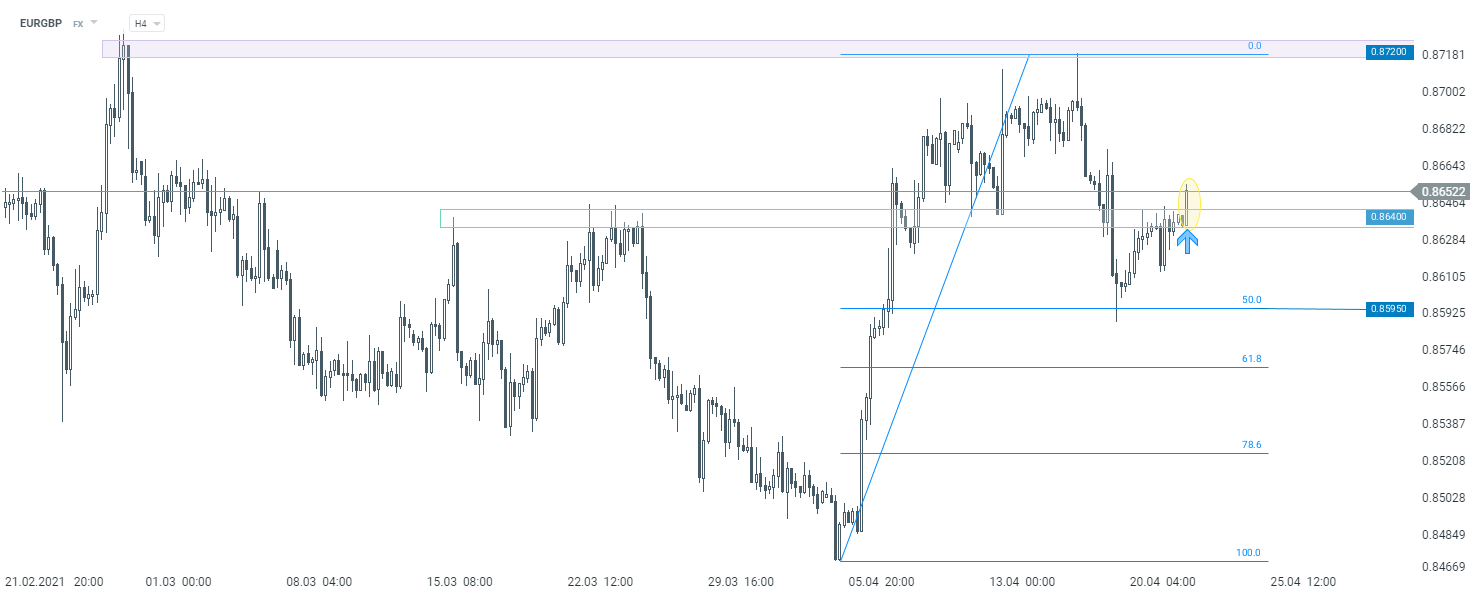

British pound is one of the worst performing major currencies today. Taking a look at EURGBP chart at H4 interval, we can see a strong upward move that has pushed the pair back above the 0.8640 price zone. In turn, it looks like recent steep declines on the pair were just a correction and the pair has launched another upward impulse following a test of the 50% retracement at 0.8595.

Key event for the pair today is the ECB rate decision at 12:45 pm BST and Lagarde's presser at 1:30 pm BST. While no change in monetary policy settings is expected, ECB President is likely to be questioned about yesterday's taper announcement from Bank of Canada. Any message perceived by markets as hawkish may provide more fuel for EURGBP and push the pair closer towards recent highs at around 0.8720.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%