The Bank of England and European Central Bank will announce monetary policy decisions today at 12:00 and 12:45 pm GMT, respectively. Rate decisions from the United Kingdom will be closely watched following yesterday's CPI data release that showed a major acceleration in price growth in November. Interest rate derivatives are currently pricing in 25-30% chance for a rate hike today. While inflation spike does not guarantee a rate hike, some forward guidance from BoE on rates would be more than welcome. When it comes to the ECB, no change is expected. There is a feeling that European central bankers will attempt to lower market expectations for rate hikes next year. Banks current guidance is to end emergency pandemic programmes in March 2022 and some started to believe that rate hikes may come some months later.

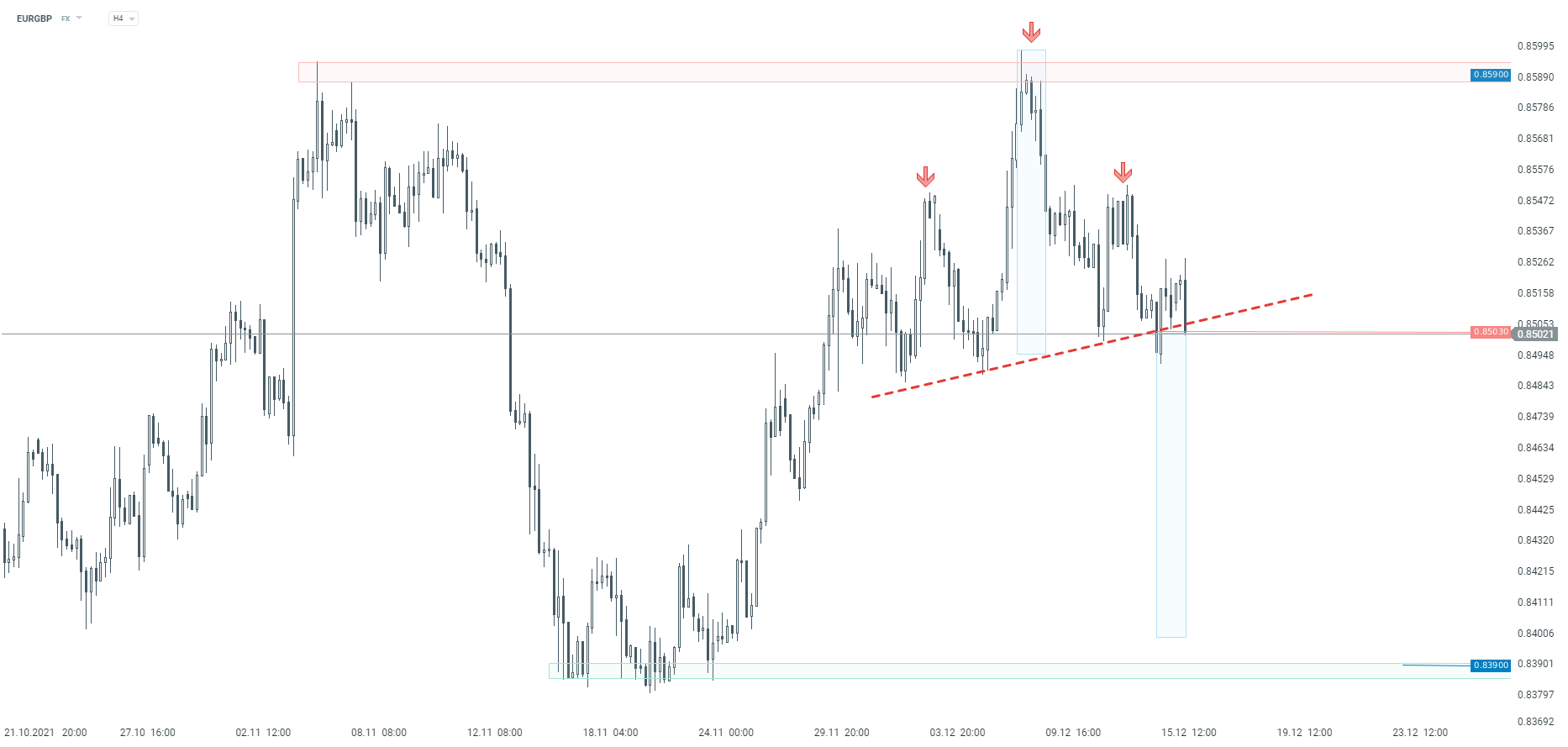

Taking a look at EURGBP pair at the H4 interval, we can see that a potential head and shoulders pattern is building up. The pair attempted to break below the neckline of the pattern in the 0.8503 area yesterday but bulls managed to defend the zone. Another attempt of breaking below the neckline can be spotted at press time. Should we see a break below, downward move may accelerate. The pair is expected to become more volatile around BoE and ECB decision announcement times.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%