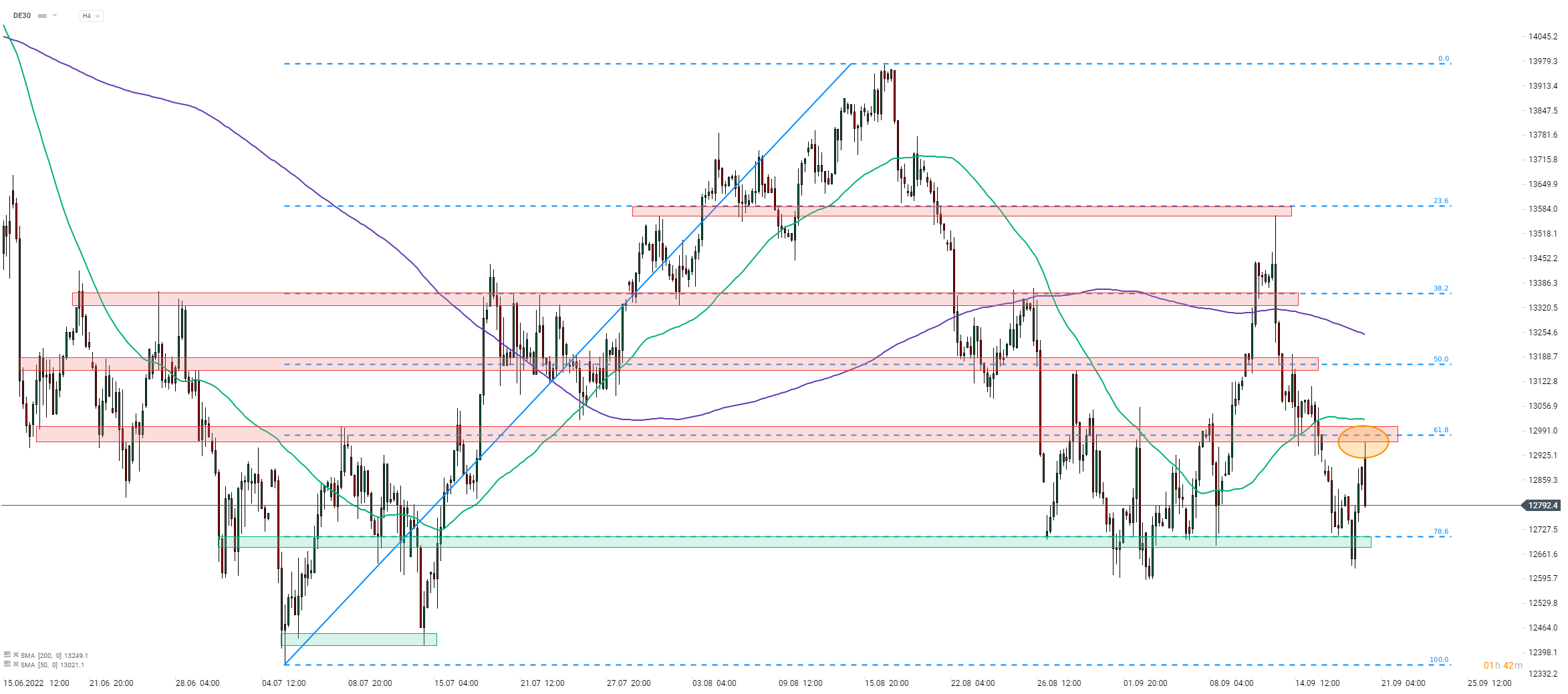

European indices halted recent downward move, triggered after the disappointing US CPI report last week, and managed to regain some ground at the beginning of a new week. However, this rebound looks to have halted today with the majority of blue chips indices from the Western Europe trading mixed. Taking a look at the DE30 chart at H4 interval, we can see that the German index turned lower today following a failed test of the resistance zone, marked with 61.8% retracement of the upward move launched in early-July 2022. The index is trading more than 150 points off a daily high already and should the ongoing pullback deepen, a test of the support zone marked with 78.6% retracement (12,700 pts area).

There are two main reasons behind sluggish performance of stock markets and neither of them is a new one. Firstly, the global economy is slowing. Secondly, central banks are tightening policy in order to combat inflation, what threatens to transform a slowdown into a recession. Riksbank went ahead of the curve today with a 100 basis point rate hike, signaling that it expects interest rates to raise further in the next 6 months. However, a key factor for risk-sentiment is upcoming Fed meeting (Wednesday, 7:00 pm BST), that may also result in a 100 bp rate move, although this is not the base case scenario.

Source: xStation5

Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments