Bitcoin rallied overnight and tested the $60,000 mark for the first time since mid-April 2021. The major cryptocurrency is trading less than 10% below its all-time highs and given the volatile nature of digital assets, a new record may be reached within days. While cryptocurrencies have been on the rise for some time already, a move during the Asian session was very quick and there is a strong fundamental reason for it.

According to a Bloomberg report, US Securities and Exchange Commission, US financial regulator, will not oppose and block applications for exchange-traded funds that will invest primarily in Bitcoin futures. This is big news as under US laws the regulator does not need to issue an outright approval but can simply let the deadline for action pass. Without asking the issuer to make any changes in the filing, it is equal to approval. It is said that there are around 40 Bitcoin ETF applications at SEC and the deadline to review some of them, like the one from ETF provider ProShares, is passing next week.

The Bloomberg report also seems to be confirmed by this tweet from the SEC yesterday. Source: SEC Investor Ed Twitter

The Bloomberg report also seems to be confirmed by this tweet from the SEC yesterday. Source: SEC Investor Ed Twitter

ETFs are passive investment vehicles that have won investors' appeal, thanks to ease of investing as well as long-term outperformance over active funds. Assets under management of passive funds are expected to surpass those under management of active funds. Launching Bitcoin ETFs therefore opens the way to the cryptocurrency world for many investors that were earlier unconvinced by risks associated with investing in cryptocurrencies (lack of regulation, risk of wallet hack etc.)

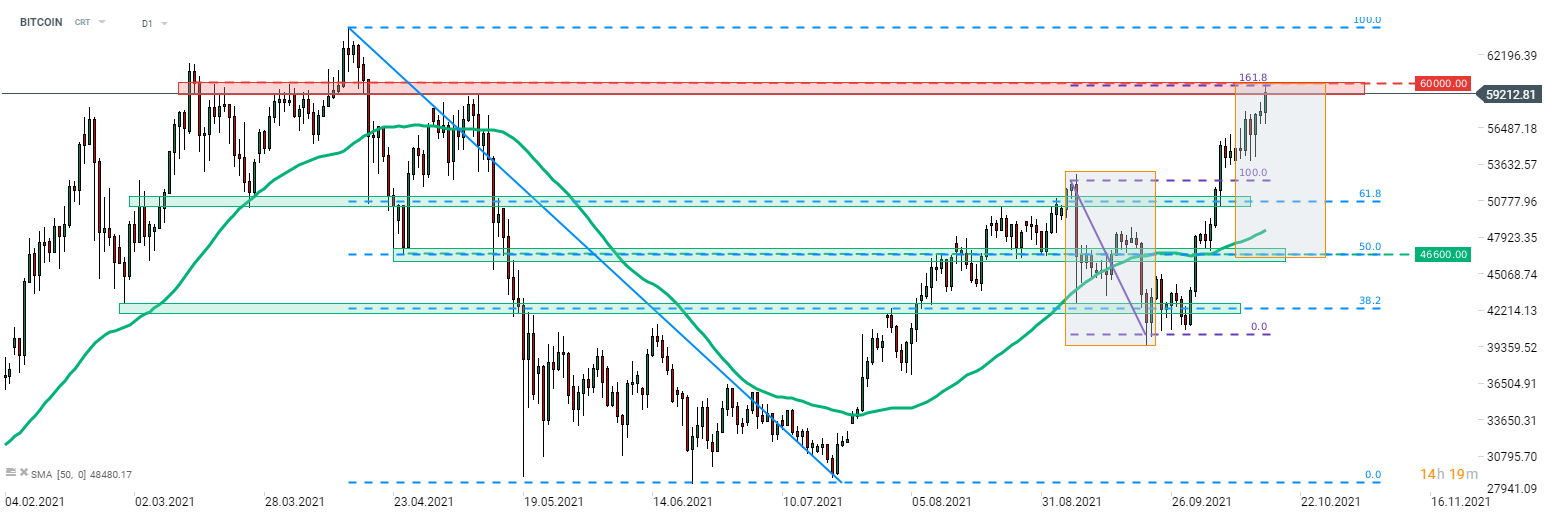

BITCOIN rallied overnight but the upward move was halted at a key psychological level - $60,000 mark. Apart from its psychological nature, this area is also marked with the 161.8% exterior retracement of the downward correction from September. First attempt of breaking above $60,000 mark was a failed one and should the ongoing pullback deepen, the first major support to watch can be found at the lower limit of the market geometry near the 50% retracement of a large downward impulse launched in April 2021 ($46,600 area). Source: xStation5

BITCOIN rallied overnight but the upward move was halted at a key psychological level - $60,000 mark. Apart from its psychological nature, this area is also marked with the 161.8% exterior retracement of the downward correction from September. First attempt of breaking above $60,000 mark was a failed one and should the ongoing pullback deepen, the first major support to watch can be found at the lower limit of the market geometry near the 50% retracement of a large downward impulse launched in April 2021 ($46,600 area). Source: xStation5

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks