Reuters reported that the European Central Bank is preparing new measures aimed at preventing fragmentation of the euro area bond markets. ECB is considering employing a new bond purchase scheme that will serve to cap yields. However, in order to partially offset the impact of this move, the Bank would simultaneously introduce measures aimed at draining liquidity from the market, like for example offering higher interest rate for banks to deposit their funds in the central bank. While the Reuters report gives a general feeling about what ECB might do, details of operations are still scarce and traders may have to wait until the next ECB meeting for details. However, this week will host a range of ECB speakers due to the ECB event being held in Portugal so some hints may be offered. Traders will hear from Lagarde (9:00 am BST), Lane (9:30 am BST) and Panetta (12:00 pm BST) today.

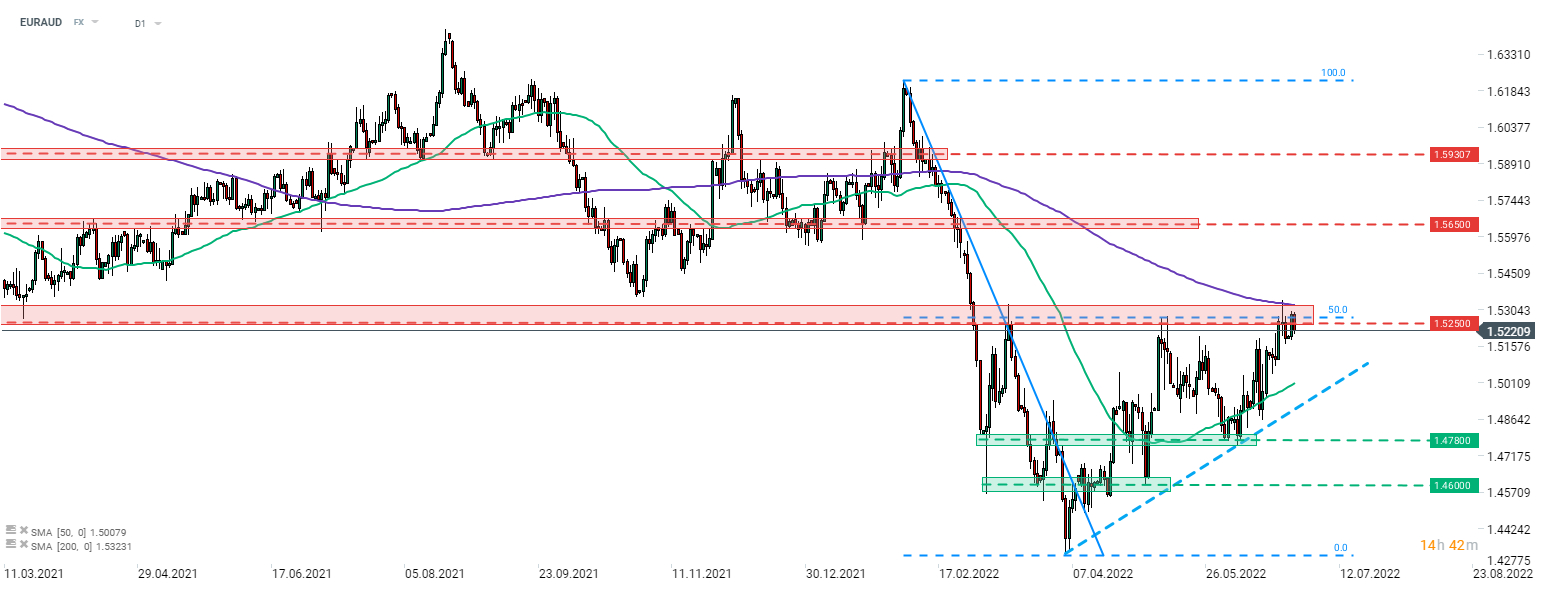

While the report signals that the ECB will ramp up efforts to control yields, no major reaction on EUR market can be spotted. This can be reasoned by the fact that ECB considers employing offsetting measures in terms of EUR impact therefore impact outside bond markets may be limited. Common currency is neither leader, nor laggard among G10 peers. Taking a look at EURAUD chart at D1 interval, we can see that the pair is testing a key resistance zone marked with 50% retracement, previous price reactions and 200-session moving average (purple line).

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)