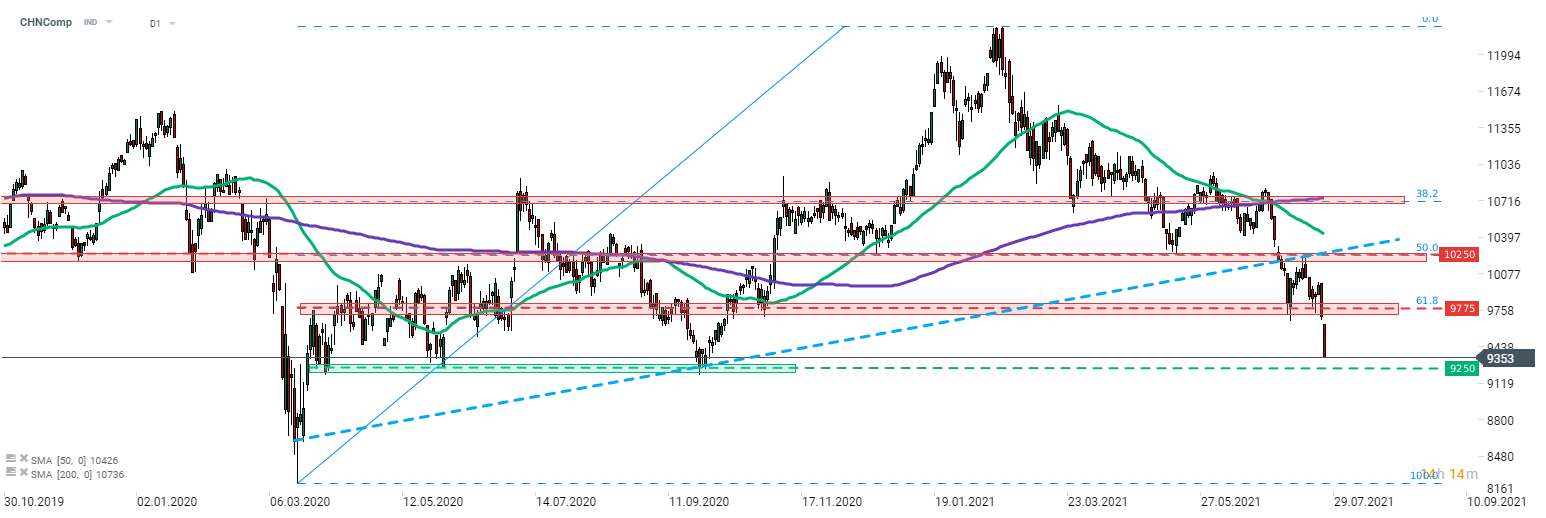

Chinese stocks have been underperforming equities from the United States and Europe for months. However, a much steeper drop could be spotted on Friday, with another big drop today, the downward move extended into a new week. Index dropped below a major price zone at 9,775 pts today, that is additionally being strengthened by the 61.8% retracement of the upward move launched in March 2020.

Chinese authorities plan a major overhaul of the after-school tutoring in the country. Namely, there are ongoing discussions on a regulation that will force tutoring companies to go non-profit. Moreover, tutoring companies will also be barred from raising capital in financial markets, including IPOs, as well as may see some restrictions on acquiring other companies. Affected companies plunged massively on Friday and deepened declines further today. CHNComp is trading almost 6% lower compared to Thursday's closing price.

Investors can get exposure on affected companies via ADRs quoted on the US market:

-

New Oriental Education (EDU.US) - 58% drop on Friday

-

TAL Education (TAL.US) - 70% drop on Friday

-

Youdao (DAO.US) - 42% drop on Friday

-

GSX Techedu (GOTU.US) - 62% drop on Friday

-

17 Education & Technology (YQ.US) - 39% drop on Friday

CHNComp dropped over 3% today, following a similar decline on Friday. Education companies, and the overall tech sector, weigh on index' performance. The nearest major support zone for the index can be found ranging around 9,250 pts. Source: xStation5

CHNComp dropped over 3% today, following a similar decline on Friday. Education companies, and the overall tech sector, weigh on index' performance. The nearest major support zone for the index can be found ranging around 9,250 pts. Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments