The Australian dollar is one of the best performing G10 currencies today and there is a good reason for it. The Australian jobs report was released today during the Asian trading session and it turned out to be a big positive surprise. Employment gain amounted to 88.4k, much higher than 30k expected and above 60.6k reported for May. Unemployment rate was expected to drop from 3.9 to 3.8% but, instead, actual data showed a drop to 3.5%. This is the lowest level of unemployment rate since 1874! Strong performance of the Australian labor market gives the Reserve Bank of Australia more room to tighten policy. Market is now pricing in a 74% chance of a 50 basis point move in August and a 26% chance of a 75 basis point move! Note that prior to data release, the market was seeing only a 73% chance of a 50 basis point move and 27% chance of a 25 basis point move. Having said that, it should not come as a surprise that AUD is one of the outperformers today.

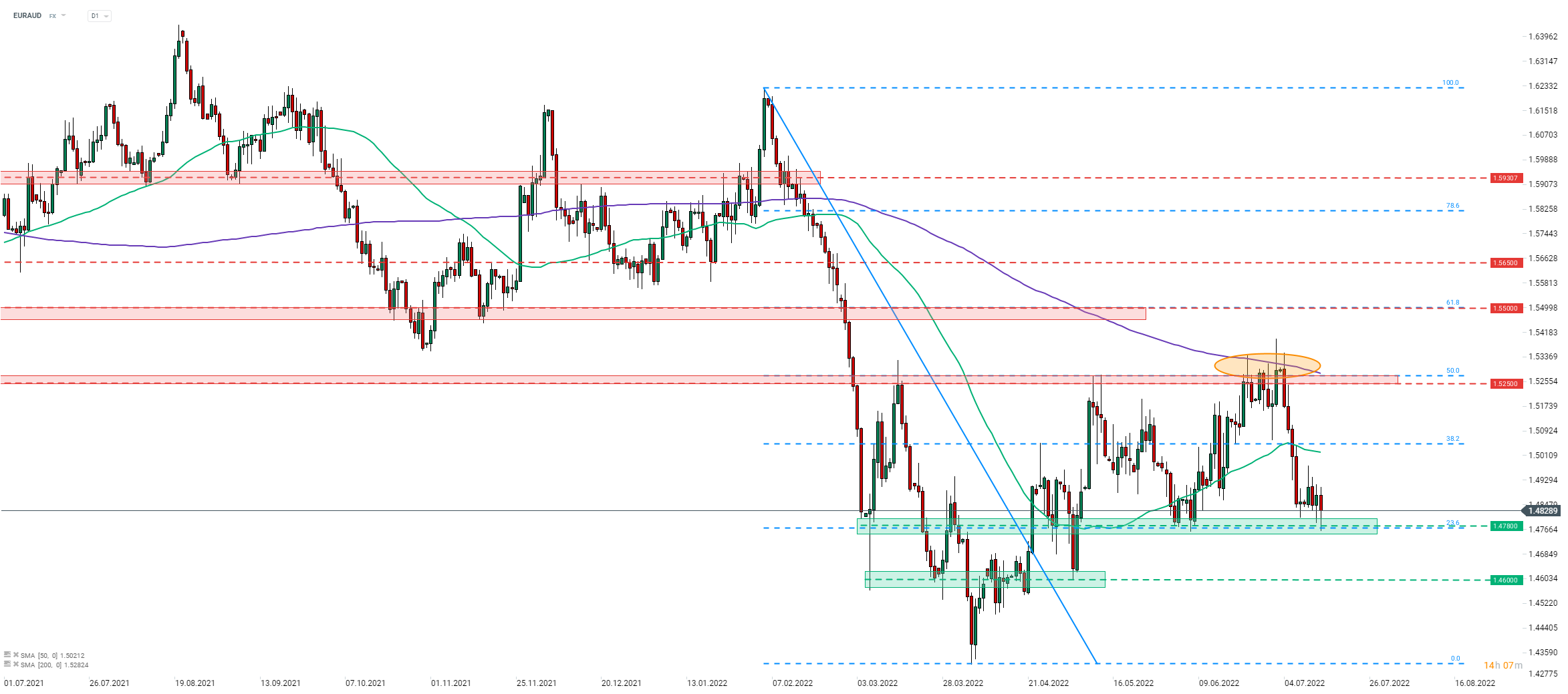

Taking a look at EURAUD chart at D1 interval, we can see that the pair has launched a downward move following repeated failed attempts of breaking above the 200-session moving average (orange circle on the chart below). Subsequent pullback has pushed the pair down to the support zone marked with 23.6% retracement in the 1.4780 area. Pair tested the zone following release of the Australian jobs report but sellers failed to break below.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%