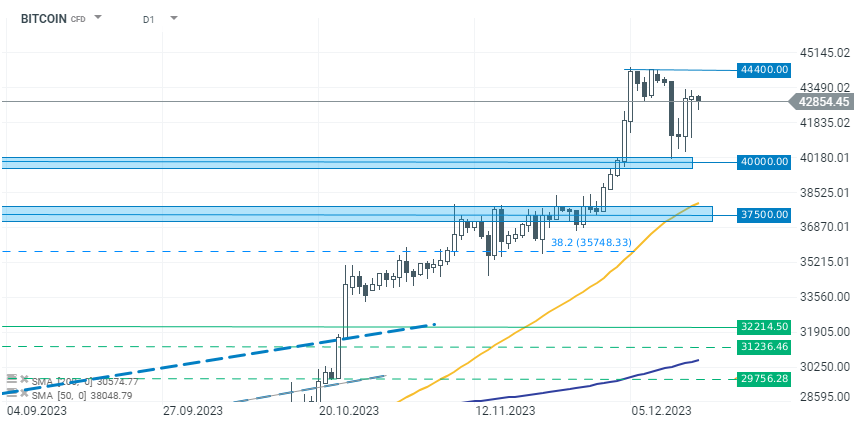

Cryptocurrencies have returned to growth mid-week, buoyed by positive sentiments on Wall Street. Bitcoin, after testing the support level at 40,000 USD, rebounded above 41,000 USD on the same day. Subsequently, following the dovish reception of Fed Chairman Jerome Powell's speech by the markets, Bitcoin surged in another wave of growth, returning to the 42,000-43,000 USD range.

The rise is also fueled by positive reports on the progress of work on spot ETFs for Bitcoin. This week, BlackRock proposed a structural change, allowing authorized participants (APs) to create new shares using cash instead of cryptocurrency. This modification paves the way for Wall Street banks such as JPMorgan and Goldman Sachs, which cannot directly hold cryptocurrencies, to invest in them. This change could significantly increase the liquidity of ETF shares, as it enables investment by mega banks on Wall Street.

Cryptocurrency market investors are becoming more eager as the final deadline for the acceptance of many ETF applications approaches, set to occur in early January. Speculations related to the acceptance of ETFs and positive moods in global financial markets are supporting growth in the cryptocurrency market. The lower limit remains at the 40,000 USD level, while resistance is around the recent local highs of 44,400 USD. Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?