Volatility on the cryptocurrency market picked up this week, especially on Bitcoin. Launch of the first US Bitcoin-linked ETF and massive interest in this new investment vehicle can be named as a reason behind the situation. Bitcoin reached fresh all-time highs near the $67,000 mark but the coin has erased part of the gains since and pulled back towards the $63,000 area. Situation looked similar on other cryptocurrency markets. For example, Ethereum managed to test highs from May 2021 but failed to break above.

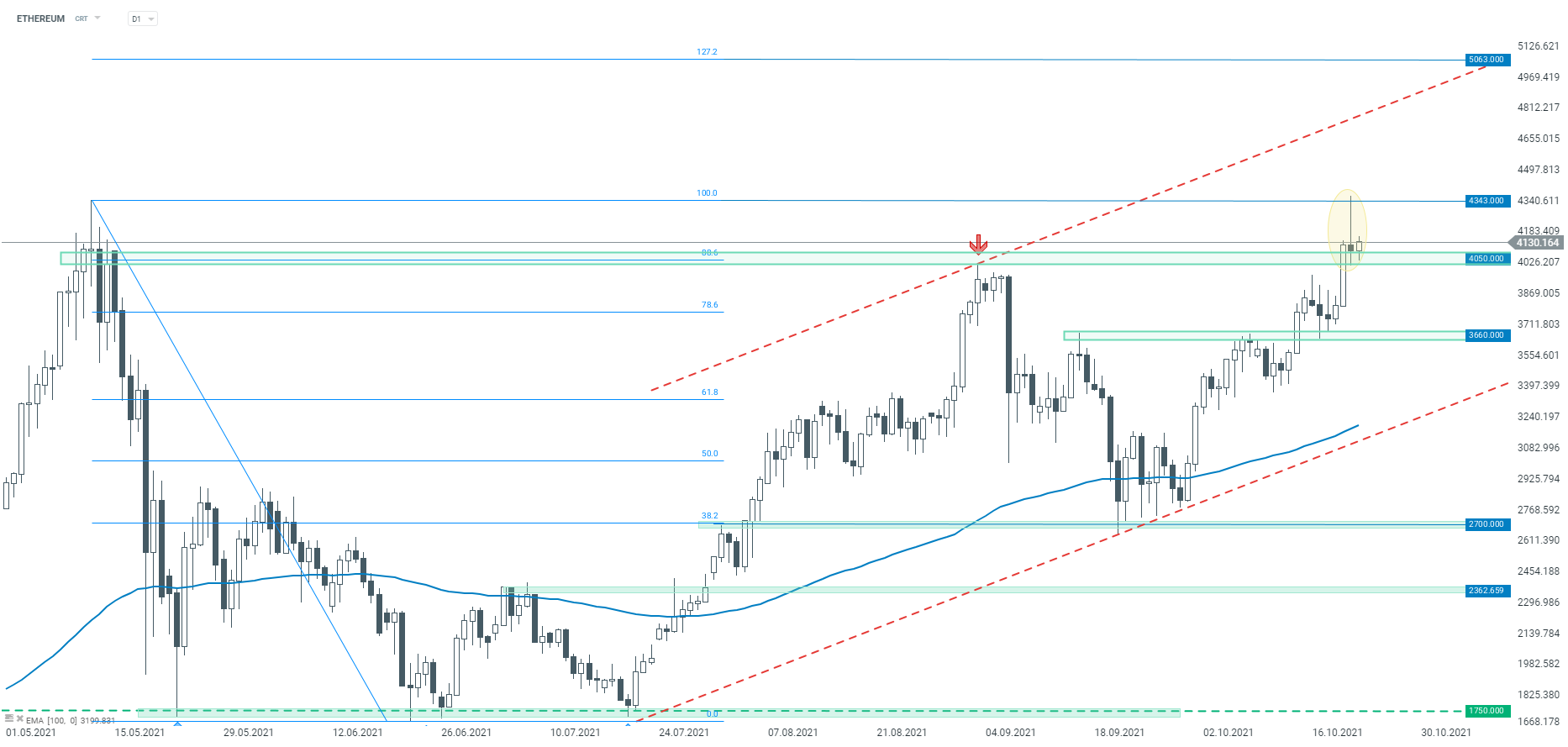

Taking a look at ETHEREUM chart at D1 interval, we can see that yesterday's daily candlestick took the form of a shooting star - narrow body, long upper wick and short lower wick. Should ETHEREUM pull back today and drop below the lower limit of Wednesday's daily candlestick, an evening star pattern would surface and it is considered a strong reversal pattern, especially if it surfaces near an important price zone.

Nevertheless, the coin is trading slightly higher today, suggesting that the evening star pattern may not materialize. A near-term resistance to watch can be found in the $4,340 area and is marked with yesterday's daily highs as well as highs from May 2021. Pushing above this hurdle could see the upward move gain even more traction. In such a scenario, bulls attention would shift to the 127.2% exterior retracement of the May-June correction in the $5,060 area.

Source: xStation5

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf