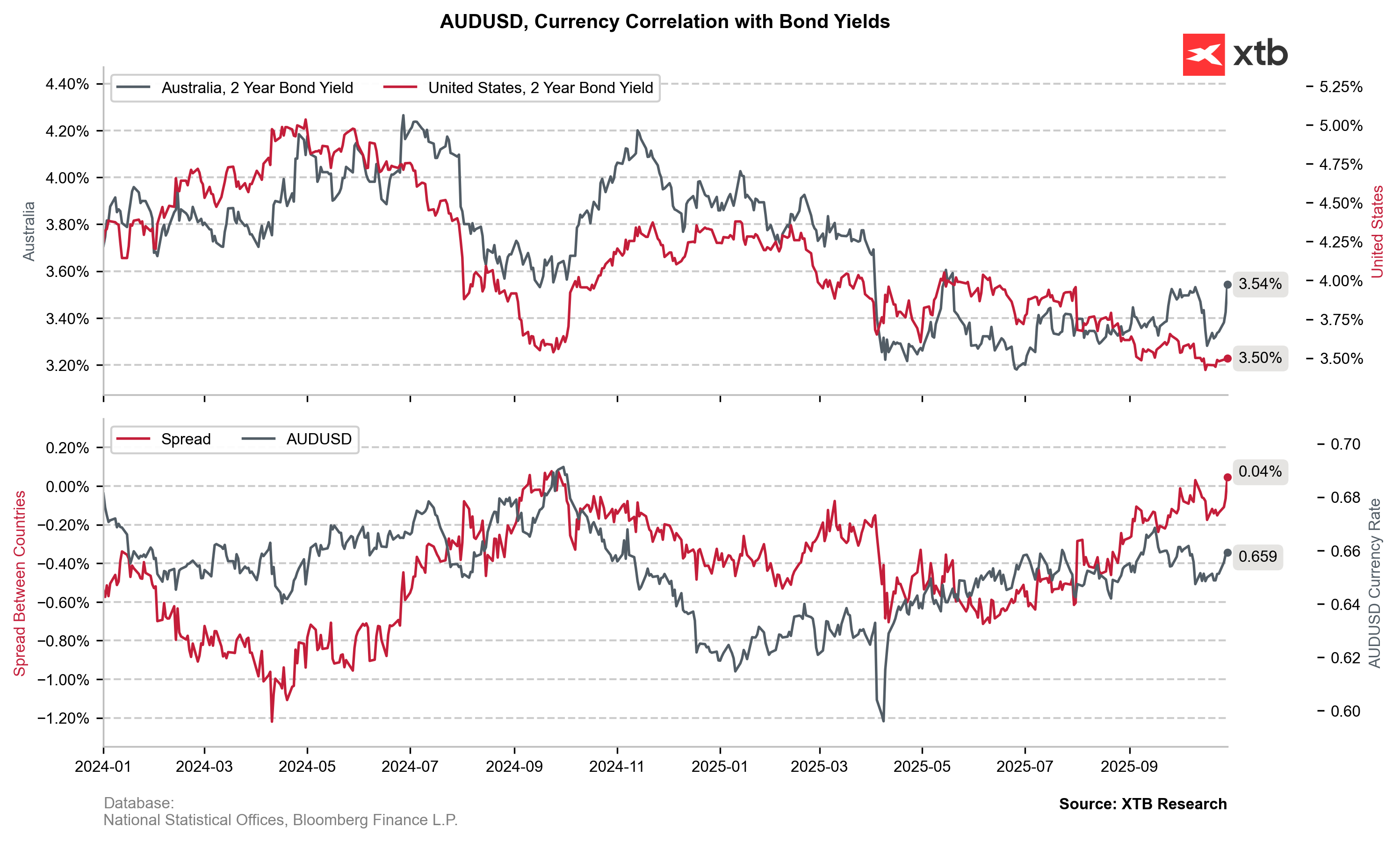

Australian 2-year yields have climbed roughly 20 bps since the start of the week to their highest level since May 2025, with AUDUSD closely tracking the yield spread after a brief period of stagnation. Source: XTB Research, Bloomberg data.

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

Crypto up 4 % despite tension📈